Region:Asia

Author(s):Shubham

Product Code:KRAA8949

Pages:92

Published On:November 2025

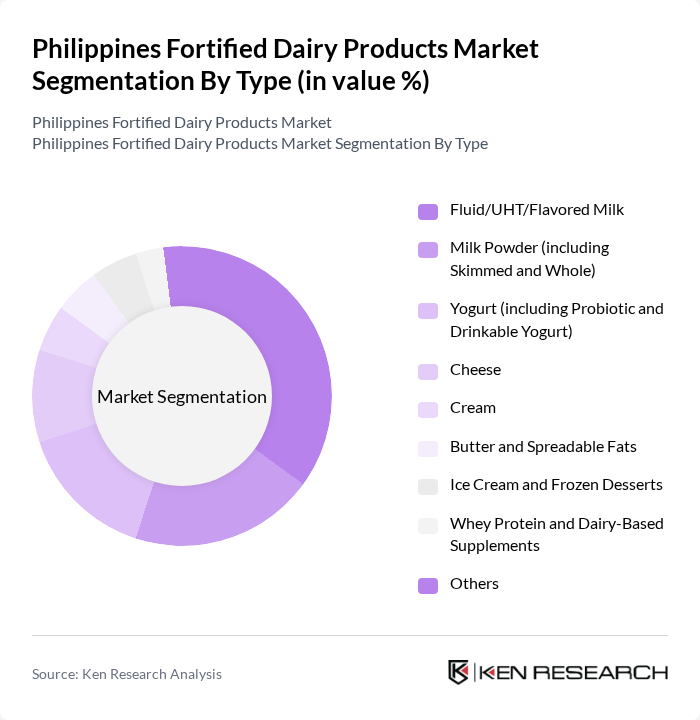

By Type:The market is segmented into various types of fortified dairy products, including Fluid/UHT/Flavored Milk, Milk Powder (including Skimmed and Whole), Yogurt (including Probiotic and Drinkable Yogurt), Cheese, Cream, Butter and Spreadable Fats, Ice Cream and Frozen Desserts, Whey Protein and Dairy-Based Supplements, and Others. Among these, Fluid/UHT/Flavored Milk is the leading sub-segment due to its convenience, popularity among urban consumers, and suitability for on-the-go consumption. Milk powder also holds significant market share, reflecting strong demand in both household and institutional settings .

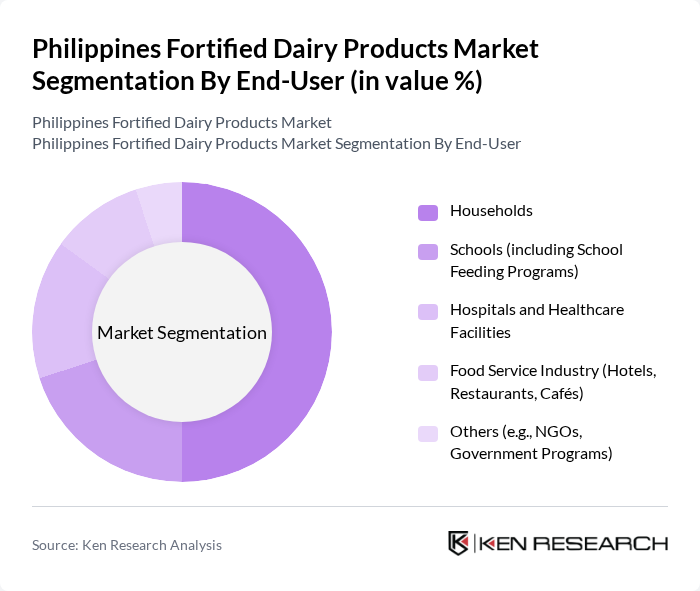

By End-User:The end-user segmentation includes Households, Schools (including School Feeding Programs), Hospitals and Healthcare Facilities, Food Service Industry (Hotels, Restaurants, Cafés), and Others (e.g., NGOs, Government Programs). Households are the primary consumers of fortified dairy products, driven by a rising focus on health and nutrition among families. School feeding programs and healthcare facilities also represent significant demand, supported by government nutrition initiatives .

