Region:Asia

Author(s):Geetanshi

Product Code:KRAC4469

Pages:100

Published On:October 2025

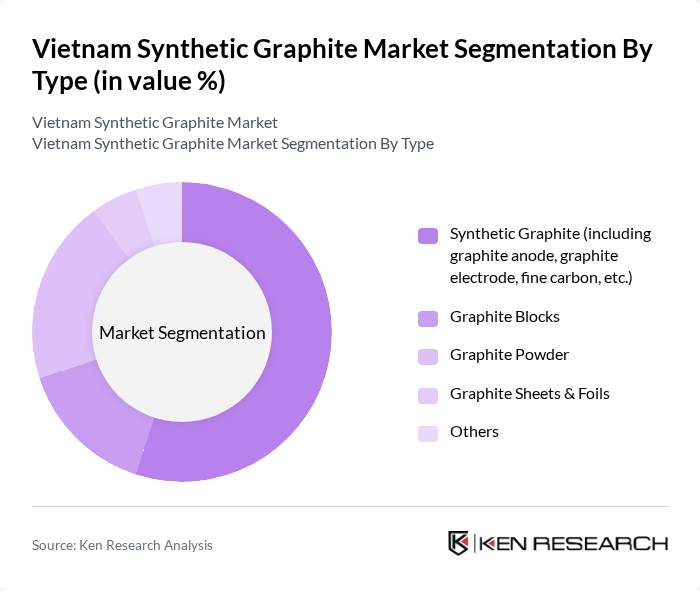

By Type:The market is segmented into various types, including Synthetic Graphite (graphite anode, graphite electrode, fine carbon, etc.), Graphite Blocks, Graphite Powder, Graphite Sheets & Foils, and Others. Among these, Synthetic Graphite is the leading sub-segment due to its essential role in battery production, particularly for electric vehicles. The increasing adoption of electric vehicles has significantly boosted the demand for high-purity synthetic graphite, which is crucial for enhancing battery performance and longevity. Graphite Powder also holds a substantial share, driven by its applications in lubricants and industrial processes .

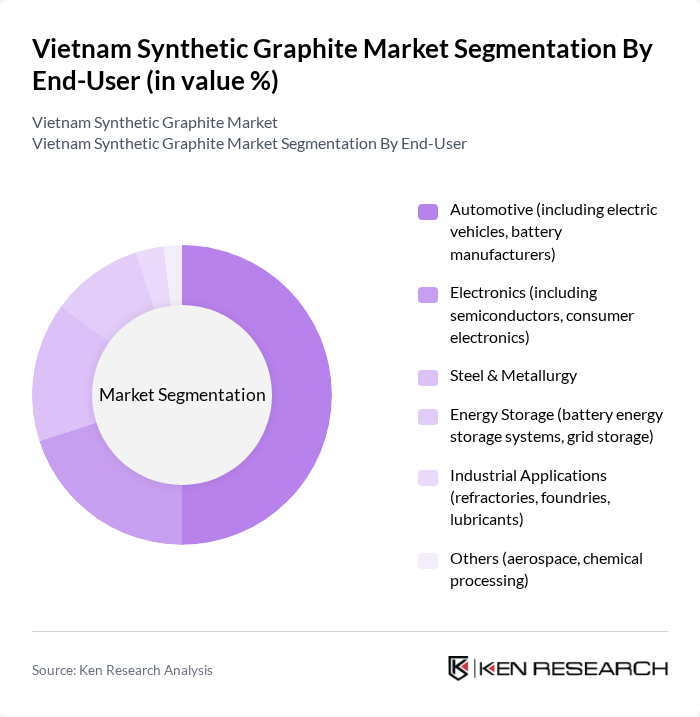

By End-User:The end-user segments include Automotive (including electric vehicles, battery manufacturers), Electronics (including semiconductors, consumer electronics), Steel & Metallurgy, Energy Storage (battery energy storage systems, grid storage), Industrial Applications (refractories, foundries, lubricants), and Others. The Automotive sector is the dominant end-user, primarily due to the rapid growth of electric vehicle production in Vietnam. This sector's demand for synthetic graphite is driven by the need for efficient battery solutions, which are essential for enhancing vehicle performance and sustainability. The Electronics sector also contributes significantly, as synthetic graphite is used in various electronic components .

