Region:Asia

Author(s):Shubham

Product Code:KRAD6602

Pages:92

Published On:December 2025

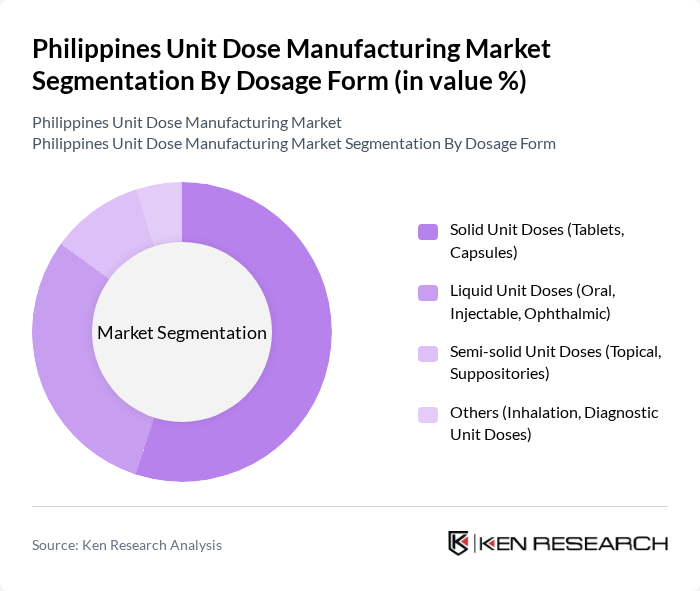

By Dosage Form:The market is segmented into various dosage forms, including solid unit doses, liquid unit doses, semi-solid unit doses, and others. Solid unit doses, such as tablets and capsules, dominate the market due to their convenience, stability, cost-effectiveness, and the fact that oral solid dosage forms represent the largest share of pharmaceutical output in the country. Liquid unit doses, including oral and injectable forms, are also significant, driven by the need for precise dosing in hospital and clinical settings, especially for pediatric, geriatric, and critical care patients, where unit dose formats help reduce medication errors. Semi-solid forms and other types, while smaller, cater to specific therapeutic needs such as dermatology, rectal/vaginal preparations, respiratory therapies, and certain diagnostic applications.

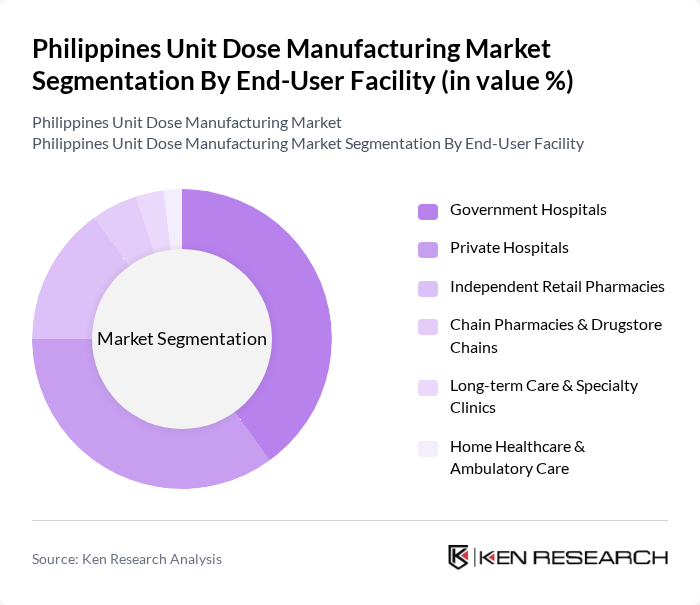

By End-User Facility:The market is segmented by end-user facilities, including government hospitals, private hospitals, independent retail pharmacies, chain pharmacies, long-term care facilities, and home healthcare. Government hospitals are the largest segment due to their extensive patient base, role as primary providers under the Universal Health Care Act, and public funding for essential medicines and formulary-based procurement. Private hospitals and pharmacies also play a crucial role, driven by increasing demand for healthcare services, growth of the middle class, expansion of private insurance, and the growing trend of outpatient and day-care services where unit dose formats support safe and efficient dispensing. Independent and chain pharmacies, long-term care and specialty clinics, and home healthcare providers are increasingly adopting barcoded and unit dose medications to improve inventory control and patient adherence in community and ambulatory care settings.

