Region:Middle East

Author(s):Rebecca

Product Code:KRAD2939

Pages:97

Published On:November 2025

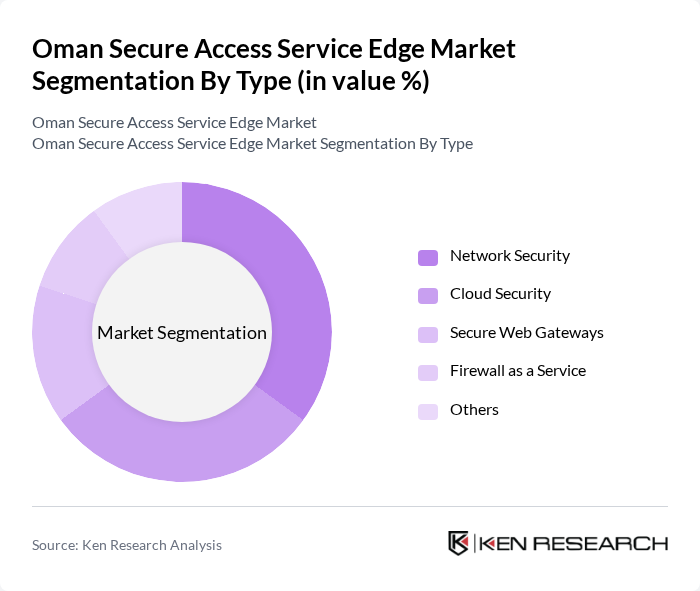

By Type:The market is segmented into various types, including Network Security, Cloud Security, Secure Web Gateways, Firewall as a Service, and Others. Each of these sub-segments plays a crucial role in addressing specific security needs of organizations.

The Network Security sub-segment is currently dominating the market due to the increasing frequency of cyber threats and the need for organizations to protect their networks from unauthorized access. Enterprises are investing heavily in advanced network security solutions to safeguard their data and maintain compliance with regulatory requirements. The growing trend of remote work has further amplified the demand for robust network security measures, making it a critical focus area for businesses across various sectors.

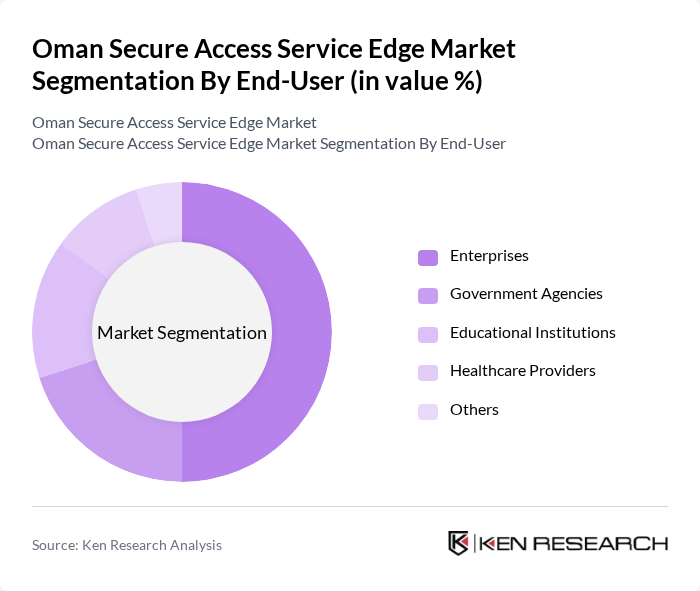

By End-User:The market is segmented by end-users, including Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, and Others. Each end-user segment has unique security requirements that drive the adoption of secure access service edge solutions.

Enterprises are the leading end-user segment in the market, driven by the need for secure access to applications and data in an increasingly digital environment. The rise of remote work and cloud adoption has prompted organizations to invest in secure access solutions to protect sensitive information and ensure business continuity. Government agencies also represent a significant portion of the market, as they are mandated to implement stringent security measures to protect national interests and sensitive data.

The Oman Secure Access Service Edge Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Palo Alto Networks, Zscaler, Fortinet, Check Point Software Technologies, Cloudflare, Akamai Technologies, Barracuda Networks, VMware, Microsoft, IBM, Trend Micro, Sophos, McAfee, F5 Networks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Secure Access Service Edge market appears promising, driven by increasing digitalization and a growing emphasis on cybersecurity. As organizations continue to embrace hybrid work models, the demand for integrated security solutions will rise. Furthermore, government initiatives aimed at enhancing digital infrastructure will likely foster innovation and investment in secure access technologies, creating a conducive environment for market growth. The focus on compliance with data protection regulations will also shape the landscape, encouraging organizations to adopt advanced security measures.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Cloud Security Secure Web Gateways Firewall as a Service Others |

| By End-User | Enterprises Government Agencies Educational Institutions Healthcare Providers Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | Financial Services Retail Manufacturing Telecommunications Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Service Model | Managed Services Professional Services Consulting Services Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services SASE Adoption | 100 | IT Managers, Security Analysts |

| Healthcare Sector Network Security | 80 | Chief Information Officers, Compliance Officers |

| Telecommunications Infrastructure | 70 | Network Engineers, Operations Managers |

| Government Agency Cybersecurity | 60 | IT Directors, Risk Management Officers |

| Retail Industry Cloud Security | 90 | eCommerce Managers, IT Security Specialists |

The Oman Secure Access Service Edge Market is valued at approximately USD 150 million, reflecting a significant growth driven by the increasing demand for secure remote access solutions and the rise in digital transformation initiatives across various sectors.