Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5854

Pages:89

Published On:December 2025

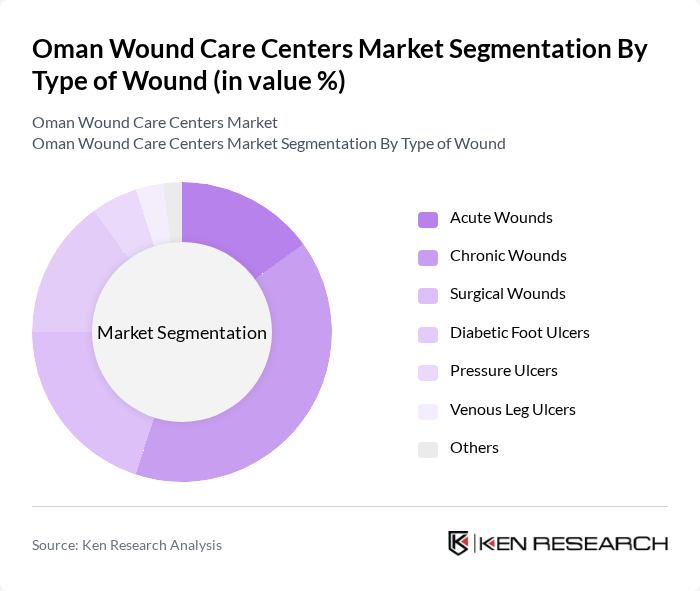

By Type of Wound:The market is segmented into various types of wounds, including acute wounds such as surgical incisions, traumatic wounds, burns, lacerations, and abrasions; chronic wounds encompassing diabetic foot ulcers, pressure ulcers, venous leg ulcers; surgical wounds, and others. Among these, chronic wounds, particularly diabetic foot ulcers, are dominating the market due to the rising prevalence of diabetes in Oman. The increasing awareness of specialized wound care and the need for advanced treatment options are driving the demand for chronic wound management services.

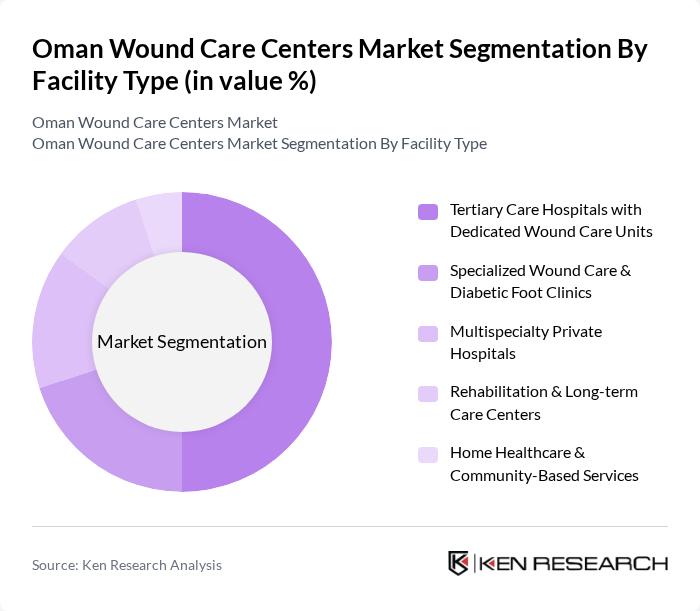

By Facility Type:The market is categorized into various facility types, including tertiary care hospitals with dedicated wound care units, specialized wound care and diabetic foot clinics, multispecialty private hospitals, rehabilitation and long-term care centers, and home healthcare and community-based services. Tertiary care hospitals are leading the market due to their advanced facilities and specialized staff, which are essential for managing complex wound cases effectively.

The Oman Wound Care Centers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal Hospital, Sultan Qaboos University Hospital, Khoula Hospital, Al Nahda Hospital, Badr Al Samaa Group of Hospitals, Muscat Private Hospital, Aster Royal Hospital, Ghubra (Aster DM Healthcare), NMC Specialty Hospital, Al Ghoubra, Oman International Hospital, Al Hayat International Hospital, Starcare Hospital, Muscat, Apollo Hospital Muscat, Burjeel Hospital, Muscat, Badr Al Samaa Hospital, Sohar, Armed Forces Hospital (Royal Army of Oman Medical Services) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman wound care centers market is poised for significant growth, driven by increasing healthcare investments and a focus on improving patient outcomes. The integration of digital health technologies, such as telemedicine, is expected to enhance access to specialized care, particularly in remote areas. Additionally, the emphasis on preventive care and education will likely foster a more proactive approach to wound management, ultimately benefiting both patients and healthcare providers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type of Wound | Acute Wounds Chronic Wounds Surgical Wounds Diabetic Foot Ulcers Pressure Ulcers Venous Leg Ulcers Others |

| By Facility Type | Tertiary Care Hospitals with Dedicated Wound Care Units Specialized Wound Care & Diabetic Foot Clinics Multispecialty Private Hospitals Rehabilitation & Long-term Care Centers Home Healthcare & Community-Based Services |

| By Clinical Service Offering | Advanced Wound Dressing & Debridement Services Negative Pressure Wound Therapy (NPWT) Hyperbaric Oxygen Therapy (HBOT) Infection Management & Antibiotic Stewardship Multidisciplinary Diabetic Foot Management Programs Patient Education & Preventive Care Programs |

| By Ownership | Public / Government Hospitals Private Hospitals & Clinics Military & Royal Court Medical Services NGO & Charity-Run Facilities |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender Socioeconomic Status Others |

| By Treatment Modality | Surgical Interventions (Debridement, Revascularization, etc.) Non-Surgical / Conservative Management Advanced & Regenerative Therapies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 100 | Wound Care Specialists, Nursing Staff |

| Private Wound Care Clinics | 80 | Clinic Owners, Medical Directors |

| Pharmaceutical Suppliers of Wound Care Products | 60 | Sales Managers, Product Development Leads |

| Insurance Providers Covering Wound Care Treatments | 50 | Claims Managers, Health Insurance Product Managers |

| Patient Advocacy Groups for Chronic Wound Care | 40 | Advocacy Leaders, Patient Representatives |

The Oman Wound Care Centers Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of chronic diseases and advancements in wound care technologies.