Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7942

Pages:96

Published On:December 2025

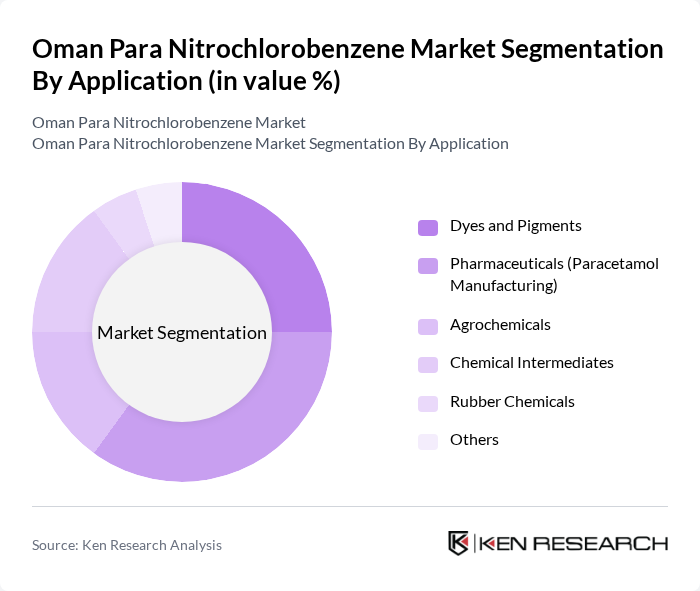

By Application:The market is segmented into various applications, including Dyes and Pigments, Pharmaceuticals (Paracetamol Manufacturing), Agrochemicals, Chemical Intermediates, Rubber Chemicals, and Others. Among these, the Pharmaceuticals segment is currently dominating the market due to the increasing demand for paracetamol and other pharmaceutical products. The growth in the healthcare sector and rising consumer awareness regarding health and wellness are driving this trend. The Dyes and Pigments segment also holds a significant share, fueled by the textile and manufacturing industries.

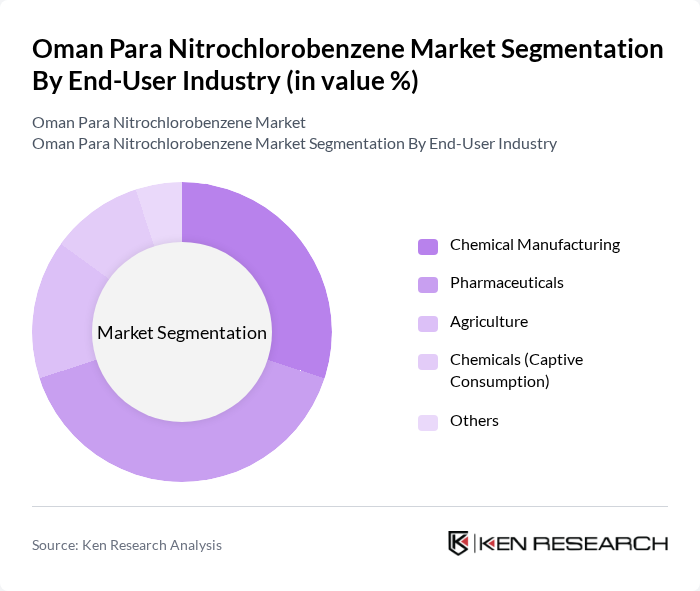

By End-User Industry:The end-user industries for para nitrochlorobenzene include Chemical Manufacturing, Pharmaceuticals, Agriculture, Chemicals (Captive Consumption), and Others. The Pharmaceuticals industry is the leading segment, driven by the increasing production of medications and the growing healthcare sector. The Chemical Manufacturing segment also plays a crucial role, as para nitrochlorobenzene is a key raw material in various chemical processes. The Agriculture sector is witnessing growth due to the rising demand for agrochemicals.

The Oman Para Nitrochlorobenzene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aarti Industries Limited (India), Hefei TNJ Chemical Industry Co., Ltd. (China), Seya Industries Ltd. (India), Panoli Intermediates India Private Limited (India), Chemdyes Corporation (India), Sarna Chemicals (India), Hangzhou Meite Industry Co., Limited (China), Charkit Chemical Company LLC (USA), Jiangsu Yangnong Chemical Group Co., Ltd. (China), Wanhua Chemical Group (China), INEOS Acetals (Global), Aromsyn Co. Ltd. (Global), Covestro AG (Germany), and Hetal Chem (Regional Supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman para nitrochlorobenzene market appears promising, driven by increasing industrialization and export potential. As the government continues to invest in infrastructure and trade agreements, the market is expected to see enhanced production capabilities. Additionally, technological advancements will likely lead to more efficient manufacturing processes. However, companies must navigate regulatory challenges and raw material supply issues to capitalize on these opportunities effectively, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Application | Dyes and Pigments Pharmaceuticals (Paracetamol Manufacturing) Agrochemicals Chemical Intermediates Rubber Chemicals Others |

| By End-User Industry | Chemical Manufacturing Pharmaceuticals Agriculture Chemicals (Captive Consumption) Others |

| By Product Grade | Industrial Grade (99.5% Purity) Pharmaceutical Grade Laboratory Grade |

| By Distribution Channel | Direct Sales to Manufacturers Chemical Distributors Trading Companies |

| By Geography (Oman Regions) | Muscat (Primary Hub) Sohar (Industrial Zone) Salalah Other Regions |

| By Packaging Type | ISO Tank Containers (Bulk) Drums (25 kg bags) Custom Packaging |

| By Cross Comparison of Key Players | Company Name Company Size (Large, Medium, or Small) Production Capacity (Metric Tons/Year) Market Share (%) Export Volume (Metric Tons/Year) Purity Grade Offerings (99.5% and above) Geographic Reach (Number of Countries Served) Certifications (ISO, AEO, etc.) Supply Chain Reliability (Lead Time Days) Pricing Competitiveness (USD/KG) Customer Base Diversification (% from Top 3 Customers) R&D Investment in Product Innovation |

| By Detailed Profile of Major Companies | Aarti Industries Limited (India) Hefei TNJ Chemical Industry Co., Ltd. (China) Seya Industries Ltd. (India) Panoli Intermediates India Private Limited (India) Chemdyes Corporation (India) Sarna Chemicals (India) Hangzhou Meite Industry Co., Limited (China) Charkit Chemical Company LLC (USA) Jiangsu Yangnong Chemical Group Co., Ltd. (China) Wanhua Chemical Group (China) INEOS Acetals (Global) Aromsyn Co. Ltd. (Global) Covestro AG (Germany) Hetal Chem (Regional Supplier) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Distribution and Supply Chain | 80 | Logistics Coordinators, Supply Chain Analysts |

| End-User Industries (Pharmaceuticals) | 70 | Procurement Managers, R&D Directors |

| Regulatory Bodies | 50 | Compliance Officers, Policy Makers |

| Environmental Impact Assessors | 60 | Sustainability Managers, Environmental Consultants |

The Oman Para Nitrochlorobenzene market is valued at approximately USD 12 million, driven by increasing demand for chemical intermediates in industries such as pharmaceuticals and agrochemicals, alongside the growth of manufacturing sectors.