Region:Global

Author(s):Dev

Product Code:KRAA8274

Pages:81

Published On:November 2025

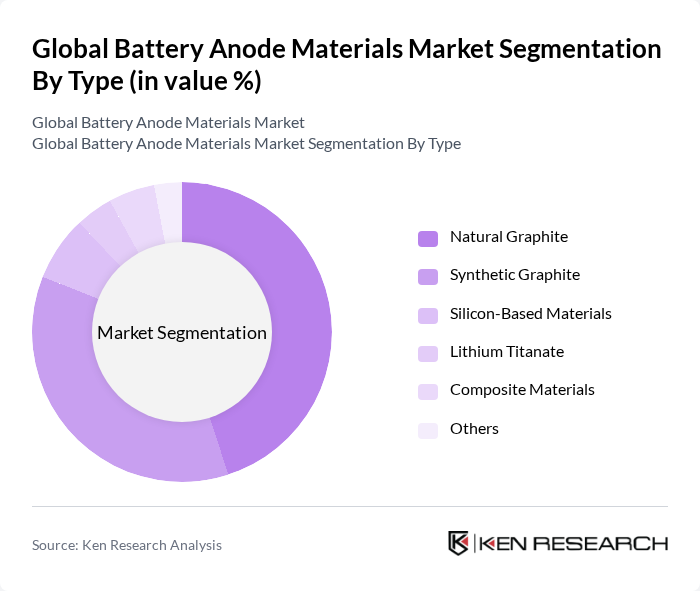

By Type:The battery anode materials market is segmented into Natural Graphite, Synthetic Graphite, Silicon-Based Materials, Lithium Titanate, Composite Materials, and Others. Natural Graphite remains the most widely used due to its high electrical conductivity and stability, making it a preferred choice for lithium-ion battery manufacturers. Synthetic Graphite is gaining traction for its customizable properties that enhance battery performance. Silicon-Based Materials are increasingly adopted for their higher energy density, while Lithium Titanate is valued for its rapid charging capability and safety profile. Composite Materials are emerging as versatile options, combining the benefits of multiple anode chemistries to optimize battery performance .

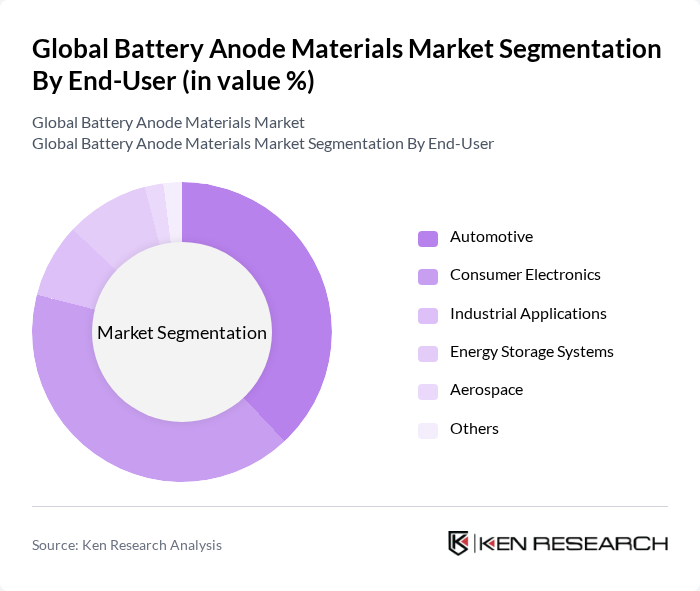

By End-User:The end-user segmentation of the battery anode materials market includes Automotive, Consumer Electronics, Industrial Applications, Energy Storage Systems, Aerospace, and Others. The automotive sector is the largest consumer, fueled by the rapid electrification of vehicles globally. Consumer electronics represent a significant share, driven by the proliferation of smartphones, laptops, and portable devices. Energy storage systems are gaining importance as grid modernization and renewable integration accelerate. Industrial applications and aerospace remain niche but are expanding as battery technologies diversify to meet specialized requirements .

The Global Battery Anode Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, LG Chem Ltd., Samsung SDI Co., Ltd., BTR New Energy Materials Inc., Resonac Holdings Corporation (formerly Hitachi Chemical), Mitsubishi Chemical Group Corporation, A123 Systems LLC, Amprius Technologies, Inc., Nexeon Limited, Sila Nanotechnologies Inc., Kanto Denka Kogyo Co., Ltd., Shanshan Technology (Ningbo Shanshan Co., Ltd.), 3M Company, BASF SE, Novonix Limited, JFE Chemical Corporation, Nippon Carbon Co., Ltd., Kureha Corporation, Chengdu Xingneng New Materials Co., Ltd., Tianjin Kimwan Carbon Technology and Development Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the battery anode materials market appears promising, driven by technological advancements and increasing demand for electric vehicles and energy storage solutions. As manufacturers focus on developing sustainable and efficient materials, the integration of AI in battery management systems is expected to enhance performance and lifecycle. Additionally, the shift towards silicon-based anodes and solid-state batteries will likely redefine market dynamics, fostering innovation and collaboration across the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Graphite Synthetic Graphite Silicon-Based Materials Lithium Titanate Composite Materials Others |

| By End-User | Automotive Consumer Electronics Industrial Applications Energy Storage Systems Aerospace Others |

| By Application | Electric Vehicles Portable Electronics Grid Storage Power Tools Others |

| By Material Source | Natural Sources Synthetic Sources Recycled Sources Others |

| By Production Method | Mechanical Milling Chemical Vapor Deposition Electrochemical Deposition Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Manufacturers | 60 | Product Development Managers, Supply Chain Directors |

| Consumer Electronics Battery Suppliers | 50 | Operations Managers, Procurement Officers |

| Research Institutions in Battery Technology | 40 | Lead Researchers, Material Scientists |

| Raw Material Suppliers for Anode Production | 40 | Sales Managers, Business Development Executives |

| Battery Recycling Companies | 40 | Sustainability Officers, Operations Managers |

The Global Battery Anode Materials Market is valued at approximately USD 2.1 billion, driven by the increasing adoption of electric vehicles, energy storage systems, and advancements in battery technology, particularly in lithium-ion chemistry.