The Philippines Fortified Dairy Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Philippines, Inc., Alaska Milk Corporation, Fonterra Brands Philippines, Inc., FrieslandCampina Philippines, Inc. (formerly Alaska Milk Corporation under FrieslandCampina), San Miguel Foods, Inc. (Magnolia Dairy), Magnolia, Inc., Arla Foods Philippines, Inc., Carmen’s Best Dairy Products, Inc., Dairy Confederation of the Philippines (DairyConPH), The Philippine Dairy Authority, Universal Robina Corporation, Del Monte Philippines, Inc., NutriAsia, Inc., Dole Philippines, Inc., MMP Dairy Products contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fortified dairy products market in the Philippines appears promising, driven by increasing health awareness and government support for nutritional initiatives. As urbanization continues, consumers are expected to seek convenient, health-oriented products. Innovations in product development, particularly in plant-based options, will likely attract a broader consumer base. Additionally, the rise of e-commerce platforms will facilitate access to fortified dairy products, enhancing market reach and consumer engagement in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fluid/UHT/Flavored Milk Milk Powder (including Skimmed and Whole) Yogurt (including Probiotic and Drinkable Yogurt) Cheese Cream Butter and Spreadable Fats Ice Cream and Frozen Desserts Whey Protein and Dairy-Based Supplements Others |

| By End-User | Households Schools (including School Feeding Programs) Hospitals and Healthcare Facilities Food Service Industry (Hotels, Restaurants, Cafés) Others (e.g., NGOs, Government Programs) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Direct Sales (including Institutional Sales) Pharmacies/Drug Stores Others |

| By Packaging Type | Tetra Packs/Cartons Bottles (Plastic/Glass) Pouches Cans Others (e.g., Sachets, Bulk Packs) |

| By Nutritional Content | High Protein Low Fat/Reduced Fat Calcium-Enriched Vitamin D Fortified Iron-Enriched Probiotic/Prebiotic Fortified Others (e.g., Omega-3, Vitamin A) |

| By Consumer Demographics | Children (including Infants and School-Age) Adults Seniors/Elderly Health-Conscious Consumers Others (e.g., Athletes, Pregnant Women) |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fortified Milk Products | 120 | Product Managers, Brand Strategists |

| Yogurt and Probiotic Products | 100 | Marketing Directors, Nutritionists |

| Cheese and Dairy Snacks | 80 | Retail Buyers, Category Managers |

| Consumer Preferences and Trends | 120 | Health-conscious Consumers, Parents |

| Distribution Channel Insights | 90 | Logistics Coordinators, Supply Chain Analysts |

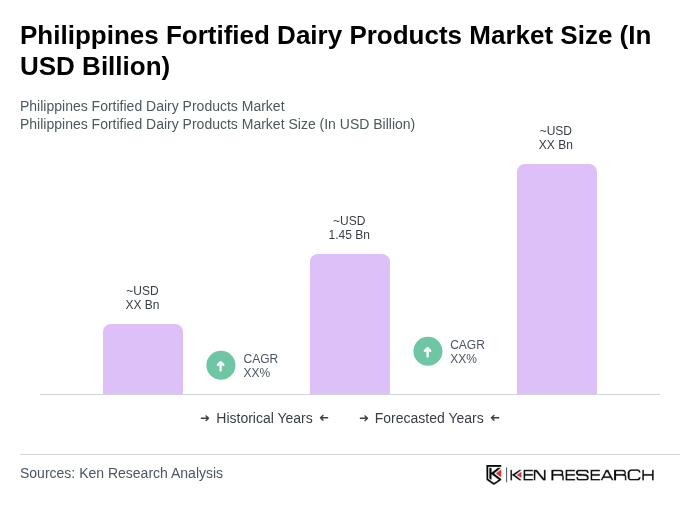

The Philippines Fortified Dairy Products Market is valued at approximately USD 1.45 billion, reflecting a significant growth trend driven by increasing health awareness, rising disposable incomes, and a demand for nutritious food options among consumers.