South Korea Online Loan & BNPL Market Overview

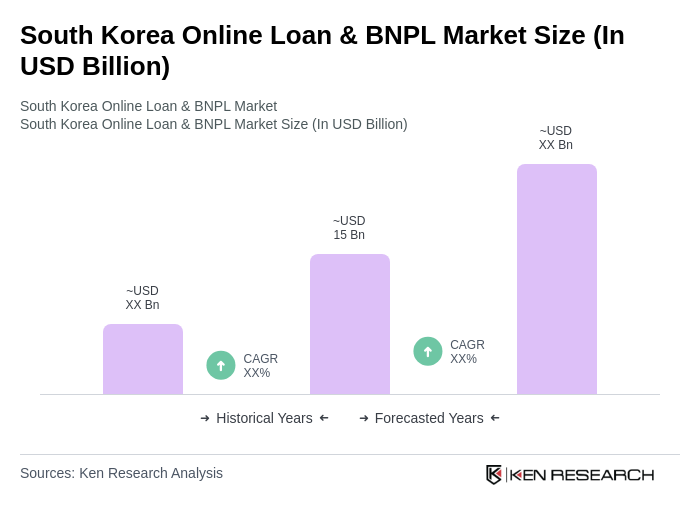

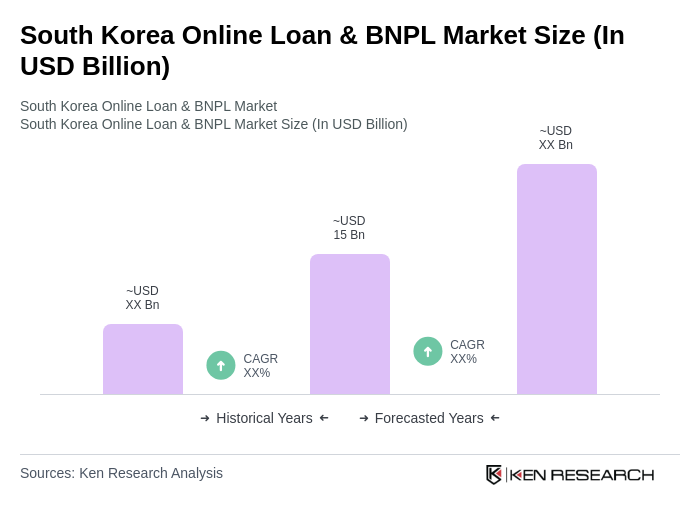

- The South Korea Online Loan & BNPL Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in e-commerce activities, and a growing consumer preference for flexible payment options. The market has seen a significant shift towards online platforms, making financial services more accessible to a broader audience.

- Seoul, Busan, and Incheon are the dominant cities in the South Korea Online Loan & BNPL Market. Seoul, as the capital, is a major financial hub with a high concentration of tech-savvy consumers and financial institutions. Busan and Incheon benefit from their strategic locations and growing urban populations, which contribute to the increasing demand for online lending and BNPL services.

- In 2023, the South Korean government implemented regulations to enhance consumer protection in the online lending sector. This includes mandatory disclosures of loan terms and interest rates, as well as stricter guidelines for advertising and marketing practices. These regulations aim to promote transparency and ensure that consumers are well-informed before taking on debt.

South Korea Online Loan & BNPL Market Segmentation

By Type:The market is segmented into various types, including Personal Loans, Business Loans, BNPL Services, Peer-to-Peer Lending, Microloans, Credit Lines, and Others. Personal Loans dominate the market due to their widespread acceptance among consumers seeking quick and accessible financing options for personal expenses. The increasing trend of online applications and approvals has further fueled the growth of this segment, making it a preferred choice for many borrowers.

