Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0999

Pages:90

Published On:October 2025

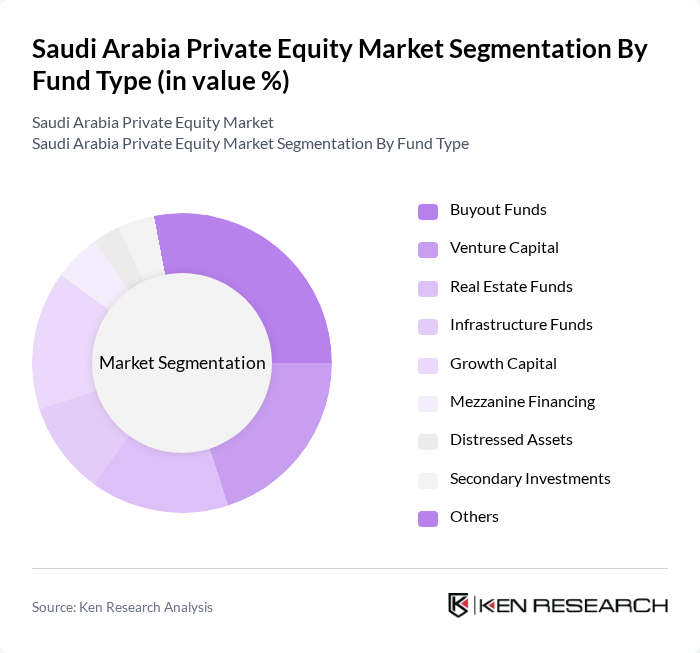

By Fund Type:The private equity market is segmented into various fund types, including Buyout Funds, Venture Capital, Real Estate Funds, Infrastructure Funds, Growth Capital, Mezzanine Financing, Distressed Assets, Secondary Investments, and Others. Each of these fund types plays a crucial role in catering to different investment strategies and risk appetites. Buyout funds and growth capital dominate capital deployment, while venture capital and real estate funds are increasingly active due to the rise of technology startups and real estate development .

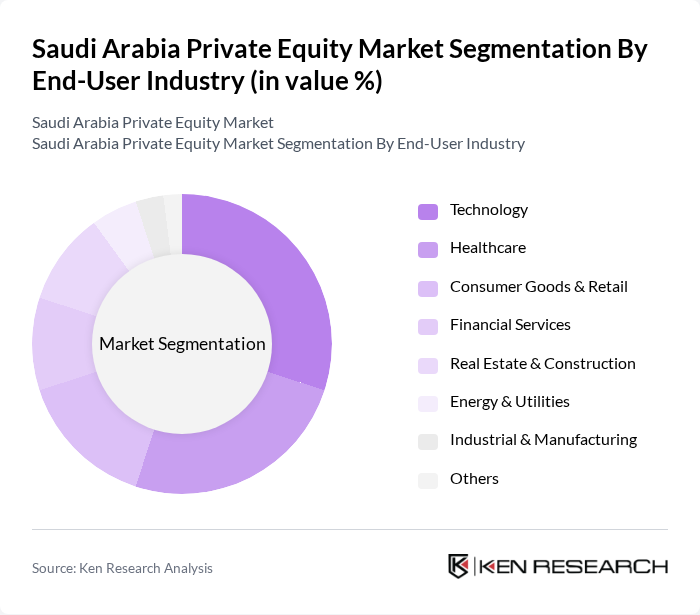

By End-User Industry:The private equity market is also segmented by end-user industries, which include Technology, Healthcare, Consumer Goods & Retail, Financial Services, Real Estate & Construction, Energy & Utilities, Industrial & Manufacturing, and Others. This segmentation reflects the diverse sectors that attract private equity investments. Technology and healthcare sectors have seen the highest deal flow, supported by government digitalization initiatives and healthcare infrastructure expansion .

The Saudi Arabia Private Equity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco Energy Ventures, Riyad Capital, Alkhabeer Capital, Gulf Capital, Jadwa Investment, SNB Capital, Al Faisaliah Group, STV (Saudi Technology Ventures), Vision Ventures, Wadi Makkah Ventures, Raed Ventures, Impact46, Sanabil Investments, Al-Muhaidib Group, Al-Tamimi Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian private equity market is poised for significant transformation, driven by ongoing economic diversification and a supportive regulatory environment. As the government continues to implement Vision 2030, sectors such as technology and renewable energy are expected to attract substantial investments. Additionally, the rise of impact investing and sustainability-focused funds will likely reshape investment strategies, fostering a more dynamic and resilient private equity landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Fund Type | Buyout Funds Venture Capital Real Estate Funds Infrastructure Funds Growth Capital Mezzanine Financing Distressed Assets Secondary Investments Others |

| By End-User Industry | Technology Healthcare Consumer Goods & Retail Financial Services Real Estate & Construction Energy & Utilities Industrial & Manufacturing Others |

| By Investment Stage | Seed Stage Early Stage Growth/Expansion Stage Late Stage Pre-IPO Others |

| By Fund Size | Less than $50 Million $50 Million - $200 Million $200 Million - $500 Million $500 Million - $1 Billion Above $1 Billion Others |

| By Geographic Focus | Domestic Investments Regional (GCC/MENA) Investments International Investments Others |

| By Sector Focus | Technology Healthcare Consumer Products & Services Industrial & Manufacturing Real Estate & Infrastructure Energy & Utilities Others |

| By Exit Strategy | IPO M&A Secondary Sale Buyback Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Venture Capital Investments | 60 | Venture Capitalists, Fund Managers |

| Buyout Transactions | 50 | Private Equity Executives, Investment Analysts |

| Sector-Specific Funds (Healthcare) | 40 | Healthcare Investment Managers, Financial Advisors |

| Real Estate Private Equity | 45 | Real Estate Fund Managers, Asset Managers |

| Impact Investing Initiatives | 40 | Impact Investors, Social Finance Experts |

The Saudi Arabia Private Equity Market is valued at approximately USD 7 billion, reflecting significant growth driven by investments in technology, healthcare, and infrastructure, as well as government initiatives like Vision 2030 aimed at diversifying the economy.