Region:Europe

Author(s):Rebecca

Product Code:KRAB2930

Pages:91

Published On:October 2025

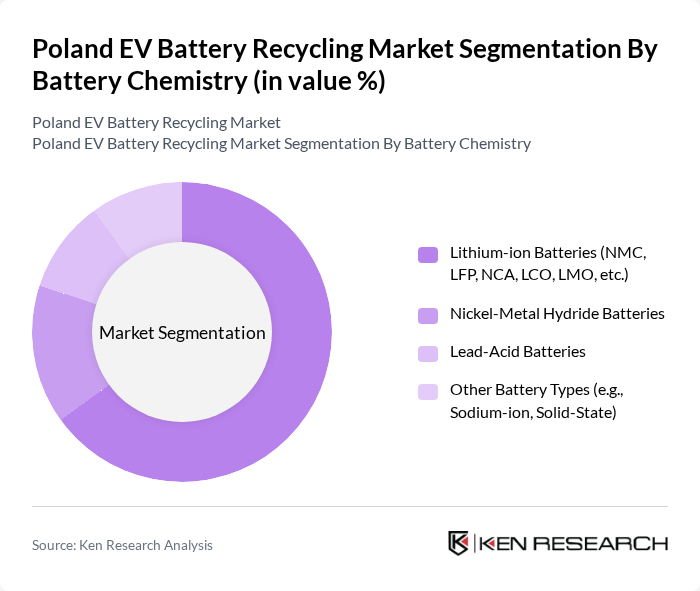

By Battery Chemistry:The battery chemistry segment includes various types of batteries that are recycled, such as lithium-ion, nickel-metal hydride, lead-acid, and other emerging battery technologies. Among these, lithium-ion batteries dominate the market due to their widespread use in electric vehicles and consumer electronics. The increasing demand for electric vehicles has led to a surge in lithium-ion battery production, resulting in a higher volume of end-of-life batteries available for recycling. This trend is further supported by advancements in recycling technologies that enhance the recovery of critical materials from these batteries .

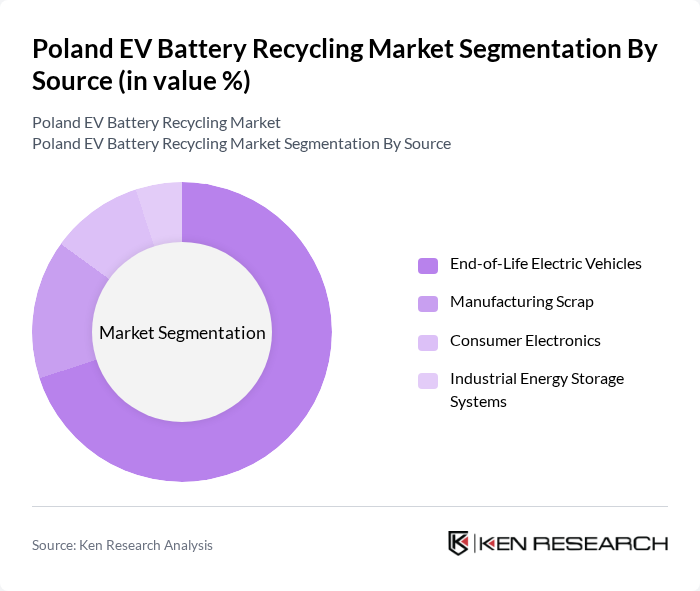

By Source:The source segment encompasses various origins of batteries that are recycled, including end-of-life electric vehicles, manufacturing scrap, consumer electronics, and industrial energy storage systems. The end-of-life electric vehicles segment is the most significant contributor to the recycling market, driven by the rapid growth of the electric vehicle market in Poland. As more electric vehicles reach the end of their lifecycle, the volume of batteries available for recycling is expected to increase, thereby enhancing the overall recycling rates and recovery of valuable materials .

The Poland EV Battery Recycling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Umicore S.A., Elemental Strategic Metals Sp. z o.o., Stena Recycling Sp. z o.o., Veolia Environnement S.A., Accurec Recycling GmbH, Fortum Battery Recycling Oy, Duesenfeld GmbH, TES-AMM Poland Sp. z o.o., Green Recycling S.A., Northvolt AB, Li-Cycle Corp., Recupyl S.A.S., Battery Solutions, LLC, Aceleron Ltd., G&P Batteries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EV battery recycling market in Poland appears promising, driven by increasing regulatory pressures and technological advancements. As the government intensifies its focus on sustainability, the demand for efficient recycling solutions is expected to rise. Furthermore, the collaboration between EV manufacturers and recycling firms will likely enhance the development of innovative recycling technologies, ensuring a steady supply of recycled materials. This synergy will play a crucial role in establishing a robust circular economy within the battery sector.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium-ion Batteries (NMC, LFP, NCA, LCO, LMO, etc.) Nickel-Metal Hydride Batteries Lead-Acid Batteries Other Battery Types (e.g., Sodium-ion, Solid-State) |

| By Source | End-of-Life Electric Vehicles Manufacturing Scrap Consumer Electronics Industrial Energy Storage Systems |

| By Recycling Process | Hydrometallurgical Process Pyrometallurgical Process Direct Physical Recycling Mechanical/Other Processes |

| By End-User | Automotive OEMs Battery Manufacturers Recycling Service Providers Government & Municipalities |

| By Collection Method | Drop-off Centers Curbside Collection Retail Collection Points OEM/Dealer Take-Back Programs |

| By Region (within Poland) | Mazowieckie ?l?skie Wielkopolskie Other Regions |

| By Policy Support | Subsidies for Recycling Facilities Tax Incentives for Recycled Materials Grants for R&D in Recycling Technologies Extended Producer Responsibility (EPR) Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Manufacturers | 100 | Product Managers, Sustainability Officers |

| Battery Recycling Facilities | 80 | Operations Managers, Technical Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

| Automotive Industry Associations | 40 | Executive Directors, Advocacy Managers |

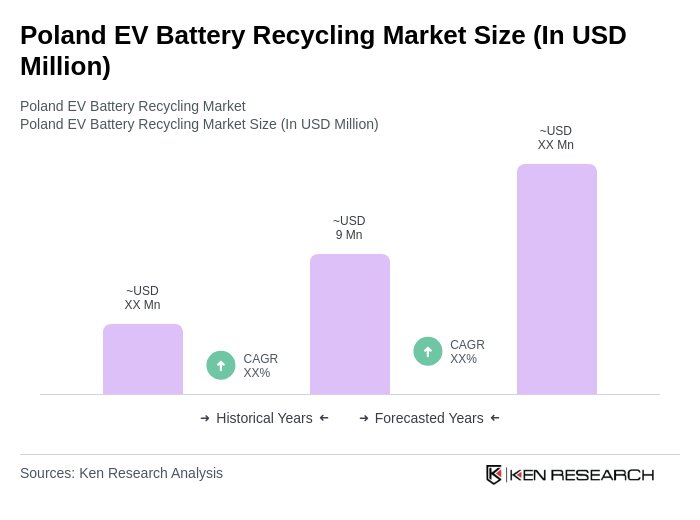

The Poland EV Battery Recycling Market is valued at approximately USD 9 million, driven by the increasing adoption of electric vehicles, stringent environmental regulations, and advancements in recycling technologies that enhance material recovery from used batteries.