Region:Central and South America

Author(s):Shubham

Product Code:KRAB5084

Pages:99

Published On:October 2025

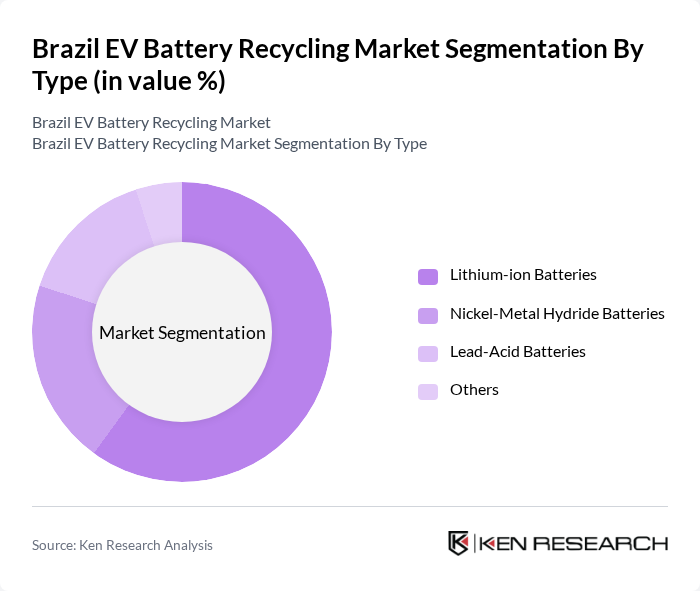

By Type:The market is segmented into various types of batteries, including Lithium-ion Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, and Others. Among these, Lithium-ion batteries dominate the market due to their widespread use in electric vehicles and consumer electronics. The increasing demand for electric vehicles has led to a significant rise in the volume of Lithium-ion batteries that require recycling, making it the leading sub-segment.

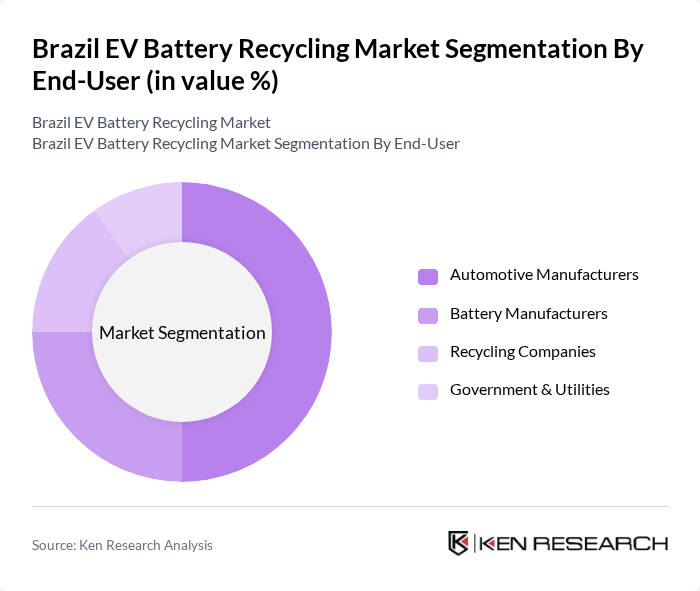

By End-User:The end-user segment includes Automotive Manufacturers, Battery Manufacturers, Recycling Companies, and Government & Utilities. Automotive Manufacturers are the leading end-users, driven by the increasing production of electric vehicles and the need for sustainable battery disposal solutions. This segment's growth is supported by partnerships between automotive companies and recycling firms to ensure responsible battery management.

The Brazil EV Battery Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Li-Cycle Corp., Redwood Materials, Umicore, American Battery Technology Company, Neometals Ltd., Duesenfeld GmbH, Battery Solutions, Inc., Accurec Recycling GmbH, Retriev Technologies, Aceleron, Veolia Environnement S.A., EcoBat Technologies, Umicore, Sacyr, Toxco, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil EV battery recycling market appears promising, driven by increasing EV adoption and supportive government policies. As the market matures, advancements in recycling technologies will likely enhance material recovery rates, making recycling more economically attractive. Furthermore, the growing emphasis on sustainability will push companies to adopt circular economy practices, ensuring that battery materials are reused effectively. This evolving landscape presents significant opportunities for innovation and collaboration within the industry, fostering a more sustainable future for Brazil's automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Batteries Nickel-Metal Hydride Batteries Lead-Acid Batteries Others |

| By End-User | Automotive Manufacturers Battery Manufacturers Recycling Companies Government & Utilities |

| By Application | Energy Storage Systems Electric Vehicles Consumer Electronics Industrial Applications |

| By Collection Method | Drop-off Centers Curbside Collection Retail Take-back Programs Others |

| By Recycling Process | Hydrometallurgical Process Pyrometallurgical Process Direct Recycling Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 100 | Product Managers, R&D Directors |

| Automotive OEMs | 80 | Supply Chain Managers, Sustainability Officers |

| Recycling Facilities | 60 | Operations Managers, Environmental Compliance Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Environmental NGOs | 40 | Program Directors, Advocacy Coordinators |

The Brazil EV Battery Recycling Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of electric vehicles, stringent environmental regulations, and heightened consumer awareness regarding sustainable practices.