Region:Asia

Author(s):Shubham

Product Code:KRAA6403

Pages:98

Published On:January 2026

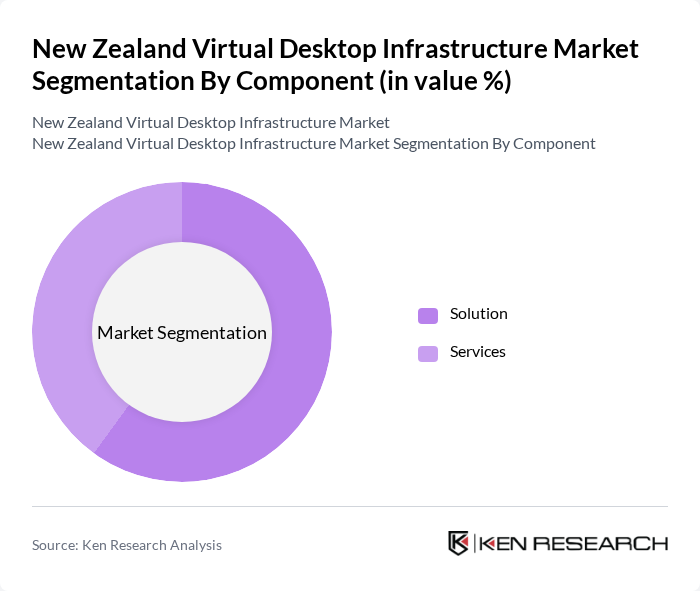

By Component:The market is segmented into two main components: Solutions and Services. Solutions encompass the software and hardware required for virtual desktop infrastructure, while Services include the support and maintenance provided to ensure optimal performance.

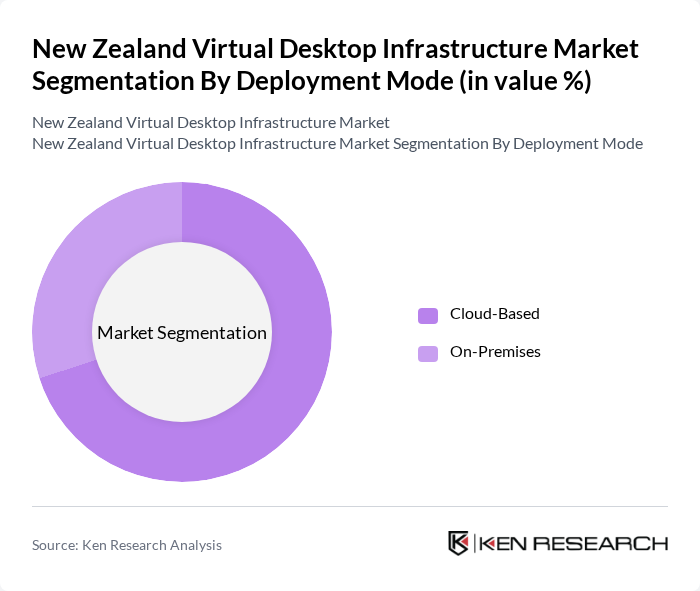

By Deployment Mode:The market is divided into Cloud-Based and On-Premises deployment modes. Cloud-Based solutions are increasingly preferred due to their scalability and cost-effectiveness, while On-Premises solutions are favored by organizations with specific security and compliance requirements.

The New Zealand Virtual Desktop Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as VMware, Citrix Systems, Microsoft, Amazon Web Services (AWS), Nutanix, Dell Technologies, IBM, Google Cloud, Parallels, Red Hat, Oracle, Rackspace, Aternity, IGEL Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand Virtual Desktop Infrastructure market appears promising, driven by the ongoing digital transformation across various sectors. As organizations increasingly adopt hybrid work models, the demand for flexible and secure VDI solutions is expected to grow. Additionally, advancements in cloud technologies and AI integration will enhance VDI capabilities, making them more attractive to businesses. The focus on sustainability will also shape future developments, as companies seek energy-efficient solutions to meet regulatory requirements and corporate social responsibility goals.

| Segment | Sub-Segments |

|---|---|

| By Component | Solution Services |

| By Deployment Mode | Cloud-Based On-Premises |

| By Organization Size | Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | IT and Telecommunications BFSI Retail Healthcare Manufacturing Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector VDI Adoption | 120 | IT Directors, Network Administrators |

| Healthcare VDI Implementation | 100 | Chief Information Officers, IT Managers |

| Financial Services VDI Usage | 90 | Compliance Officers, IT Security Managers |

| SMB VDI Solutions | 110 | Business Owners, IT Consultants |

| Government VDI Initiatives | 80 | Public Sector IT Managers, Digital Transformation Leads |

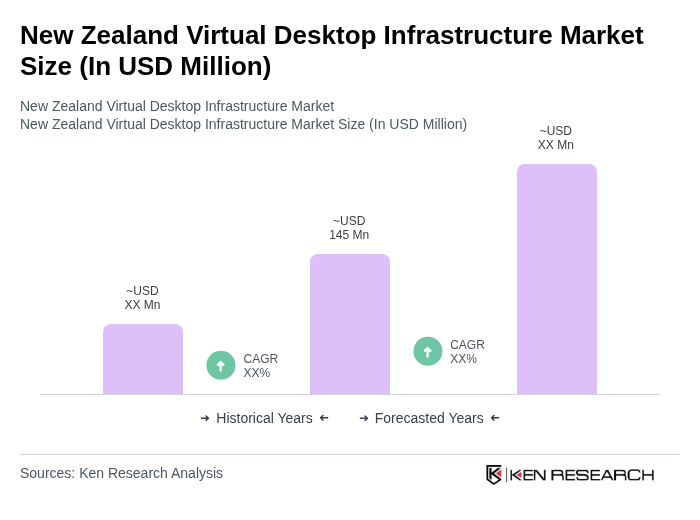

The New Zealand Virtual Desktop Infrastructure Market is valued at approximately USD 145 million, reflecting a significant growth trend driven by the increasing demand for remote work solutions and enhanced security features among organizations.