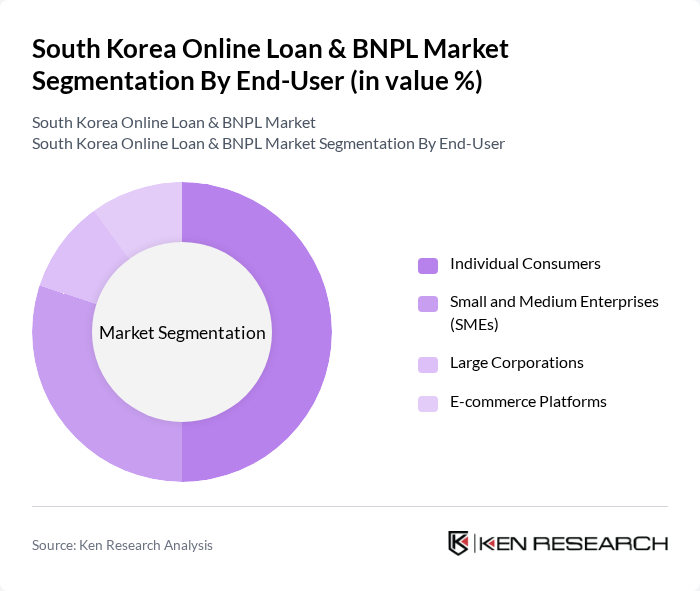

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and E-commerce Platforms. Individual Consumers represent the largest segment, driven by the increasing need for personal financing solutions and the convenience of online applications. The rise of e-commerce has also led to a growing demand for BNPL services among consumers, further solidifying the dominance of this segment.

South Korea Online Loan & BNPL Market Competitive Landscape

The South Korea Online Loan & BNPL Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kakao Bank, Toss Bank, NH Nonghyup Bank, Shinhan Bank, Woori Bank, KEB Hana Bank, Samsung Card, Lendit, Viva Republica, BNPL Korea, Kakaopay, Payco, Naver Financial, Credit Saison, AhnLab contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Online Loan & BNPL Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:South Korea's digital economy is thriving, with over 95% of the population using the internet as of future. This high penetration rate facilitates the growth of online loan and BNPL services, as consumers increasingly prefer digital platforms for financial transactions. The number of mobile payment users is projected to reach 45 million, indicating a robust shift towards digital financial solutions. This trend is further supported by the government's push for a cashless society, enhancing accessibility to online lending.

- Rising Consumer Demand for Flexible Payment Options:In future, consumer spending in South Korea is expected to exceed 2,000 trillion KRW, with a significant portion directed towards e-commerce. This surge in online shopping has led to a growing demand for flexible payment solutions, such as BNPL services. Approximately 65% of consumers express a preference for installment payments, highlighting the need for financial products that cater to their desire for convenience and affordability, thus driving market growth.

- Expansion of E-commerce Platforms:The e-commerce sector in South Korea is projected to reach 250 trillion KRW in future, driven by increased online shopping habits. This growth creates a fertile environment for online loan and BNPL services, as e-commerce platforms often integrate these financial solutions to enhance customer experience. With over 85% of online shoppers utilizing BNPL options, the synergy between e-commerce and financial services is a key driver of market expansion, fostering greater accessibility to credit.

Market Challenges

- High Competition Among Providers:The South Korean online loan and BNPL market is characterized by intense competition, with over 60 active providers vying for market share in future. This saturation leads to aggressive pricing strategies and marketing efforts, which can erode profit margins. As companies strive to differentiate themselves, the pressure to innovate and offer superior customer service intensifies, posing a significant challenge for sustainability in this competitive landscape.

- Regulatory Compliance Costs:Compliance with evolving regulations in South Korea incurs substantial costs for online loan and BNPL providers. In future, it is estimated that compliance expenditures could account for up to 20% of operational budgets. This financial burden can hinder smaller firms from competing effectively, as they may lack the resources to meet stringent regulatory requirements. Consequently, navigating the regulatory landscape remains a critical challenge for market participants.

South Korea Online Loan & BNPL Market Future Outlook

The South Korean online loan and BNPL market is poised for continued growth, driven by technological advancements and changing consumer preferences. As digital adoption accelerates, financial institutions are likely to enhance their offerings, integrating AI and machine learning for better risk assessment. Additionally, the increasing focus on consumer education will empower users to make informed financial decisions, fostering a more robust market environment. The interplay between innovation and regulation will shape the future landscape, ensuring sustainable growth in the sector.

Market Opportunities

- Growth in Fintech Innovations:The fintech sector in South Korea is expected to attract over 1.5 trillion KRW in investments by future. This influx of capital will facilitate the development of innovative financial products, including personalized lending solutions. By leveraging technology, companies can enhance customer experiences and streamline operations, creating significant opportunities for growth in the online loan and BNPL market.

- Expansion into Underserved Demographics:Approximately 35% of South Koreans remain underserved by traditional financial institutions. Targeting these demographics presents a lucrative opportunity for online loan and BNPL providers. By offering tailored financial products that cater to the unique needs of these consumers, companies can tap into a substantial market segment, driving growth and enhancing financial inclusion across the country.