Region:Middle East

Author(s):Rebecca

Product Code:KRAC3248

Pages:81

Published On:October 2025

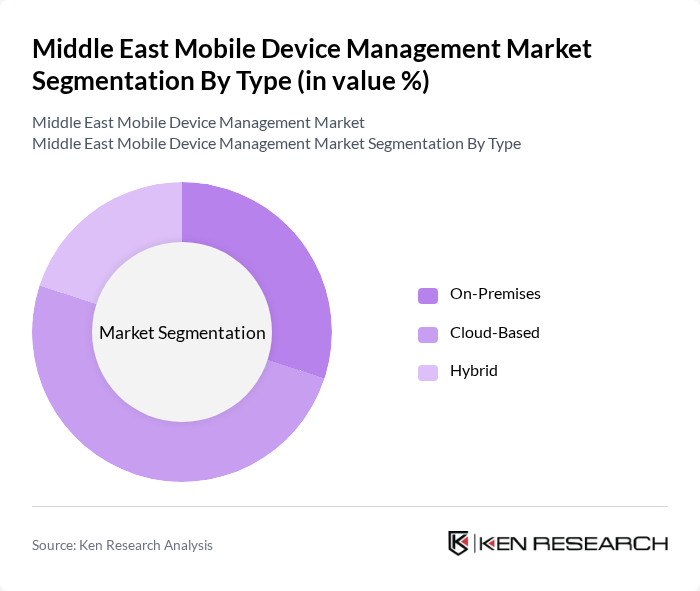

By Type:

The segmentation by type includes On-Premises, Cloud-Based, and Hybrid solutions. Cloud-Based solutions are leading the market, driven by their scalability, cost efficiency, and ease of deployment. Organizations are increasingly choosing cloud solutions for flexible device management and remote access, aligning with digital transformation initiatives and the rise of distributed workforces. Hybrid solutions are gaining relevance for enterprises with mixed infrastructure needs, while On-Premises solutions remain preferred in highly regulated sectors requiring local data control .

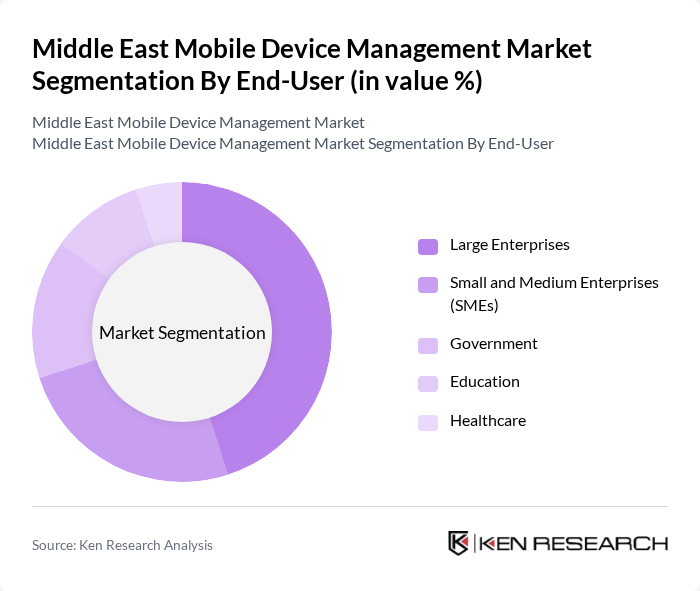

By End-User:

The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Government, Education, and Healthcare. Large Enterprises are the primary adopters, driven by the need to secure extensive device fleets and sensitive data. Regulatory compliance and complex IT environments further accelerate investment in advanced mobile device management. SMEs are expanding their adoption, seeking cost-effective, scalable solutions. Government, education, and healthcare sectors are increasingly implementing mobile device management to address data privacy, remote access, and operational continuity requirements .

The Middle East Mobile Device Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as VMware, Inc., IBM Corporation, Microsoft Corporation, MobileIron, Inc., Citrix Systems, Inc., Sophos Ltd., Cisco Systems, Inc., BlackBerry Limited, SOTI Inc., ManageEngine (Zoho Corporation), Jamf Software, LLC, Scalefusion (ProMobi Technologies), 42Gears Mobility Systems, Lookout, Inc., Zimperium, Inc., Ivanti, Inc., Kaspersky Lab, Micro Focus International plc, Broadcom Inc., SAP SE, SolarWinds Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East mobile device management market is poised for significant evolution, driven by technological advancements and changing workforce dynamics. As organizations increasingly adopt AI-driven management solutions, the focus will shift towards enhancing user experience and integrating MDM with broader enterprise mobility strategies. Additionally, the rise of mobile threat defense solutions will play a crucial role in addressing security concerns, ensuring that businesses can effectively manage and protect their mobile assets in an increasingly complex digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premises Cloud-Based Hybrid |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government Education Healthcare |

| By Industry Vertical | IT & Telecom Retail Manufacturing Financial Services (BFSI) Transportation & Logistics Energy & Utilities |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium |

| By Others | Niche Solutions Custom Integrations Managed Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Mobile Device Management | 100 | IT Managers, CIOs, Security Officers |

| Healthcare Sector Device Management | 60 | Healthcare IT Directors, Compliance Officers |

| Education Sector Mobile Solutions | 40 | IT Administrators, Educational Technology Coordinators |

| Financial Services Device Security | 50 | Risk Management Officers, IT Security Analysts |

| Retail Sector Mobile Device Usage | 40 | Operations Managers, Retail IT Specialists |

The Middle East Mobile Device Management Market is valued at approximately USD 7.8 billion, driven by the increasing adoption of mobile devices in enterprises, heightened security requirements, and the expansion of remote work policies.