Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0542

Pages:96

Published On:December 2025

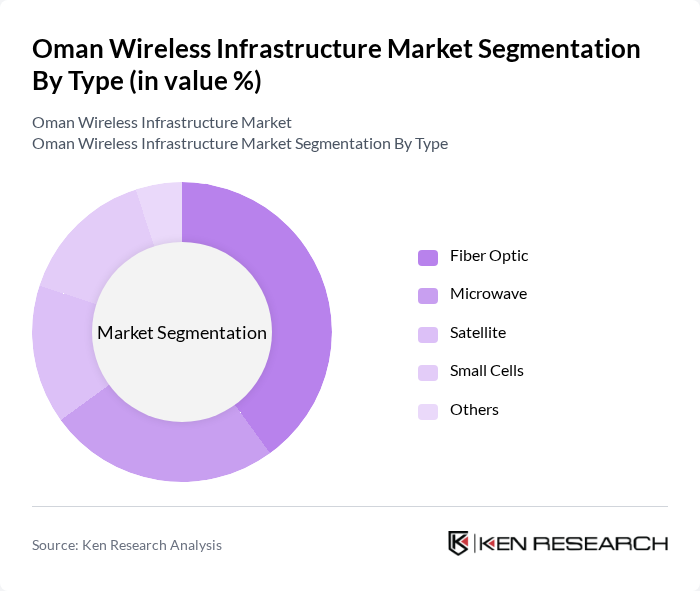

By Type:The market is segmented into various types, including Fiber Optic, Microwave, Satellite, Small Cells, and Others. Fiber Optic technology is currently dominating the market due to its high-speed data transmission capabilities and reliability, which are essential for supporting the increasing demand for bandwidth from both consumers and businesses. Microwave technology is also gaining traction, particularly in remote areas where fiber optic deployment is challenging. The demand for Small Cells is rising as urban areas seek to enhance network capacity and coverage.

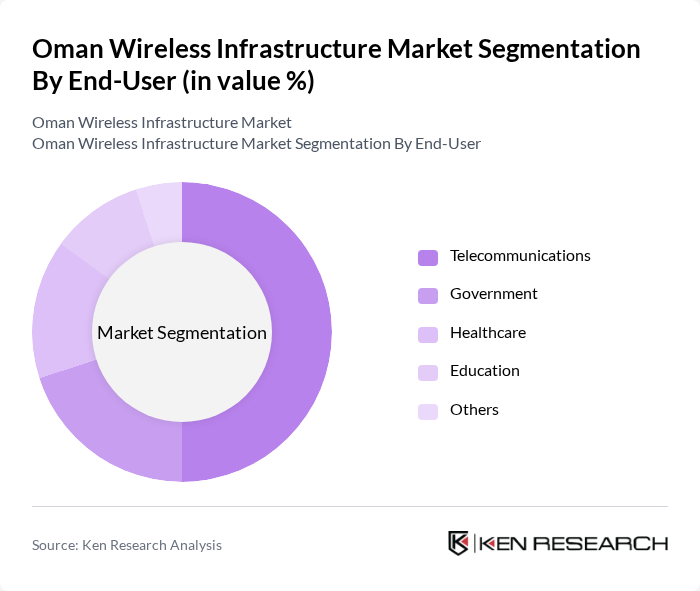

By End-User:The end-user segmentation includes Telecommunications, Government, Healthcare, Education, and Others. The Telecommunications sector is the leading end-user, driven by the increasing demand for mobile connectivity and data services. Government initiatives aimed at enhancing digital infrastructure also contribute significantly to market growth. The Healthcare and Education sectors are increasingly adopting wireless technologies to improve service delivery and operational efficiency, further expanding the market.

The Oman Wireless Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Awasr, Vodafone Oman, Al Shamil, Nawras, Oman Fiber Optic, Oman Telecommunications Company, Gulf Bridge International, Ericsson Oman, Huawei Technologies Oman, Nokia Oman, Zain Group, Cisco Systems Oman, NEC Corporation Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman wireless infrastructure market appears promising, driven by ongoing digital transformation initiatives and the integration of advanced technologies. The government aims to digitize 80% of public services in future, which will significantly boost demand for high-speed internet and wireless connectivity. Additionally, the expansion of 5G networks and IoT applications will further enhance service capabilities, positioning Oman as a regional digital hub. Continued investment in infrastructure will be crucial to support these developments and meet the growing consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber Optic Microwave Satellite Small Cells Others |

| By End-User | Telecommunications Government Healthcare Education Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah |

| By Technology | G LTE G Wi-Fi IoT Connectivity Others |

| By Application | Mobile Communications Fixed Wireless Access Smart Grid Emergency Services Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Infrastructure Providers | 100 | Network Engineers, Infrastructure Managers |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| End-User Enterprises | 80 | IT Managers, Operations Directors |

| Consulting Firms in Telecommunications | 60 | Market Analysts, Strategy Consultants |

| Wireless Technology Innovators | 70 | Product Development Managers, R&D Heads |

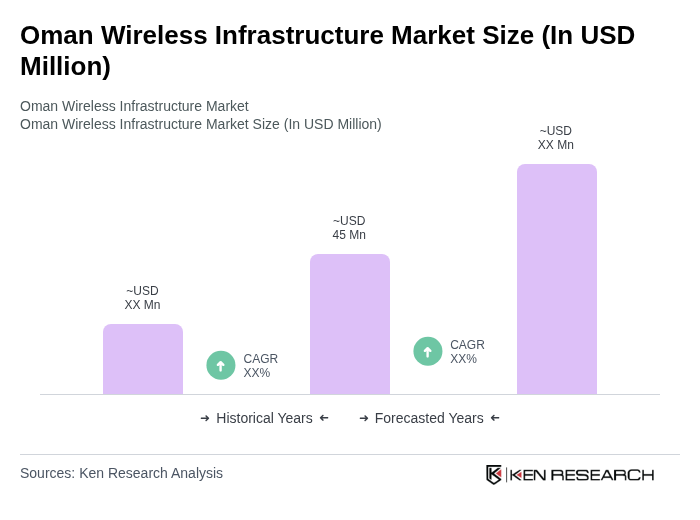

The Oman Wireless Infrastructure Market is valued at approximately USD 45 million, driven by factors such as 5G expansion, increasing mobile and IoT subscriptions, and digital transformation initiatives under the national Vision 2040 agenda.