Oman Pretzel Market Overview

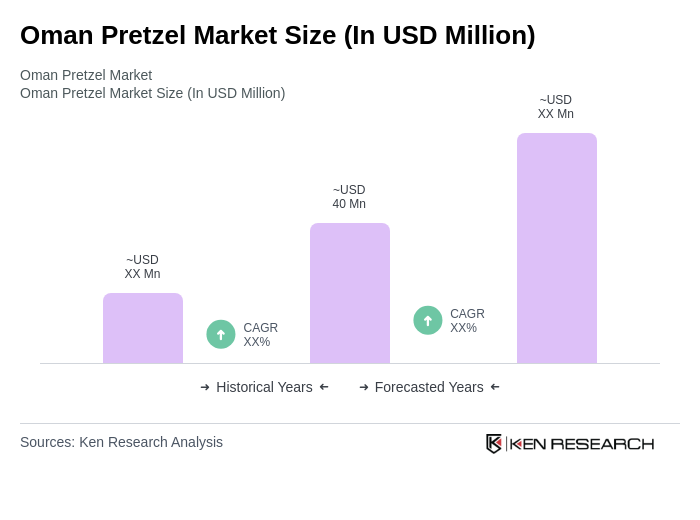

- The Oman Pretzel Market is valued at USD 40 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for convenient snack options, coupled with a rising trend towards healthier eating habits, including gluten-free and organic products. The market has seen a significant uptick in sales due to the expansion of retail channels and the growing popularity of pretzels as a versatile snack.

- Key cities such as Muscat and Salalah dominate the Oman Pretzel Market due to their high population density and vibrant food culture. These urban centers have a diverse demographic that appreciates both traditional and modern snack options, leading to a robust demand for pretzels in various forms, including soft and flavored varieties. The presence of numerous retail outlets and food service establishments further enhances market growth in these regions.

- In recent years, the Omani government has emphasized food safety and quality standards through regulations that mandate nutritional labeling and allergen warnings. These measures are designed to enhance consumer trust and drive market growth by ensuring that manufacturers adhere to high-quality standards. Such regulations are expected to foster consumer trust and drive market growth by ensuring that pretzel manufacturers adhere to high-quality standards.

Oman Pretzel Market Segmentation

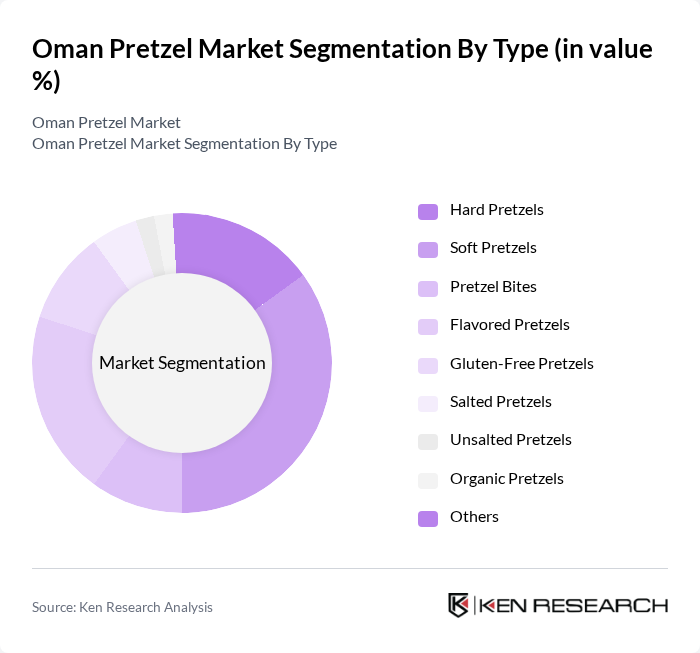

By Type:The market is segmented into various types of pretzels, including Hard Pretzels, Soft Pretzels, Pretzel Bites, Flavored Pretzels, Gluten-Free Pretzels, Salted Pretzels, Unsalted Pretzels, Organic Pretzels, and Others. Among these, Soft Pretzels are currently leading the market due to their popularity in food service settings, particularly in cafes and restaurants. The demand for gluten-free options is also rising, reflecting changing consumer preferences towards healthier snack choices.

