Region:Asia

Author(s):Geetanshi

Product Code:KRAA3235

Pages:85

Published On:September 2025

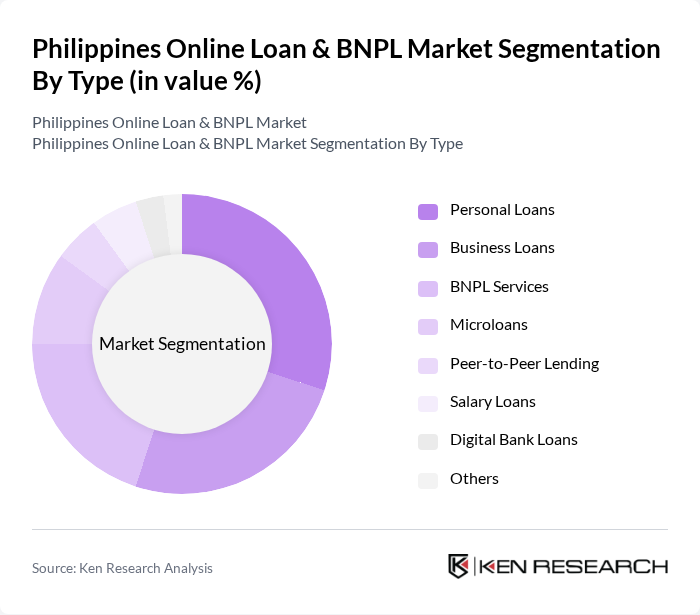

By Type:The market is segmented into Personal Loans, Business Loans, BNPL Services, Microloans, Peer-to-Peer Lending, Salary Loans, Digital Bank Loans, and Others. Each subsegment addresses distinct consumer and business needs, reflecting the Philippines’ diverse financial ecosystem. Personal Loans and BNPL Services are favored for their quick approval and flexible terms, while Microloans and Peer-to-Peer Lending cater to underserved and unbanked populations. Digital Bank Loans are gaining traction due to seamless integration with mobile banking and e-wallet platforms .

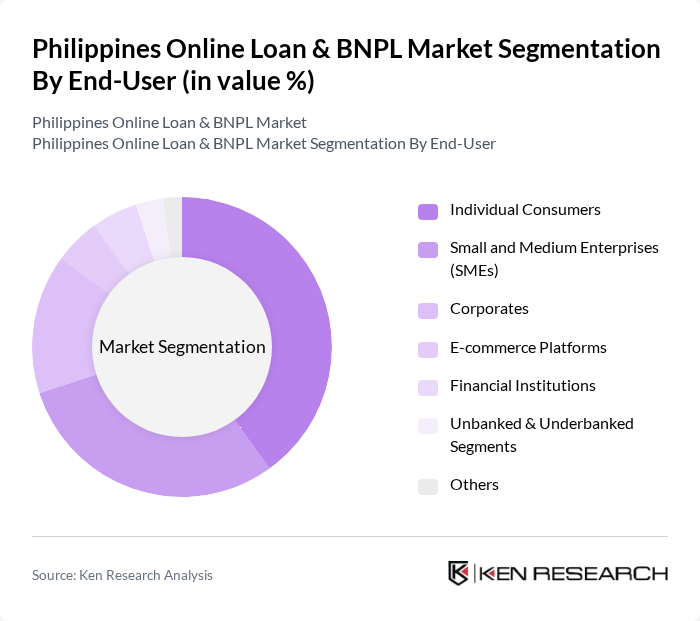

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, E-commerce Platforms, Financial Institutions, Unbanked & Underbanked Segments, and Others. Individual Consumers and SMEs are the primary drivers of demand, leveraging online loans and BNPL services for personal finance management and business expansion. E-commerce platforms and financial institutions increasingly integrate BNPL solutions to enhance customer experience and broaden financial inclusion .

The Philippines Online Loan & BNPL Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cashalo, Home Credit Philippines, Tala Philippines, GCredit (GCash), PayMaya (Maya Bank), Grab Financial Group, Loan Ranger, Digido Finance Corp., JuanHand, Atome Philippines, BillEase, LenddoEFL, First Circle, Kiva Philippines, SeedIn Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines online loan and BNPL market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. As digital-first lending becomes the norm, companies will increasingly leverage alternative credit scoring models to enhance accessibility. Additionally, the integration of artificial intelligence in credit assessments will streamline processes, improving customer experience. These trends indicate a robust future for the market, with potential for increased financial inclusion and tailored loan products catering to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Microloans Peer-to-Peer Lending Salary Loans Digital Bank Loans Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates E-commerce Platforms Financial Institutions Unbanked & Underbanked Segments Others |

| By Application | Retail Purchases Emergency Expenses Business Expansion Education Financing Medical Expenses Bill Payments Others |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers Agent Networks Others |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees Self-Employed Others |

| By Loan Amount | Below PHP 10,000 PHP 10,000 - PHP 50,000 PHP 50,000 - PHP 100,000 Above PHP 100,000 |

| By Loan Tenure | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (above 2 years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Loan Users | 100 | Consumers aged 18-45, recent borrowers |

| BNPL Service Users | 90 | Consumers aged 20-40, frequent BNPL users |

| Financial Advisors | 60 | Financial consultants, personal finance coaches |

| Fintech Executives | 50 | CEOs, CTOs, and product managers from fintech firms |

| Regulatory Bodies | 40 | Officials from financial regulatory agencies |

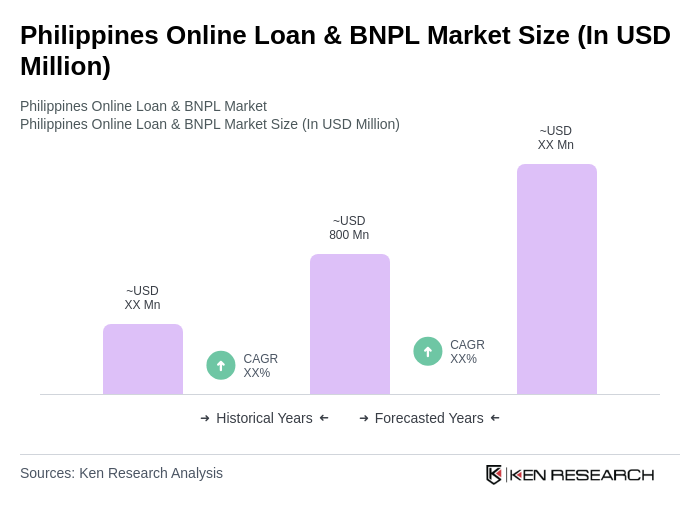

The Philippines Online Loan and BNPL market is valued at approximately USD 800 million, driven by the increasing adoption of digital financial services and the rapid expansion of e-commerce, with significant consumer engagement reflected in over 58 million app downloads in 2024.