Region:Asia

Author(s):Rebecca

Product Code:KRAD4379

Pages:98

Published On:December 2025

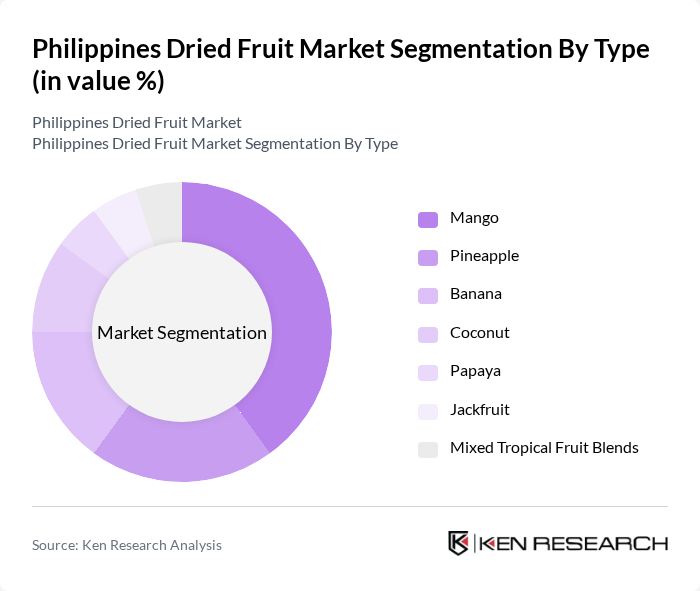

By Type:The dried fruit market in the Philippines is segmented into various types, including Mango, Pineapple, Banana, Coconut, Papaya, Jackfruit, and Mixed Tropical Fruit Blends. Each type caters to different consumer preferences and market demands. Mango, in particular, is a leading subsegment due to its popularity both domestically and internationally, driven by its unique flavor and nutritional benefits. The increasing trend of healthy snacking has further propelled the demand for dried mangoes, making it a staple in many households.

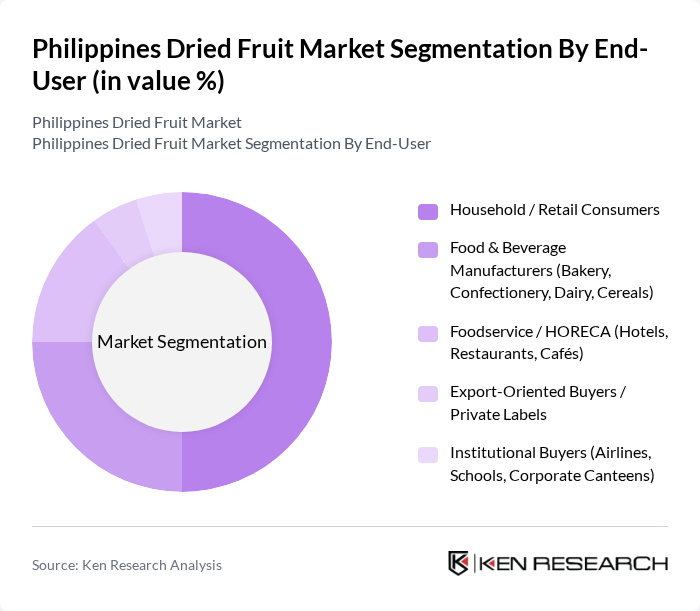

By End-User:The dried fruit market is also segmented by end-user categories, including Household/Retail Consumers, Food & Beverage Manufacturers, Foodservice/HORECA, Export-Oriented Buyers, and Institutional Buyers. The Household/Retail Consumers segment is the largest, driven by the growing trend of healthy eating and snacking. Consumers are increasingly opting for dried fruits as nutritious snacks, which has led to a surge in retail sales across supermarkets and online platforms.

The Philippines Dried Fruit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Profood International Corporation (Cebu), Philippine Brand / Brandexports Philippines, Inc., Jhaz Dried Mangoes (Cebu), Prime Fruits International, Inc., R&M Preserves and Mango Products (Cebu), CEBO Dried Fruit Corp., 7D Food International, Inc., Sutiwa Dried Fruits (Mindanao), Celebes Coconut Corporation (Coconut & Dried Fruit Lines), Sunbest Dried Fruits & Nuts (Philippines), Raquel Farms Foods Corp. (Dried Tropical Fruits), Philippine Dehydrated Foods for Export (PDFFEX), M.Lhuillier Food Products (Mango Processing), Cebu Tropical Food Export Corporation, Dole Philippines, Inc. (Tropical Fruit & Value-Added Dried Products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dried fruit market in the Philippines appears promising, driven by increasing health consciousness and the growing popularity of natural snacks. As e-commerce continues to expand, producers will have enhanced opportunities to reach consumers. Additionally, the market is likely to see innovations in product offerings, including organic and sustainably sourced options, which align with global trends. The focus on health and convenience will further solidify dried fruits as a staple in the Filipino diet, fostering growth in both domestic and export markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Mango Pineapple Banana Coconut Papaya Jackfruit Mixed Tropical Fruit Blends |

| By End-User | Household / Retail Consumers Food & Beverage Manufacturers (Bakery, Confectionery, Dairy, Cereals) Foodservice / HORECA (Hotels, Restaurants, Cafés) Export-Oriented Buyers / Private Labels Institutional Buyers (Airlines, Schools, Corporate Canteens) |

| By Packaging Type | Bulk Industrial Packs (Sacks, Cartons) Retail Pillow Packs & Pouches Resealable & Stand-Up Pouches Eco-Friendly / Compostable Packaging |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience Stores & Groceries Online Retail & E-Grocery Platforms Specialty Health & Organic Stores Direct & Institutional Sales |

| By Region | Luzon Visayas Mindanao |

| By Price Range | Premium (Export-Grade, Organic, Value-Added) Mid-Range Branded Products Economy / Private Label Foodservice / Bulk Price Tiers |

| By Nutritional / Product Claim | High Fiber No Added Sugar / Low Sugar Organic / Naturally Grown Fortified / Functional (Vitamins, Probiotics, Etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Health-Conscious Shoppers, Regular Dried Fruit Consumers |

| Supply Chain Dynamics | 100 | Logistics Coordinators, Distribution Managers |

| Production Insights | 80 | Farm Owners, Processing Plant Managers |

| Export Market Analysis | 70 | Export Managers, Trade Analysts |

The Philippines Dried Fruit Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by health consciousness, demand for convenient snacks, and the country's agricultural resources supporting diverse dried fruit production.