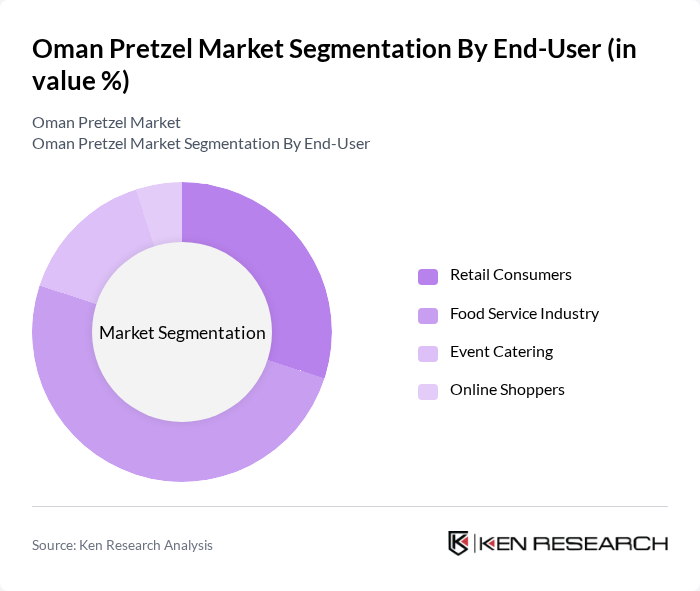

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Event Catering, and Online Shoppers. The Food Service Industry is the dominant segment, driven by the increasing number of cafes, restaurants, and food trucks offering pretzels as part of their menu. Retail Consumers are also significant, as more people are purchasing pretzels for home consumption, especially during social gatherings and events.

Oman Pretzel Market Competitive Landscape

The Oman Pretzel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Pretzel Co., Al Ahlia Food Industries LLC, Muscat Bakery LLC, Sultanate Snacks LLC, Gulf Snacks & Food Industries, Oman Chips Company SAOG, Al Fawaz Bakery, Al Muna Food Products, Golden Bakery LLC, Al Noor Food Industries, Muscat Gourmet Foods, Oman Artisan Bakers, Al Jazeera Food Industries, Royal Snacks LLC, Al Harthy Bakery contribute to innovation, geographic expansion, and service delivery in this space.

Oman Pretzel Market Industry Analysis

Growth Drivers

- Increasing Demand for Snack Foods:The snack food market in Oman is projected to reach OMR 1.2 billion by 2024, driven by a growing urban population and changing lifestyles. As consumers increasingly seek convenient food options, pretzels are gaining popularity due to their portability and variety. The rise in disposable income, which is expected to increase by 3.5% annually, further supports this trend, making pretzels an attractive choice for on-the-go snacking.

- Rising Health Consciousness Among Consumers:With 60% of Omani consumers prioritizing health in their food choices, the demand for healthier snack alternatives is surging. This shift is evident as sales of low-calorie and whole-grain pretzels have increased by 25% in the last year. The World Health Organization's guidelines on reducing sugar and fat intake are influencing consumer preferences, leading to a greater acceptance of pretzels as a healthier snack option.

- Expansion of Retail Outlets:The number of retail outlets in Oman has grown by 15% over the past two years, facilitating greater access to snack foods, including pretzels. This expansion includes supermarkets and convenience stores, which are increasingly stocking a variety of pretzel brands. The Ministry of Commerce and Industry's initiatives to support local businesses have also contributed to this growth, enhancing market visibility and availability for consumers.

Market Challenges

- High Competition from Other Snack Products:The Oman snack market is highly competitive, with over 200 brands vying for consumer attention. This saturation makes it challenging for pretzel manufacturers to differentiate their products. The increasing popularity of alternative snacks, such as chips and nuts, which saw a 10% sales increase last year, poses a significant threat to pretzel market share, necessitating innovative marketing strategies.

- Fluctuating Raw Material Prices:The cost of key ingredients for pretzel production, such as wheat and salt, has seen fluctuations of up to 20% in the past year due to global supply chain disruptions. This volatility can significantly impact profit margins for manufacturers. The reliance on imported raw materials, which constitutes 70% of the total ingredient cost, further exacerbates this challenge, making cost management critical for sustainability.

Oman Pretzel Market Future Outlook

The Oman pretzel market is poised for growth, driven by evolving consumer preferences towards healthier snack options and the increasing availability of diverse flavors. As e-commerce continues to expand, online sales channels are expected to play a crucial role in reaching a broader audience. Additionally, the trend towards sustainable packaging will likely influence product development, aligning with consumer values and enhancing brand loyalty in the future.

Market Opportunities

- Growth of E-commerce Platforms:The e-commerce sector in Oman is projected to grow by 30% in the future, providing a significant opportunity for pretzel brands to reach consumers directly. By leveraging online sales channels, companies can enhance their market presence and cater to the increasing demand for convenient shopping experiences, particularly among younger demographics.

- Introduction of Gluten-Free Options:With approximately 10% of the population actively seeking gluten-free products, introducing gluten-free pretzel options can tap into this niche market. This segment is expected to grow by 15% annually, presenting a lucrative opportunity for brands to diversify their product offerings and attract health-conscious consumers.