Region:Asia

Author(s):Rebecca

Product Code:KRAA9320

Pages:85

Published On:November 2025

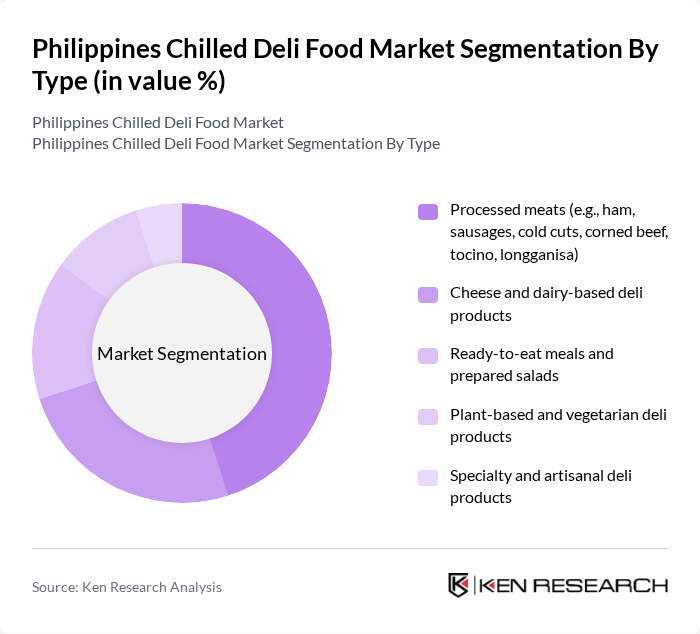

By Type:The market is segmented into various types of chilled deli products, including processed meats, cheese and dairy-based products, ready-to-eat meals, plant-based options, and specialty items. Processed meats, such as ham and sausages, dominate the market due to their popularity and convenience among consumers. The increasing trend towards health-conscious eating has also led to a rise in demand for cheese and dairy-based products, as well as plant-based alternatives .

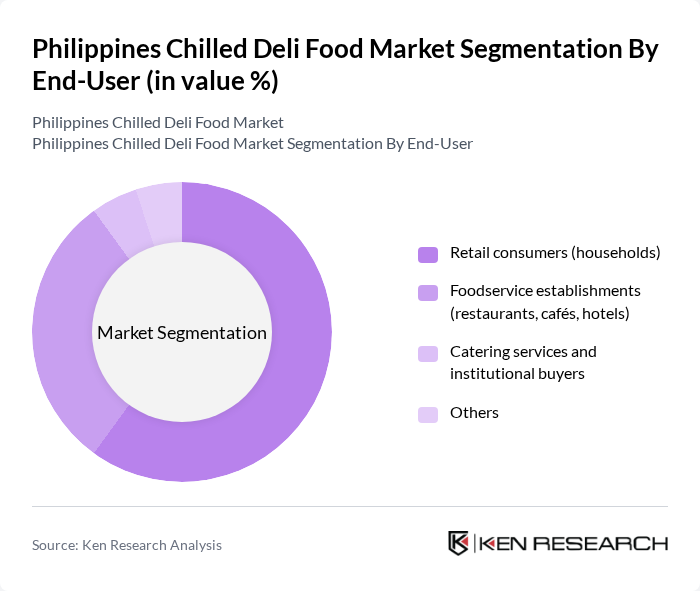

By End-User:The end-user segmentation includes retail consumers, foodservice establishments, catering services, and other institutional buyers. Retail consumers represent the largest segment, driven by the increasing trend of home cooking and the demand for convenient meal solutions. Foodservice establishments, including restaurants and cafés, are also significant contributors, as they seek high-quality deli products to enhance their menus .

The Philippines Chilled Deli Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Purefoods Hormel Company, Inc., Monterey Foods Corporation, CDO Foodsphere, Inc., San Miguel Foods, Inc., Delimondo, The Purefoods Company, Inc., Jollibee Foods Corporation, Nestlé Philippines, Inc., Unilever Philippines, Inc., Kraft Heinz Philippines, Inc., Albay Deli, Deli Dishes, Gourmet Farms, Inc., S&R Membership Shopping, Foodie Market contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines chilled deli food market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for convenience and health-oriented products continues to rise, companies are likely to innovate their offerings. Additionally, the expansion of online sales channels will enhance accessibility, allowing brands to reach a broader audience. With a focus on sustainability and local sourcing, the market is expected to adapt to changing consumer values, fostering growth and resilience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Processed meats (e.g., ham, sausages, cold cuts, corned beef, tocino, longganisa) Cheese and dairy-based deli products Ready-to-eat meals and prepared salads Plant-based and vegetarian deli products Specialty and artisanal deli products |

| By End-User | Retail consumers (households) Foodservice establishments (restaurants, cafés, hotels) Catering services and institutional buyers Others |

| By Distribution Channel | Supermarkets and hypermarkets Convenience stores Online grocery and e-commerce Foodservice distributors Traditional wet markets Others |

| By Packaging Type | Vacuum-sealed packaging Modified atmosphere packaging Resealable and portion-controlled packaging Others |

| By Price Range | Premium products Mid-range products Economy products Others |

| By Consumer Demographics | Age groups Income levels Urban vs rural consumers Others |

| By Health Attributes | Low-fat and reduced-sodium products Gluten-free and allergen-free options Organic and clean-label products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Chilled Deli Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences for Chilled Deli Products | 120 | Household Decision Makers, Food Enthusiasts |

| Distribution Channel Insights | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Regulatory Impact on Chilled Deli Market | 40 | Food Safety Inspectors, Regulatory Affairs Specialists |

The Philippines Chilled Deli Food Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by consumer demand for convenient and ready-to-eat food options, urbanization, and healthier eating habits.