Region:Middle East

Author(s):Rebecca

Product Code:KRAD6217

Pages:86

Published On:December 2025

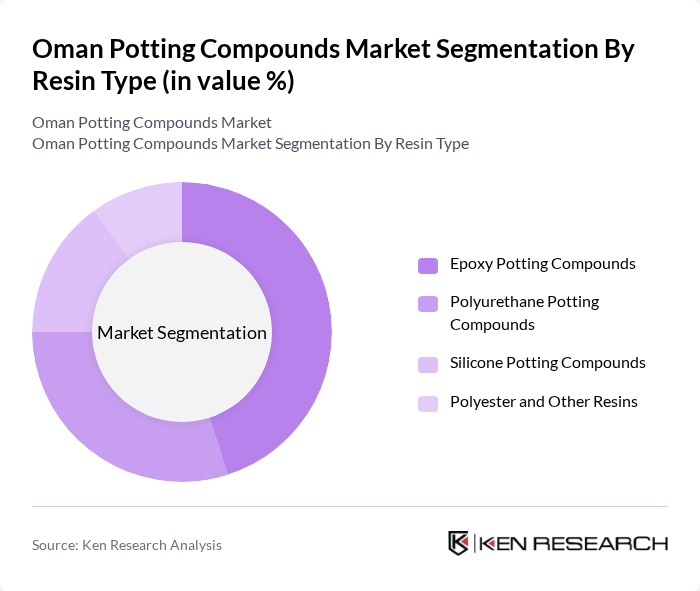

By Resin Type:The potting compounds market is segmented by resin type into four main categories: Epoxy Potting Compounds, Polyurethane Potting Compounds, Silicone Potting Compounds, and Polyester and Other Resins. Among these, Epoxy Potting Compounds dominate the market due to their excellent adhesion, thermal stability, and electrical insulation properties, which are widely required in automotive electronics, industrial controls, LED lighting, and power electronics where mechanical strength and dielectric performance are critical. Polyurethane systems are increasingly used where flexibility and shock absorption are needed, while silicone potting compounds are gaining share in high?temperature and outdoor applications such as LED drivers, inverters, and harsh?environment sensors. The indicative 2024 market share split of 45% for epoxy, 30% for polyurethane, 15% for silicone, and 10% for polyester and other resins is consistent with global potting and encapsulation usage patterns in electronics and automotive segments.

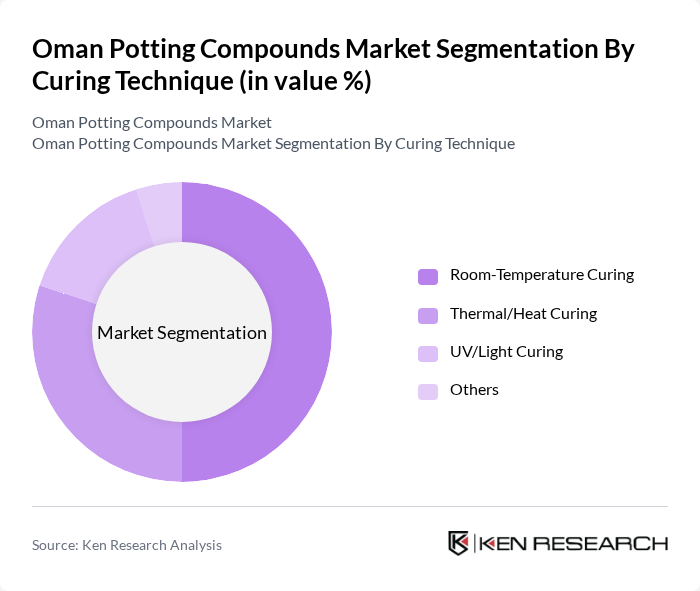

By Curing Technique:The market is also segmented by curing technique, which includes Room-Temperature Curing, Thermal/Heat Curing, UV/Light Curing, and Others. Room-Temperature Curing is the leading technique due to its ease of application, lower energy consumption, and suitability for a wide range of electronic assemblies and repair operations, making it a preferred choice for manufacturers and service providers aiming to streamline production and reduce process complexity. Thermal/Heat Curing remains important for high?performance epoxy systems requiring elevated?temperature crosslinking, while UV/Light Curing technologies are gaining adoption in fast?cycle electronics manufacturing, LED assembly, and conformal coating applications where rapid throughput is essential. The indicative 2024 split of 50% for room?temperature curing, 30% for thermal/heat curing, 15% for UV/light curing, and 5% for other techniques aligns with prevailing global usage trends in potting and encapsulation processes for electronics and automotive components.

The Oman Potting Compounds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, Dow Inc., Elantas (Altana AG), Huntsman Corporation, 3M Company, BASF SE, H.B. Fuller Company, LORD Corporation (Parker Hannifin), WEVO-Chemie GmbH, MG Chemicals Ltd., ACC Silicones / Elkem Silicones, Electrolube (HK Wentworth Group), Dymax Corporation, Robnor ResinLab, Local & Regional GCC Distributors and Converters (Oman & UAE based) contribute to innovation, geographic expansion, and service delivery in this space, offering epoxy, polyurethane, silicone, and hybrid systems tailored for automotive electronics, industrial equipment, and energy applications used in Oman and the wider GCC.

The Oman potting compounds market is poised for growth, driven by increasing consumer interest in sustainable gardening and the expansion of the horticulture sector. As local manufacturers adapt to market demands, innovations in product formulations are expected to enhance competitiveness. Additionally, the rise of e-commerce platforms will facilitate access to gardening products, further stimulating market growth. Overall, the future landscape appears promising, with opportunities for collaboration and product development on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Epoxy Potting Compounds Polyurethane Potting Compounds Silicone Potting Compounds Polyester and Other Resins |

| By Curing Technique | Room-Temperature Curing Thermal/Heat Curing UV/Light Curing Others |

| By Application | Electrical Components (Transformers, Coils, Relays) Electronic Assemblies and PCBs Automotive and Transportation Electronics Industrial and Energy & Power Systems Others |

| By End-Use Industry | Electronics & Electrical Automotive Industrial Machinery & Equipment Energy & Power (including Renewables) Aerospace & Defense Others |

| By Distribution Channel | Direct Sales (OEM & Key Accounts) Industrial Distributors Online / E-Procurement Platforms Others |

| By Region | Muscat & Batinah Dhofar (Salalah) Dhahirah & Al Wusta Interior & Other Governorates |

| By Performance Characteristics | General-Purpose Potting Compounds High-Temperature Resistant Compounds Chemically and Moisture-Resistant Compounds Thermally Conductive / Electrically Insulating Compounds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Nurseries | 45 | Nursery Managers, Horticulturalists |

| Retail Garden Centers | 40 | Store Managers, Product Buyers |

| Landscaping Companies | 35 | Landscape Architects, Project Managers |

| Agricultural Cooperatives | 20 | Cooperative Managers, Agronomists |

| Research Institutions | 10 | Research Scientists, Agricultural Economists |

The Oman Potting Compounds Market is valued at approximately USD 40 million, reflecting the growing demand for electronic components in automotive, industrial, and energy applications, alongside the expansion of the automotive market in Oman.