The Philippines Unit Dose Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilab, Inc., Lloyd Laboratories, Inc., Hizon Laboratories, Inc., Pascual Laboratories, Inc., Euro-Med Laboratories Phil., Inc., Scheele Laboratories Philippines, Inc., PharmaServ Express / PharmaServ, Inc. (unit-dose and hospital repackaging services), Cathay Drug Company, Inc., Rx Global Sales, Inc. (hospital & pharmacy unit-dose solutions), Pascual Pharma Corp. (contract manufacturing and packaging), United Laboratories – Amherst Laboratories (solid dosage and blistering facilities), Philippine Pharma Procurement & Distribution players (e.g., Zuellig Pharma Corporation – unit-dose distribution and repack), Multinational CDMOs serving the Philippines unit dose market (e.g., Catalent, Inc.; Recipharm AB; PCI Pharma Services), Multinational Pharma with local unit dose packaging in the Philippines (e.g., Pfizer Philippines, Inc.; GlaxoSmithKline Philippines, Inc.), Select Hospital Pharmacy Automation & Unit Dose Technology Providers (e.g., Omnicell, Inc.; BD Pyxis solutions in the Philippines) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines unit dose manufacturing market appears promising, driven by increasing healthcare investments and a shift towards personalized medicine. As the government continues to support local manufacturing through favorable policies, the industry is likely to see enhanced collaboration between manufacturers and healthcare providers. Additionally, the integration of digital technologies and automation will streamline operations, improving efficiency and product quality, ultimately benefiting patient outcomes and market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Dosage Form | Solid Unit Doses (Tablets, Capsules) Liquid Unit Doses (Oral, Injectable, Ophthalmic) Semi-solid Unit Doses (Topical, Suppositories) Others (Inhalation, Diagnostic Unit Doses) |

| By End-User Facility | Government Hospitals Private Hospitals Independent Retail Pharmacies Chain Pharmacies & Drugstore Chains Long-term Care & Specialty Clinics Home Healthcare & Ambulatory Care |

| By Sourcing / Production Model | In-house Unit Dose Manufacturing (Hospital / Pharmacy-based) Outsourced / Contract Unit Dose Manufacturing (CDMOs) Hybrid Models |

| By Packaging Format | Blister Packs (Cold-form & Thermoform) Ampoules & Vials Sachets & Strip Packs Prefilled Syringes & Single-use Devices Others (Pouches, Dose Cups, Unit-dose Bottles) |

| By Therapeutic Area | Anti-infectives Cardiovascular & Metabolic Disorders Respiratory & Allergy Central Nervous System (CNS) & Pain Management Gastrointestinal & Nutritional Products Others (Oncology, Vaccines, Specialty Care) |

| By Brand / Formulation Type | Branded Originator Drugs Branded Generics Unbranded Generics Biosimilars & Biologics in Unit Dose |

| By Customer Segment | B2B (Hospitals, Pharmacies, Institutional Buyers) B2G (Government Tenders & Procurement) B2C (Patient-facing Unit Dose Packs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | Production Managers, Quality Assurance Officers |

| Healthcare Providers | 80 | Pharmacists, Hospital Administrators |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 70 | Market Analysts, Business Development Managers |

| Healthcare Policy Makers | 60 | Health Economists, Policy Advisors |

The Philippines Unit Dose Manufacturing Market is valued at approximately USD 1.0 billion. This valuation reflects a five-year historical analysis and its share within the broader domestic pharmaceuticals-in-dosage-form and pharmaceutical packaging markets in the country.