Region:Asia

Author(s):Geetanshi

Product Code:KRAD1318

Pages:100

Published On:November 2025

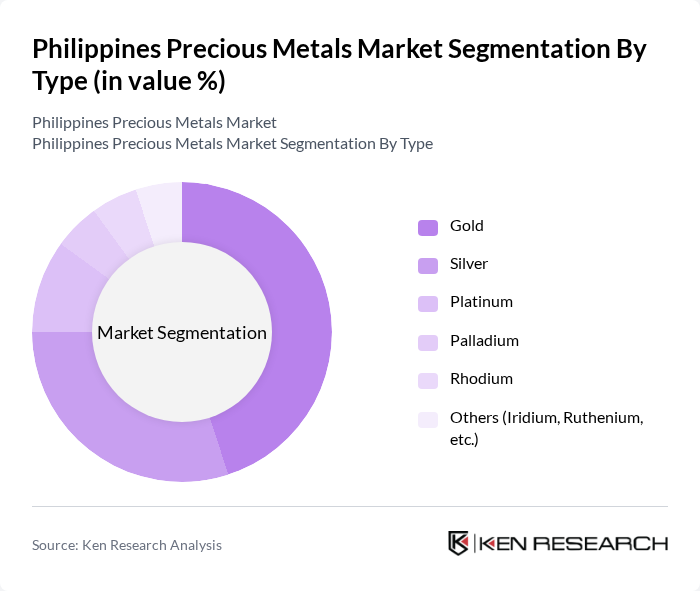

By Type:The market is segmented into gold, silver, platinum, palladium, rhodium, and others such as iridium and ruthenium. Gold is the dominant segment, supported by its extensive use in jewelry and as an investment asset. Silver follows, driven by its applications in electronics, solar energy, and industrial uses. Platinum and palladium demand is influenced by automotive and clean energy sectors, particularly for catalytic converters and fuel cell technologies. Rhodium and other metals are used in specialized industrial and chemical processes .

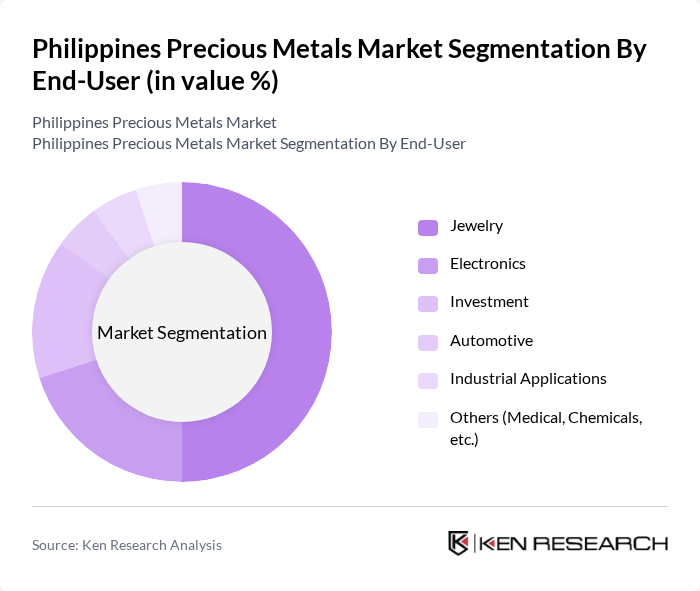

By End-User:The end-user segmentation includes jewelry, electronics, investment, automotive, industrial applications, and others such as medical and chemicals. The jewelry segment is the largest consumer of precious metals, especially gold and silver, reflecting cultural preferences and investment demand. Electronics is a significant segment, utilizing silver and gold for their conductive properties in devices and renewable energy applications. Investment demand is rising as precious metals are increasingly used for portfolio diversification and as a hedge against market volatility. The automotive sector drives demand for platinum group metals, while industrial and medical uses contribute to niche consumption .

The Philippines Precious Metals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philex Mining Corporation, Apex Mining Co., Inc., Nickel Asia Corporation, DMCI Holdings, Inc., Manila Mining Corporation, OceanaGold (Philippines), Inc., Lepanto Consolidated Mining Company, Benguet Corporation, TVI Resource Development (Phils.) Inc., Silangan Mindanao Mining Co., Inc., Mindoro Resources Ltd., Cadan Resources Corporation, Marinduque Mining and Industrial Corporation, Greenstone Resources Corporation, Filminera Resources Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines precious metals market appears promising, driven by increasing consumer awareness of sustainable sourcing and ethical practices. As the demand for responsibly sourced materials grows, companies are likely to adapt their operations to meet these expectations. Additionally, advancements in mining technology are expected to enhance efficiency and reduce environmental impact, potentially attracting more investments. The market is poised for growth, with a focus on sustainability and innovation shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gold Silver Platinum Palladium Rhodium Others (Iridium, Ruthenium, etc.) |

| By End-User | Jewelry Electronics Investment Automotive Industrial Applications Others (Medical, Chemicals, etc.) |

| By Region | Luzon Visayas Mindanao |

| By Application | Manufacturing Retail Investment Products Renewable Energy Others |

| By Source | Primary Mining Secondary Recycling Artisanal and Small-Scale Mining (ASGM) Others |

| By Market Channel | Direct Sales Online Platforms Retail Outlets Precious Metals Exchanges Others |

| By Investment Type | Individual Investors Institutional Investors Government Investments Precious Metal Derivatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gold Mining Operations | 100 | Mine Managers, Geologists |

| Silver Trading Market | 60 | Traders, Financial Analysts |

| Jewelry Manufacturing Sector | 50 | Production Managers, Designers |

| Precious Metal Recycling | 40 | Recycling Facility Operators, Environmental Managers |

| Investment and Retail Sales | 70 | Retail Managers, Investment Advisors |

The Philippines Precious Metals Market is valued at approximately USD 4.7 billion, driven by increasing demand for gold and silver in jewelry, investment, and industrial applications, alongside favorable global trends for precious metals as safe-haven assets.