The Vietnam Synthetic Graphite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Showa Denko K.K., SGL Carbon SE, GrafTech International Ltd., Mitsubishi Chemical Corporation, Tokai Carbon Co., Ltd., Graphite India Limited, HEG Limited, Asbury Carbons, Imerys Graphite & Carbon, Nippon Carbon Co., Ltd., BTR New Material Group Co., Ltd., Shanshan Technology (Ningbo Shanshan Co., Ltd.), XRD Graphite Manufacturing Co., Ltd., AMG Advanced Metallurgical Group N.V., Triton Minerals Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the synthetic graphite market in Vietnam appears promising, driven by the increasing demand from the battery and electric vehicle sectors. As the government continues to support green technologies and sustainable practices, manufacturers are likely to invest in advanced production methods. Additionally, the focus on recycling and sustainable sourcing of materials will shape the market landscape, encouraging innovation and collaboration among industry players to meet evolving consumer and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Graphite (including graphite anode, graphite electrode, fine carbon, etc.) Graphite Blocks Graphite Powder Graphite Sheets & Foils Others |

| By End-User | Automotive (including electric vehicles, battery manufacturers) Electronics (including semiconductors, consumer electronics) Steel & Metallurgy Energy Storage (battery energy storage systems, grid storage) Industrial Applications (refractories, foundries, lubricants) Others (aerospace, chemical processing) |

| By Application | Battery Anodes (Li-ion batteries, EV batteries) Refractories Steel Production (graphite electrodes for EAF) Lubricants Thermal Management (heat spreaders, cooling systems) Others |

| By Distribution Channel | Direct Sales (to OEMs and large industrial users) Distributors/Agents Online Sales Retail Others |

| By Pricing Strategy | Premium Pricing (high-purity, specialty grades) Competitive Pricing (standard grades) Value-Based Pricing Others |

| By Product Form | Powder Granules Blocks Electrodes Others |

| By Quality Grade | Battery Grade (high purity, low impurity) Standard Industrial Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 50 | Production Managers, R&D Directors |

| Automotive Industry | 40 | Supply Chain Managers, Product Development Engineers |

| Electronics Sector | 40 | Procurement Managers, Quality Assurance Specialists |

| Graphite Mining and Processing | 40 | Operations Managers, Environmental Compliance Officers |

| Research Institutions and Academia | 40 | Research Scientists, Industry Analysts |

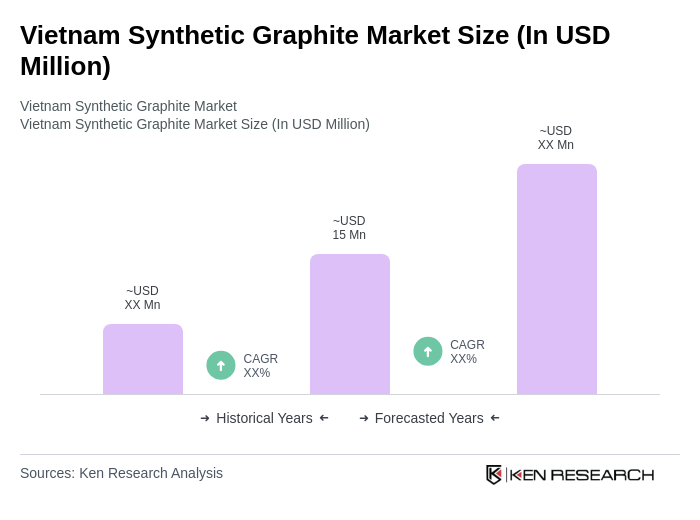

The Vietnam Synthetic Graphite Market is valued at approximately USD 15 million, driven by increasing demand from electric vehicles and advancements in battery technology, which require high-quality synthetic graphite for battery anodes and other industrial applications.