Region:Asia

Author(s):Rebecca

Product Code:KRAA4874

Pages:86

Published On:September 2025

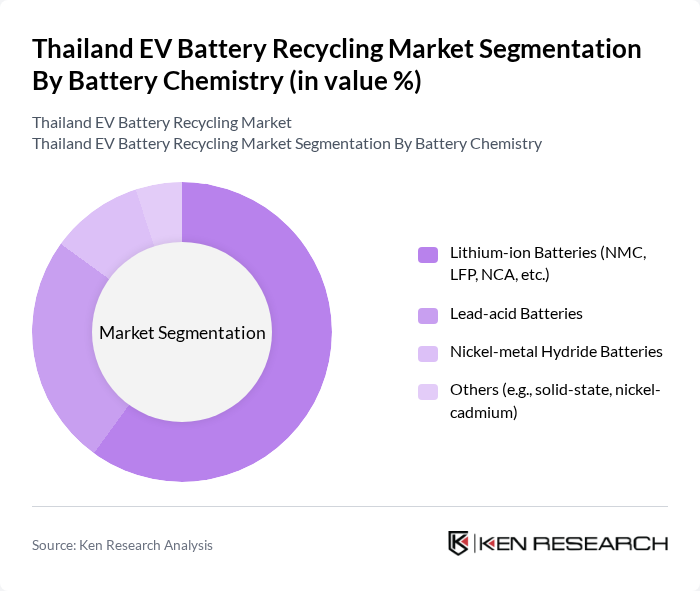

By Battery Chemistry:The market is segmented based on battery chemistry, which includes various types of batteries used in electric vehicles and other applications. The dominant sub-segment isLithium-ion Batteries, which are widely used due to their high energy density, efficiency, and increasing adoption in new EV models.Lead-acid Batteriesfollow, primarily used in older vehicle models and for stationary applications, and remain significant in the recycling stream.Nickel-metal Hydride Batteriesare also present, though their usage is declining in favor of lithium technologies. Other types, such as solid-state and nickel-cadmium batteries, represent a smaller share of the market .

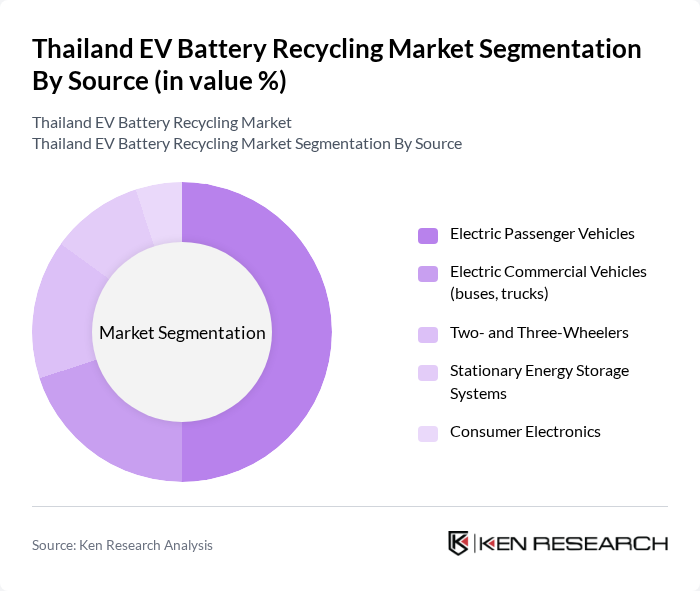

By Source:The market is also segmented by the source of used batteries, which includes various applications from which batteries are collected for recycling.Electric Passenger Vehiclesare the largest source, driven by the rapid growth of the EV market and government EV adoption targets.Electric Commercial Vehicles, including buses and trucks, contribute significantly as well, supported by fleet electrification initiatives.Two- and Three-Wheelersare gaining traction, especially in urban areas with high adoption of electric motorcycles and tuk-tuks.Stationary Energy Storage SystemsandConsumer Electronicsalso provide a steady supply of batteries for recycling .

The Thailand EV Battery Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Energy Absolute Public Company Limited (Amita Technology Thailand), ACE Green Recycling, TES-AMM (TES Sustainable Battery Solutions), Umicore, Veolia, Ecobat, Li-Cycle, Duesenfeld, Retriev Technologies, Battery Solutions, Accurec Recycling GmbH, Green Lithium, Sacyr, Toxco, SCG Chemicals Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's EV battery recycling market appears promising, driven by increasing EV adoption and supportive government policies. As the market matures, technological advancements will likely enhance recycling efficiency, making it more economically viable. Furthermore, the growing emphasis on sustainability will encourage partnerships between recycling firms and automotive manufacturers, fostering innovation. The integration of digital technologies in recycling operations is expected to streamline processes, improve traceability, and enhance overall operational efficiency in the sector.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium-ion Batteries (NMC, LFP, NCA, etc.) Lead-acid Batteries Nickel-metal Hydride Batteries Others (e.g., solid-state, nickel-cadmium) |

| By Source | Electric Passenger Vehicles Electric Commercial Vehicles (buses, trucks) Two- and Three-Wheelers Stationary Energy Storage Systems Consumer Electronics |

| By Collection Channel | OEM/Automaker Collection Programs Independent Collection Centers Retailer/Dealer Take-back Scrap Dealers |

| By Recycling Technology | Hydrometallurgical Process Pyrometallurgical Process Direct Physical/Mechanical Recycling Emerging/Hybrid Technologies |

| By Material Recovered | Lithium Cobalt Nickel Manganese Copper Graphite Others |

| By End-User Industry | Automotive OEMs Battery Manufacturers Energy Utilities Metal Refiners Others |

| By Regulatory/Policy Support | Government Subsidies Tax Incentives R&D Grants Import/Export Regulations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 60 | Production Managers, R&D Directors |

| Recycling Facilities | 50 | Operations Managers, Environmental Compliance Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Automotive OEMs | 45 | Supply Chain Managers, Sustainability Officers |

| Industry Associations | 40 | Executive Directors, Research Analysts |

The Thailand EV Battery Recycling Market is valued at approximately USD 4 million, driven by the increasing adoption of electric vehicles, government incentives, and the need for sustainable battery disposal and recycling practices.