Region:North America

Author(s):Geetanshi

Product Code:KRAA9071

Pages:92

Published On:November 2025

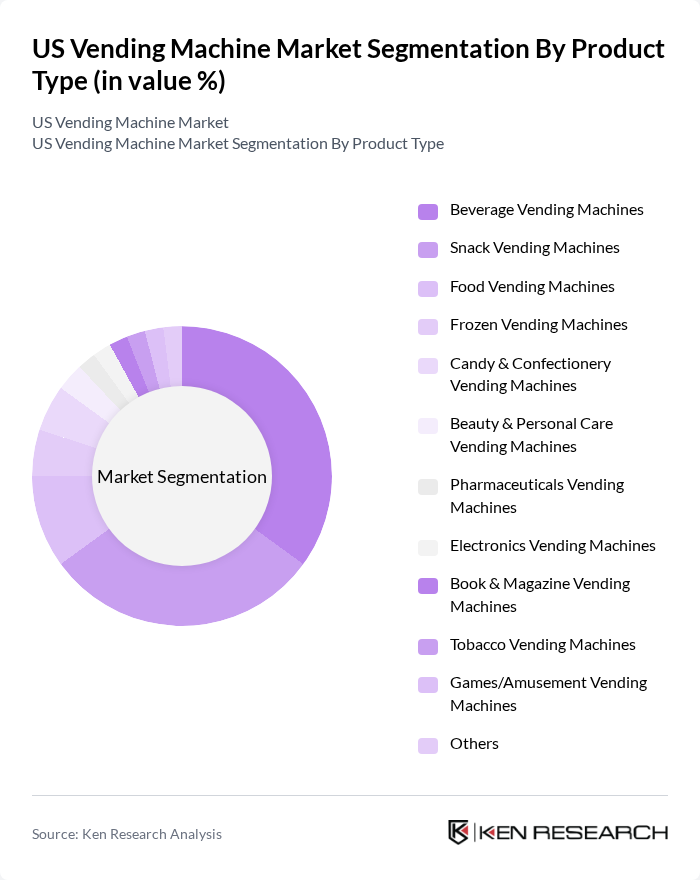

By Product Type:The product type segmentation includes various categories of vending machines that cater to different consumer needs. The dominant sub-segment is Beverage Vending Machines, which are popular due to the high demand for drinks in public spaces and offices. Snack Vending Machines also hold a significant share, driven by the convenience of quick snacks and the increasing preference for healthier options. Other segments such as Food, Frozen, and Candy & Confectionery Vending Machines are experiencing steady growth, supported by innovations in product offerings and machine technology. Beauty & Personal Care, Pharmaceuticals, and Electronics vending machines represent emerging categories, gaining traction in urban centers, airports, and university campuses due to evolving consumer lifestyles and the need for on-demand access to diverse products .

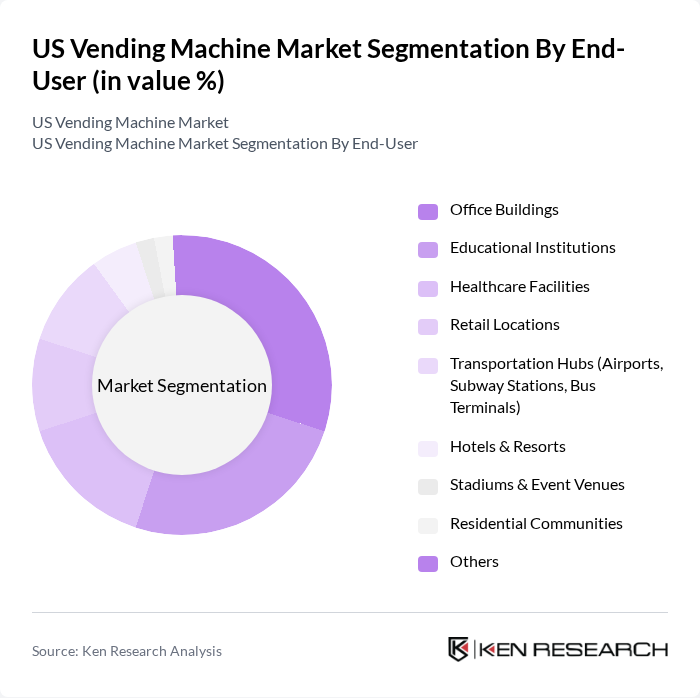

By End-User:The end-user segmentation highlights the various sectors utilizing vending machines. Office Buildings and Educational Institutions are the leading segments, driven by the need for quick and accessible food and beverage options for employees and students. Healthcare Facilities represent a growing market, as they require vending solutions that cater to health-conscious consumers and support 24/7 access to essential items. Retail Locations and Transportation Hubs, including airports and subway stations, are significant contributors, benefiting from high foot traffic and the demand for convenience. Hotels, resorts, stadiums, event venues, and residential communities are also adopting vending machines to enhance guest experiences and provide on-demand services .

The US Vending Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crane Merchandising Systems, Canteen Vending Services (Compass Group USA), Aramark Corporation, Selecta Group, USA Technologies (now Cantaloupe Inc.), Coin Acceptors, Inc., Jofemar USA, Royal Vendors, Inc., Vending.com (Fawn Engineering), Vending Solutions, Fresh Healthy Vending, VendSys, Seaga Manufacturing Inc., Automated Merchandising Systems (AMS), Wittern Group (USI - United Services Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US vending machine market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As cashless payment systems become more prevalent, operators can expect increased transaction volumes. Additionally, the growing focus on health and wellness will likely lead to a broader range of healthy product offerings, catering to health-conscious consumers. These trends suggest a dynamic market landscape that will continue to evolve in response to consumer demands and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Beverage Vending Machines Snack Vending Machines Food Vending Machines Frozen Vending Machines Candy & Confectionery Vending Machines Beauty & Personal Care Vending Machines Pharmaceuticals Vending Machines Electronics Vending Machines Book & Magazine Vending Machines Tobacco Vending Machines Games/Amusement Vending Machines Others |

| By End-User | Office Buildings Educational Institutions Healthcare Facilities Retail Locations Transportation Hubs (Airports, Subway Stations, Bus Terminals) Hotels & Resorts Stadiums & Event Venues Residential Communities Others |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments Contactless Payments Others |

| By Technology | Traditional (Manual/Semi-Automatic) Smart (IoT-Enabled, Touchscreen, Mobile App Integration) Others |

| By Location | Urban Areas Suburban Areas Rural Areas High Traffic Locations Others |

| By Machine Size | Full-Size Machines Compact Machines Mini Machines Others |

| By Brand | National Brands Regional Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Snack Vending Machines | 60 | Vending Operators, Retail Managers |

| Beverage Vending Machines | 55 | Product Managers, Sales Directors |

| Healthy Options Vending Machines | 45 | Health and Wellness Coordinators, Nutritionists |

| Corporate Vending Solutions | 40 | Office Managers, Facility Coordinators |

| Public Space Vending Machines | 50 | Event Coordinators, Municipal Facility Managers |

The US vending machine market is valued at approximately USD 21.9 billion, reflecting a significant growth trend driven by consumer demand for convenience and advancements in vending technology.