Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3943

Pages:81

Published On:November 2025

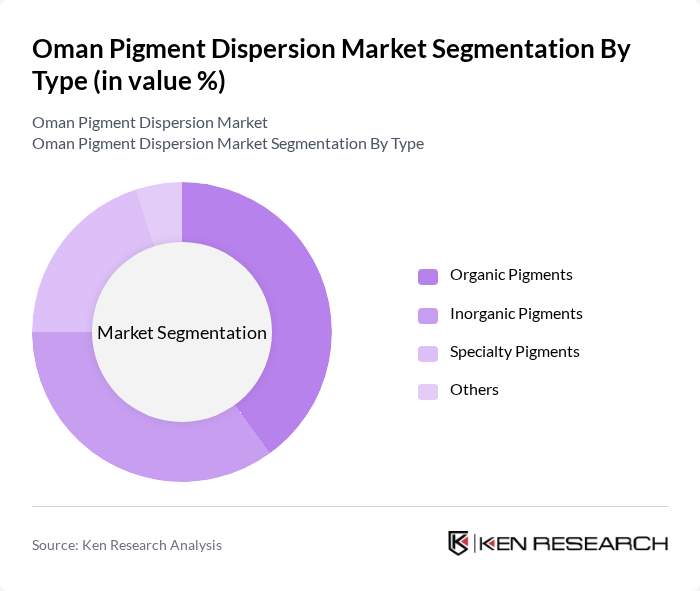

By Type:The market is segmented into Organic Pigments, Inorganic Pigments, Specialty Pigments, and Others. Organic pigments are gaining traction due to their vibrant colors and eco-friendly properties, while inorganic pigments are favored for their durability and cost-effectiveness. Specialty pigments cater to niche applications, driving innovation and customization in product offerings.

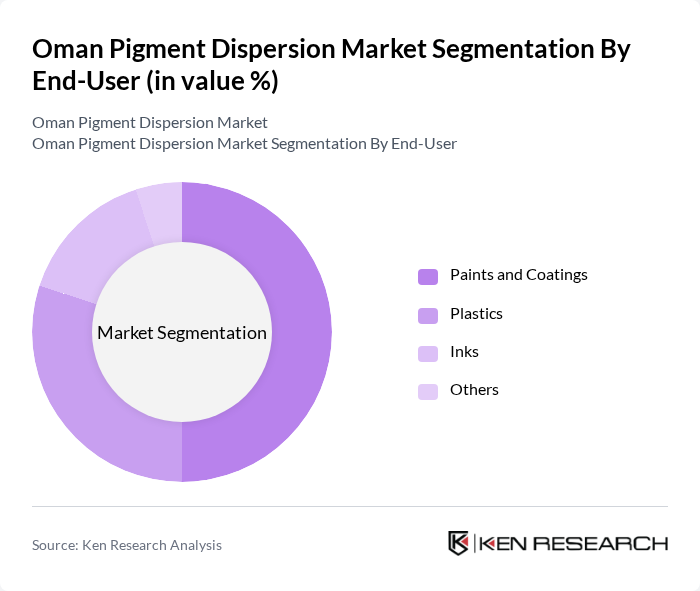

By End-User:The end-user segmentation includes Paints and Coatings, Plastics, Inks, and Others. The Paints and Coatings sector is the largest consumer of pigment dispersions, driven by the construction and automotive industries. Plastics and Inks are also significant contributors, with increasing demand for high-performance and visually appealing products.

The Oman Pigment Dispersion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Paints, Al Jazeera Paints, National Paints, Jotun Oman, Berger Paints Oman, Al Hodaifi Group, Gulf Paints, Al Mufeed Group, Oman Chemical Industries, Al Muna Group, Oman Pigments, Al Fajr Group, Al Mufeed Paints, Al Shams Paints, Oman Coatings contribute to innovation, geographic expansion, and service delivery in this space.

The Oman pigment dispersion market is poised for significant growth, driven by increasing demand for high-quality pigments and advancements in technology. As industries such as construction and automotive expand, the need for innovative and sustainable pigment solutions will rise. Additionally, the shift towards eco-friendly products will shape market dynamics, encouraging manufacturers to invest in sustainable practices. Overall, the market is expected to adapt to evolving consumer preferences and regulatory requirements, fostering a competitive and innovative environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Pigments Inorganic Pigments Specialty Pigments Others |

| By End-User | Paints and Coatings Plastics Inks Others |

| By Application | Architectural Coatings Industrial Coatings Automotive Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Dhofar Al Batinah Others |

| By Product Formulation | Aqueous Dispersions Solvent-Based Dispersions Powdered Pigments Others |

| By Regulatory Compliance | ISO Standards REACH Compliance Local Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Production Managers, Quality Control Supervisors |

| Construction Materials | 80 | Procurement Managers, Project Engineers |

| Plastics and Polymers | 70 | Product Development Managers, R&D Specialists |

| Textile Applications | 60 | Textile Engineers, Production Supervisors |

| Consumer Goods | 90 | Marketing Managers, Product Managers |

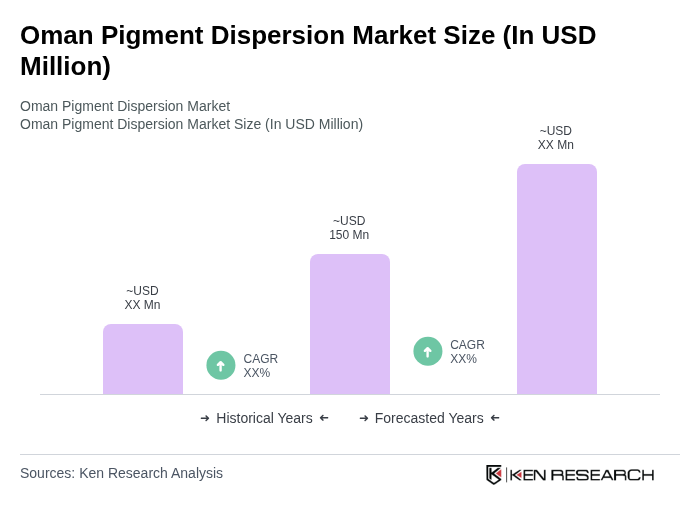

The Oman Pigment Dispersion Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for high-quality pigments across various industries, including paints, coatings, and plastics.