Region:Middle East

Author(s):Shubham

Product Code:KRAD0868

Pages:83

Published On:November 2025

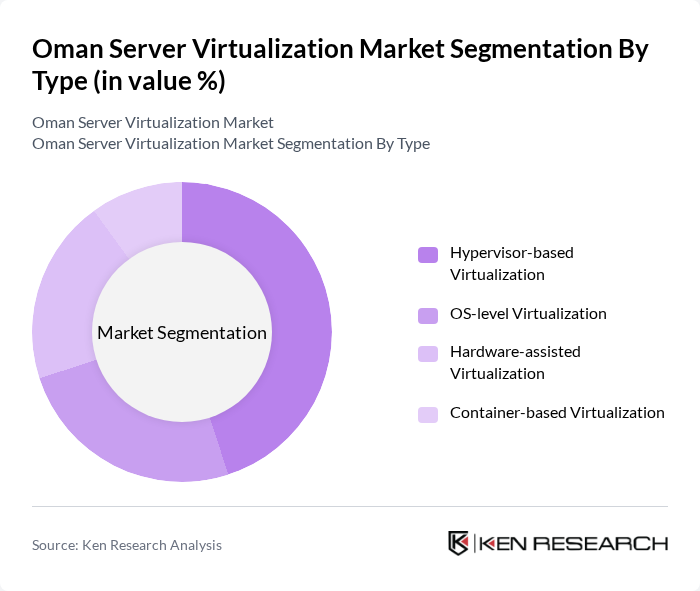

By Type:The market is segmented into four types of virtualization technologies: Hypervisor-based Virtualization, OS-level Virtualization, Hardware-assisted Virtualization, and Container-based Virtualization. Hypervisor-based Virtualization remains the dominant segment due to its flexibility and ability to run multiple operating systems on a single physical machine, making it a preferred choice for enterprises seeking to maximize resource utilization and enable rapid scaling. The adoption of container-based virtualization is also rising, driven by the need for agile application deployment and integration with DevOps and cloud-native environments .

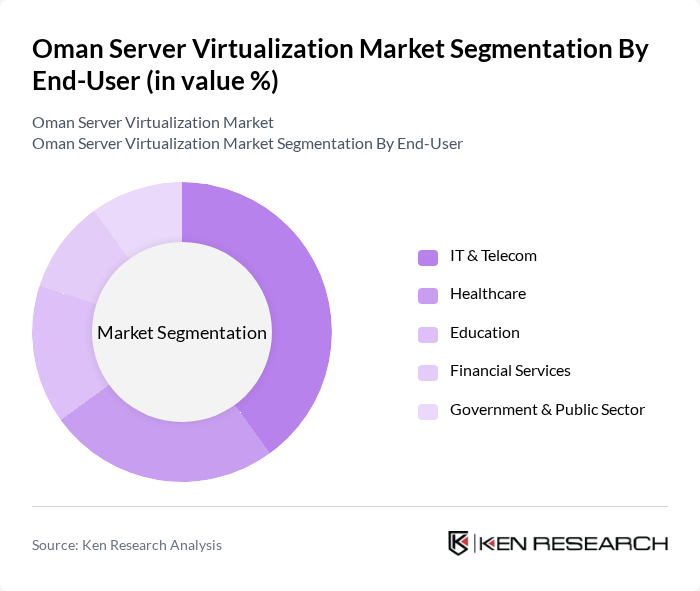

By End-User:The end-user segmentation includes IT & Telecom, Healthcare, Education, Financial Services, and Government & Public Sector. The IT & Telecom sector is the leading segment, driven by the need for scalable and efficient IT solutions to support growing data demands, enhance service delivery, and enable rapid digital transformation. Healthcare and financial services are also key adopters, leveraging virtualization for secure data management and compliance with sector-specific regulations .

The Oman Server Virtualization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, VMware, Inc., Microsoft Corporation, Red Hat, Inc., Citrix Systems, Inc., Nutanix, Inc., IBM Corporation, Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Parallels International GmbH, Alibaba Cloud, Google Cloud, Amazon Web Services (AWS), Rackspace Technology, Oman Data Park, Etisalat Oman, Omantel, STC Oman, Tata Consultancy Services (TCS) Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman server virtualization market is poised for significant growth as organizations increasingly recognize the benefits of virtualization technologies. With a projected increase in cloud adoption and a focus on cost efficiency, businesses are likely to invest more in virtualization solutions. Additionally, the ongoing digital transformation initiatives and government support for IT infrastructure development will further drive market expansion. As companies embrace hybrid cloud environments and automation, the demand for advanced virtualization technologies will continue to rise, shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hypervisor-based Virtualization OS-level Virtualization Hardware-assisted Virtualization Container-based Virtualization |

| By End-User | IT & Telecom Healthcare Education Financial Services Government & Public Sector |

| By Deployment Model | On-Premises Cloud-based Hybrid Multi-cloud |

| By Industry Vertical | Government Manufacturing Retail Energy & Utilities Transportation & Logistics |

| By Service Type | Consulting Services Implementation Services Maintenance & Support Services Managed Services |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Pricing Model | Subscription-based Pay-as-you-go One-time License Fee Usage-based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Virtualization | 100 | IT Managers, Network Administrators |

| Healthcare Sector Virtualization | 80 | System Administrators, IT Directors |

| Education Sector Cloud Adoption | 70 | IT Coordinators, Technology Officers |

| Telecommunications Infrastructure | 90 | Network Engineers, Operations Managers |

| SME Virtualization Solutions | 60 | Business Owners, IT Consultants |

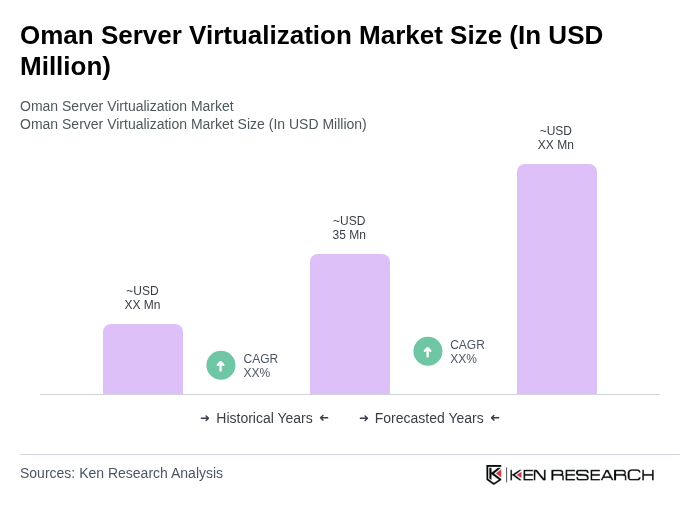

The Oman Server Virtualization Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is attributed to the increasing demand for efficient IT infrastructure and enhanced data security among organizations.