Region:Middle East

Author(s):Shubham

Product Code:KRAA6397

Pages:97

Published On:January 2026

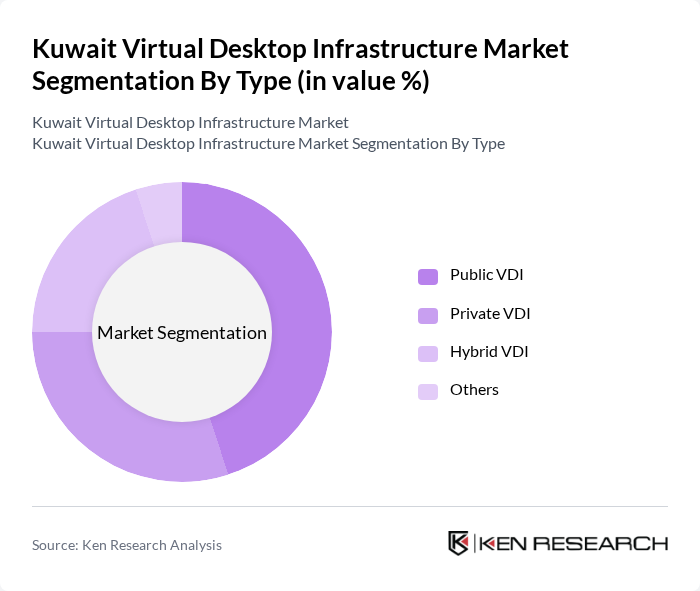

By Type:

The Virtual Desktop Infrastructure market is segmented into Public VDI, Private VDI, Hybrid VDI, and Others. Among these, the Public VDI segment is currently leading the market due to its cost-effectiveness and scalability, making it an attractive option for small and medium enterprises. The increasing adoption of cloud services and the need for flexible work environments are driving the growth of Public VDI. Private VDI is also gaining traction, particularly among large enterprises that prioritize data security and control over their IT environments. Hybrid VDI is emerging as a popular choice for organizations looking to balance the benefits of both public and private solutions.

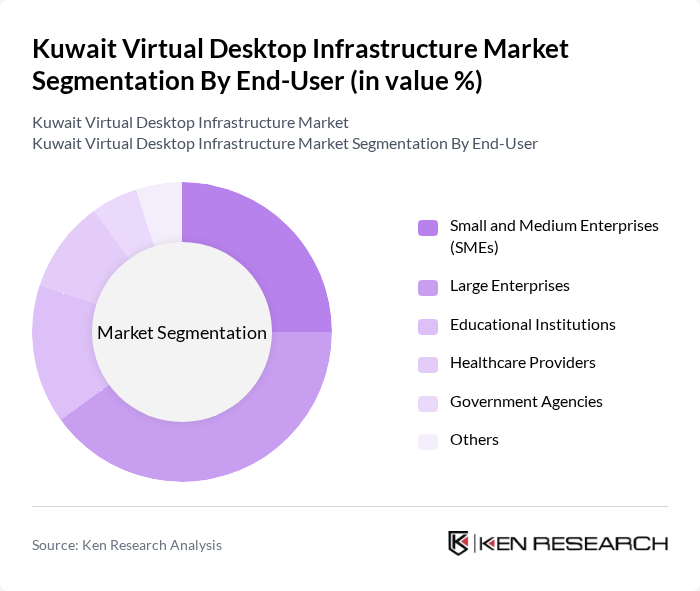

By End-User:

The market is segmented by end-user into Small and Medium Enterprises (SMEs), Large Enterprises, Educational Institutions, Healthcare Providers, Government Agencies, and Others. The Large Enterprises segment dominates the market due to their substantial IT budgets and the need for robust security and management solutions. SMEs are increasingly adopting VDI solutions as they seek to enhance productivity without incurring high infrastructure costs. Educational institutions are also leveraging VDI to provide students with access to learning resources remotely, while healthcare providers are utilizing these solutions to ensure secure access to patient data.

The Kuwait Virtual Desktop Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Citrix Systems, Inc., VMware, Inc., Microsoft Corporation, Amazon Web Services, Inc., Nutanix, Inc., Dell Technologies Inc., IBM Corporation, Parallels International GmbH, Red Hat, Inc., Google Cloud, Oracle Corporation, Rackspace Technology, Inc., Huawei Technologies Co., Ltd., Lenovo Group Limited, Fujitsu Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Virtual Desktop Infrastructure market appears promising, driven by the ongoing digital transformation initiatives across various sectors. As organizations increasingly prioritize remote work and cost efficiency, the demand for VDI solutions is expected to rise significantly in future. Additionally, advancements in cloud technologies and AI-driven solutions will further enhance the capabilities of VDI, making it more attractive to businesses. The focus on sustainability will also shape the market, as companies seek eco-friendly IT solutions that align with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Public VDI Private VDI Hybrid VDI Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Educational Institutions Healthcare Providers Government Agencies Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | IT and Telecommunications Financial Services Retail Manufacturing Others |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| By User Type | Individual Users Corporate Users Educational Users Others |

| By Service Model | Desktop as a Service (DaaS) Infrastructure as a Service (IaaS) Software as a Service (SaaS) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services VDI Adoption | 100 | IT Managers, Chief Technology Officers |

| Healthcare Sector VDI Implementation | 80 | Healthcare IT Directors, System Administrators |

| Education Sector VDI Usage | 70 | IT Coordinators, Educational Administrators |

| Government Agency VDI Deployment | 60 | IT Policy Makers, Network Administrators |

| SME VDI Solutions Adoption | 90 | Small Business Owners, IT Consultants |

The Kuwait Virtual Desktop Infrastructure market is valued at approximately USD 170 million, reflecting a significant growth driven by the increasing demand for remote work solutions and enhanced IT management across various sectors such as IT, healthcare, and finance.