Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9352

Pages:86

Published On:November 2025

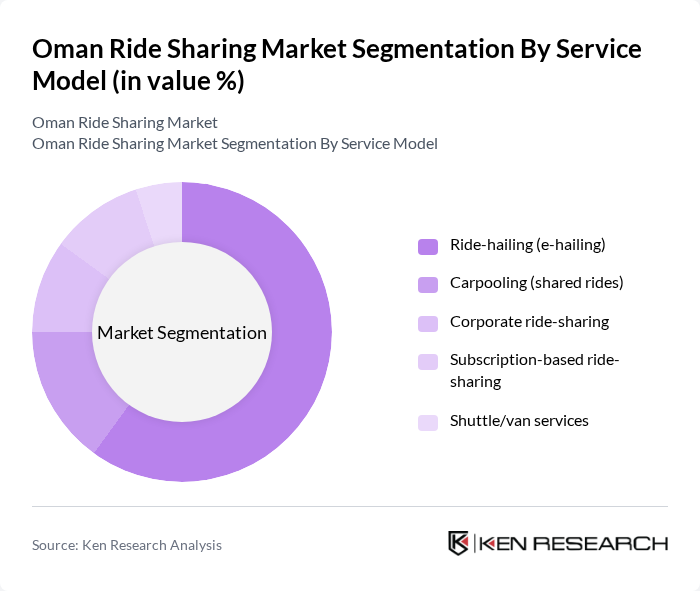

By Service Model:The service model segmentation includes various approaches to ride-sharing, such as ride-hailing, carpooling, corporate ride-sharing, subscription-based services, and shuttle/van services. Among these,ride-hailing (e-hailing)has emerged as the most popular choice due to its convenience and ease of use, particularly among younger consumers who prefer app-based solutions. Carpooling is gaining traction as a cost-effective alternative, while corporate ride-sharing is increasingly adopted by businesses looking to streamline employee transportation. Subscription-based models are appealing to frequent users, and shuttle services cater to specific routes, enhancing overall market diversity .

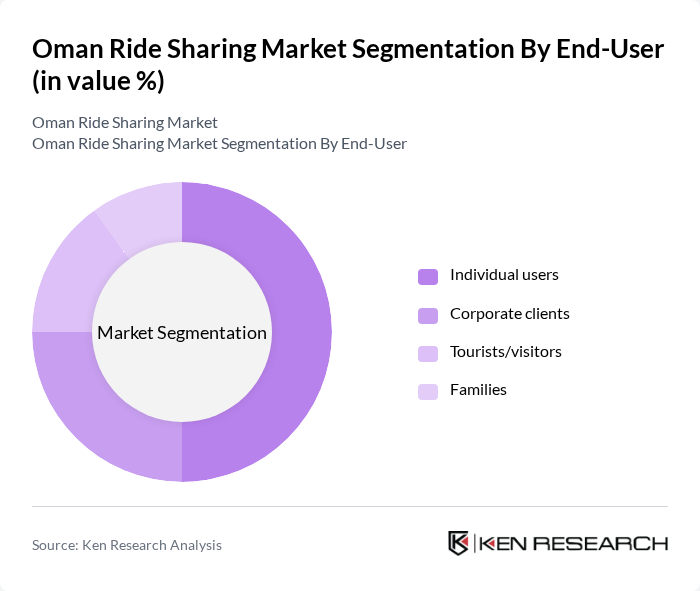

By End-User:The end-user segmentation encompasses individual users, corporate clients, tourists/visitors, and families.Individual usersdominate the market, driven by the convenience of on-demand transportation and the growing trend of urban mobility. Corporate clients are increasingly utilizing ride-sharing services for employee transportation, while tourists benefit from the accessibility and affordability of these services. Families are also turning to ride-sharing for group travel, particularly during vacations or outings, contributing to the overall growth of the market .

The Oman Ride Sharing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, OTaxi, Mwasalat, Fennel, Qarar, Oman Taxi, Al Mufeed, Al Ameen, Omani Rides, RideOman, Smart Ride, Easy Taxi, Marhaba Taxi, OtaxiGo contribute to innovation, geographic expansion, and service delivery in this space.

The Oman ride-sharing market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of electric vehicles is expected to gain traction, aligning with global sustainability trends. Additionally, the rise of subscription-based models may reshape consumer engagement, offering more predictable pricing structures. As the market evolves, partnerships with local businesses will likely enhance service offerings, creating a more robust ecosystem for ride-sharing in Oman.

| Segment | Sub-Segments |

|---|---|

| By Service Model | Ride-hailing (e-hailing) Carpooling (shared rides) Corporate ride-sharing Subscription-based ride-sharing Shuttle/van services |

| By End-User | Individual users Corporate clients Tourists/visitors Families |

| By Vehicle Type | Sedans SUVs Vans/minibuses Electric vehicles |

| By Booking & Payment Model | App-based (online) Web-based Phone-based (offline) Pay-per-ride Subscription/contract |

| By Commute Type | Intracity (within city) Intercity (between cities) |

| By Geographic Coverage | Muscat Salalah Sohar Other governorates |

| By Customer Demographics | Age group (18-24, 25-34, 35-44, 45+) Income level (Low, Middle, High) Occupation (Students, Professionals, Retirees) |

| By Service Features | In-app navigation Multi-language support Driver ratings and reviews Accessibility features (for people with disabilities) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuters | 140 | Daily commuters, occasional ride-sharing users |

| Ride-sharing Drivers | 90 | Active drivers, part-time drivers |

| Transportation Authorities | 40 | Policy makers, regulatory officials |

| Ride-sharing Platform Executives | 40 | CEOs, Operations Managers |

| Potential Users | 110 | Individuals aged 18-45, tech-savvy users |

The Oman Ride Sharing Market is valued at approximately USD 135 million, reflecting significant growth driven by urbanization, smartphone penetration, and a preference for app-based transportation solutions among consumers.