Region:Middle East

Author(s):Shubham

Product Code:KRAA6399

Pages:93

Published On:January 2026

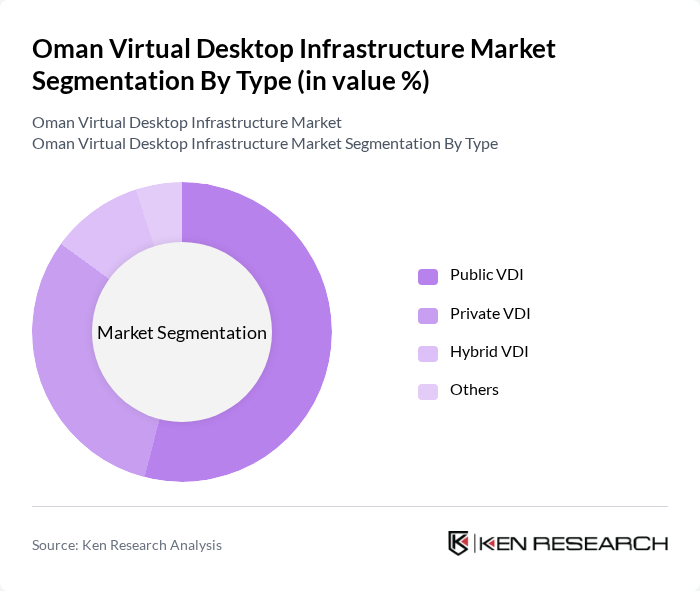

By Type:The market is segmented into Public VDI, Private VDI, Hybrid VDI, and Others. Public VDI is gaining traction due to its cost-effectiveness and scalability, while Private VDI is preferred by organizations requiring enhanced security. Hybrid VDI is increasingly popular as it combines the benefits of both public and private models, allowing flexibility and control. The Others segment includes niche solutions catering to specific business needs.

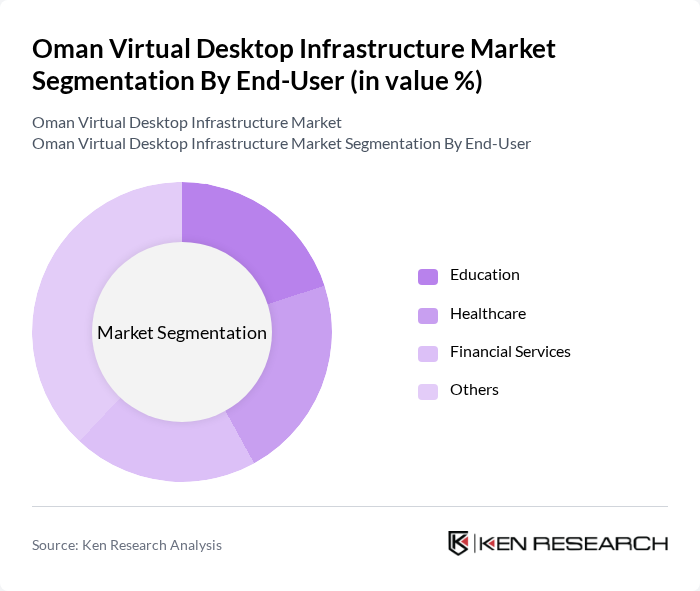

By End-User:The end-user segmentation includes Education, Healthcare, Financial Services, and Others. The Education sector is increasingly adopting VDI solutions to facilitate remote learning and improve access to educational resources. Healthcare organizations utilize VDI for secure patient data management and telemedicine services. Financial Services leverage VDI for enhanced security and compliance, while the Others segment encompasses various industries adopting VDI for operational efficiency.

The Oman Virtual Desktop Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Citrix Systems, Inc., VMware, Inc., Microsoft Corporation, Amazon Web Services, Inc., Nutanix, Inc., Dell Technologies Inc., IBM Corporation, Parallels International GmbH, Red Hat, Inc., Google Cloud, Cisco Systems, Inc., HPE (Hewlett Packard Enterprise), Citrix Systems, Inc., Aternity, Inc., IGEL Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Virtual Desktop Infrastructure market appears promising, driven by the increasing integration of advanced technologies and the ongoing digital transformation initiatives. As organizations continue to embrace hybrid work models, the demand for flexible and secure VDI solutions is expected to rise. Additionally, the government's commitment to enhancing IT infrastructure will likely facilitate broader adoption, enabling businesses to leverage VDI for improved operational efficiency and security in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Public VDI Private VDI Hybrid VDI Others |

| By End-User | Education Healthcare Financial Services Others |

| By Deployment Model | On-Premises Cloud-Based Others |

| By Industry Vertical | Government Retail Manufacturing Others |

| By Service Type | Managed Services Professional Services Others |

| By User Type | Individual Users Corporate Users Others |

| By Geographic Distribution | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector VDI Adoption | 100 | IT Directors, Educational Administrators |

| Healthcare VDI Implementation | 80 | Healthcare IT Managers, System Administrators |

| Government Agency VDI Usage | 70 | Government IT Officers, Project Managers |

| Corporate Sector VDI Solutions | 90 | Corporate IT Managers, CIOs |

| SME VDI Adoption Trends | 60 | Small Business Owners, IT Consultants |

The Oman Virtual Desktop Infrastructure Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for remote work solutions and digital transformation initiatives across various sectors.