Region:Asia

Author(s):Rebecca

Product Code:KRAD2781

Pages:84

Published On:November 2025

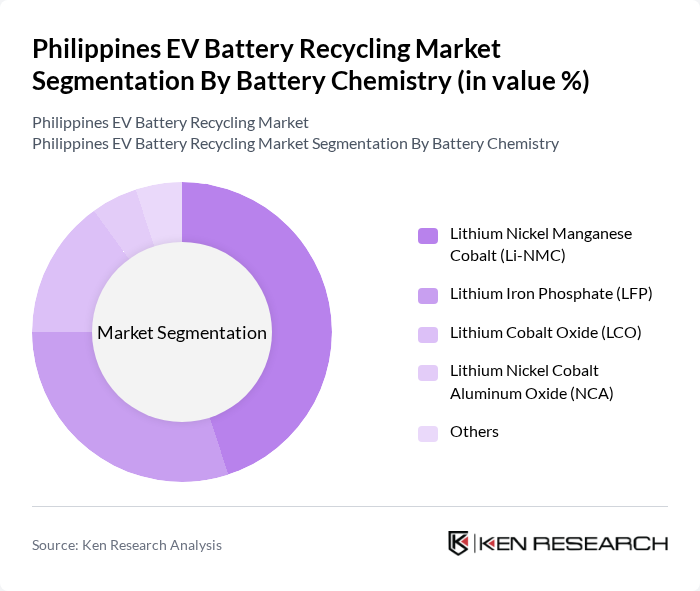

By Battery Chemistry:The battery chemistry segment includes various types of batteries used in electric vehicles, each with unique recycling processes and recovery rates. The dominant subsegment is Lithium Nickel Manganese Cobalt (Li-NMC), favored for its high energy density and efficiency in EV applications. Lithium Iron Phosphate (LFP) is also gaining traction due to its safety, thermal stability, and cost-effectiveness. The market is witnessing a shift towards more sustainable battery chemistries, especially LFP, which is increasingly adopted in the Asia-Pacific region, influencing recycling practices and technology development .

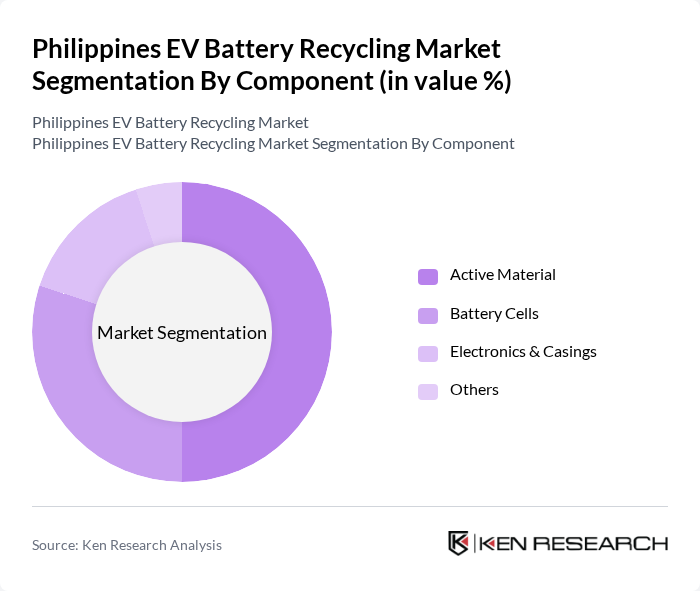

By Component:The component segment encompasses various parts of EV batteries that can be recycled. The leading subsegment is Active Material, which includes essential components like cathodes and anodes that are critical for battery performance. Battery Cells and Electronics & Casings also play significant roles in the recycling process, as they contain valuable materials that can be recovered and reused, contributing to sustainability efforts. The surge in EV adoption and consumer electronics is intensifying the need for advanced recycling of both active materials and battery cells .

The Philippines EV Battery Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Battery Recycling Corporation, Envirocycle Philippines, Green Antz Builders, E-Waste Management Philippines, Battery Solutions Philippines, Recycle Energy Philippines, EcoWaste Coalition, Integrated Recycling Industries Philippines, Inc., Clean Tech Solutions, Powercycle, Green Energy Solutions, Eco-Environmental Solutions, Recycle Bin, Sustainable Energy Solutions, Battery Recycling Technologies contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Philippines EV battery recycling market appears promising, driven by increasing EV adoption and supportive government policies. As the market matures, advancements in recycling technologies are expected to enhance efficiency and reduce costs. Additionally, collaboration among stakeholders, including automotive manufacturers and recycling firms, will likely foster innovation and improve recycling rates. With a growing emphasis on sustainability, the market is poised for significant growth, aligning with global trends towards circular economy practices and responsible resource management.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium Nickel Manganese Cobalt (Li-NMC) Lithium Iron Phosphate (LFP) Lithium Cobalt Oxide (LCO) Lithium Nickel Cobalt Aluminum Oxide (NCA) Others |

| By Component | Active Material Battery Cells Electronics & Casings Others |

| By End-User | Automotive Consumer Electronics Industrial Applications Energy Storage Systems Others |

| By Collection Method | Drop-off Centers Mobile Collection Units Retail Partnerships Others |

| By Recycling Process | Hydrometallurgical Pyrometallurgical Direct Recycling Others |

| By Material Recovered | Cobalt Lithium Nickel Iron Others |

| By Geographic Distribution | Luzon Visayas Mindanao Others |

| By Policy Support | Subsidies Tax Exemptions Grants Extended Producer Responsibility (EPR) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Manufacturers | 60 | Product Managers, Sustainability Officers |

| Battery Recycling Facilities | 40 | Operations Managers, Environmental Compliance Officers |

| Government Regulatory Bodies | 45 | Policy Makers, Environmental Analysts |

| Automotive Industry Experts | 50 | Market Analysts, Industry Consultants |

| Consumer Advocacy Groups | 40 | Advocacy Leaders, Research Analysts |

The Philippines EV Battery Recycling Market is valued at approximately USD 15 million, driven by the increasing adoption of electric vehicles, consumer electronics usage, and government initiatives promoting sustainability and effective recycling solutions.