Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0333

Pages:81

Published On:December 2025

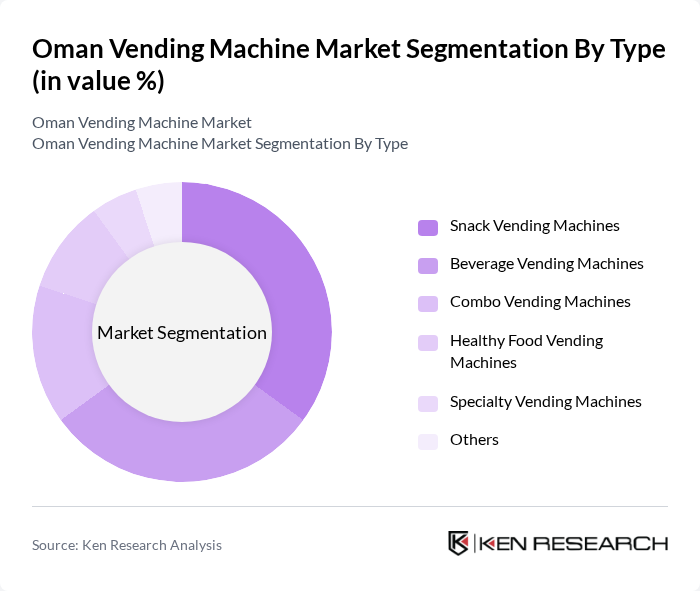

By Type:The vending machine market can be segmented into various types, including snack vending machines, beverage vending machines, combo vending machines, healthy food vending machines, specialty vending machines, and others. Among these, snack vending machines are particularly popular due to their convenience and the high demand for quick snack options in urban areas. Beverage vending machines also hold a significant share, driven by the increasing consumption of bottled drinks. The trend towards healthier eating has led to a rise in healthy food vending machines, catering to health-conscious consumers.

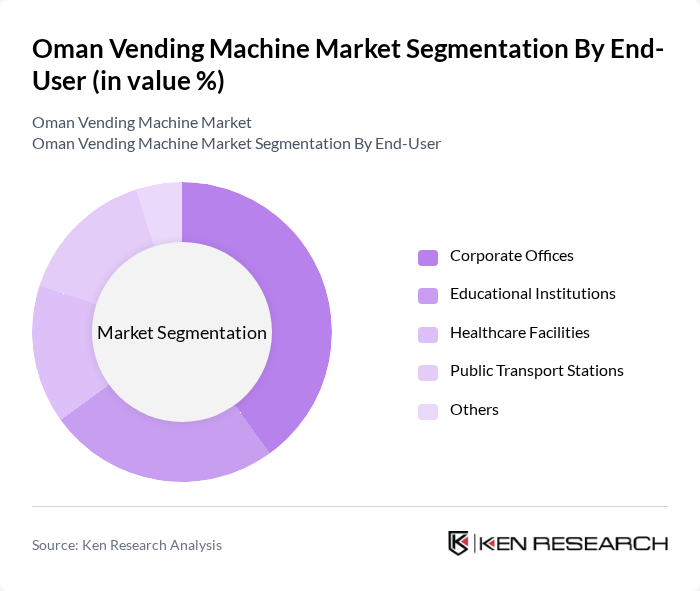

By End-User:The end-user segmentation includes corporate offices, educational institutions, healthcare facilities, public transport stations, and others. Corporate offices are a leading segment due to the high demand for quick snacks and beverages among employees. Educational institutions also represent a significant market, as students seek convenient food options. Healthcare facilities are increasingly adopting vending machines to provide easy access to snacks and drinks for patients and visitors, while public transport stations cater to travelers looking for quick refreshments.

The Oman Vending Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Vending, Al Mufeed Vending, Al Muna Vending Machines, Al Shams Vending, Al Waha Vending, Al Zawya Vending, Muscat Vending Solutions, Oman Vending Services, Smart Vending Oman, Vending Solutions Oman, Vending Technologies Oman, Vending World Oman, Vending Hub Oman, Vending Innovations Oman, Vending Systems Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman vending machine market is poised for growth, driven by advancements in digital infrastructure and increasing consumer demand for convenience. The expansion of fiber-optic networks and the rollout of 5G technology will enhance connectivity, enabling smart vending solutions that cater to tech-savvy consumers. Additionally, the government's focus on digital transformation and infrastructure investment will likely create a supportive environment for the vending industry, fostering innovation and market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Snack Vending Machines Beverage Vending Machines Combo Vending Machines Healthy Food Vending Machines Specialty Vending Machines Others |

| By End-User | Corporate Offices Educational Institutions Healthcare Facilities Public Transport Stations Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Payment Method | Cash Payment Card Payment Mobile Payment Others |

| By Product Offering | Snacks Beverages Fresh Food Others |

| By Machine Size | Small Vending Machines Medium Vending Machines Large Vending Machines Others |

| By Technology | Traditional Vending Machines Smart Vending Machines Touchless Vending Machines Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Vending Products | 150 | General Consumers, College Students |

| Business Utilization of Vending Services | 100 | Office Managers, Facility Coordinators |

| Vending Machine Operators Insights | 80 | Business Owners, Operations Managers |

| Technological Adoption in Vending Machines | 70 | IT Managers, Product Development Leads |

| Market Trends and Future Outlook | 90 | Industry Analysts, Market Researchers |

The Oman vending machine market is valued at approximately USD 30 million, reflecting a growing demand for automated retail solutions in the region, which is part of a larger Middle East and Africa vending sector valued at USD 922.6 million.