Region:Middle East

Author(s):Dev

Product Code:KRAB7811

Pages:93

Published On:October 2025

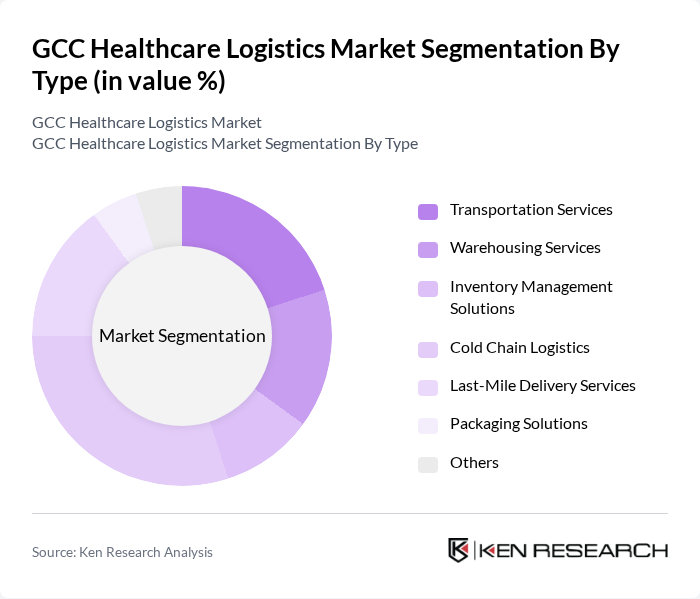

By Type:The market is segmented into various types, including Transportation Services, Warehousing Services, Inventory Management Solutions, Cold Chain Logistics, Last-Mile Delivery Services, Packaging Solutions, and Others. Among these, Cold Chain Logistics is currently the leading sub-segment due to the increasing demand for temperature-sensitive products, particularly vaccines and biologics. The rise in e-commerce and home delivery services has also contributed to the growth of Last-Mile Delivery Services, which is gaining traction in the healthcare sector.

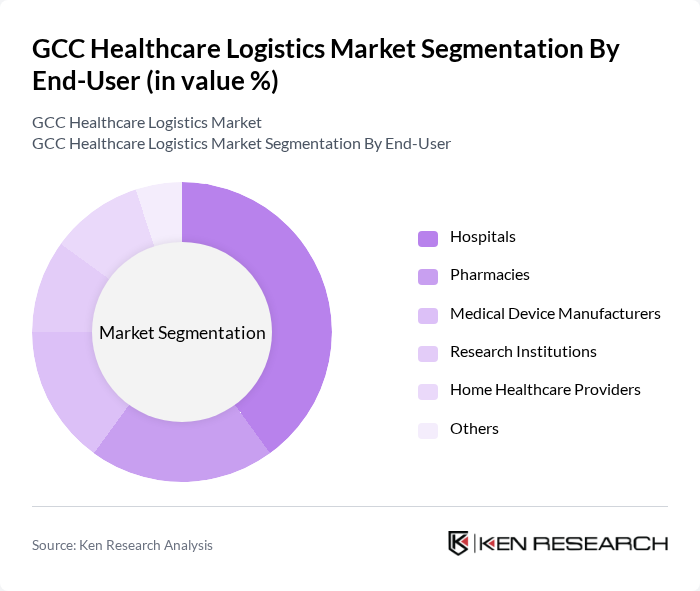

By End-User:The end-user segmentation includes Hospitals, Pharmacies, Medical Device Manufacturers, Research Institutions, Home Healthcare Providers, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of healthcare facilities and the rising demand for efficient logistics solutions to manage the supply of medical products. The growing trend of home healthcare services is also contributing to the expansion of the Home Healthcare Providers segment.

The GCC Healthcare Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Agility Logistics, CEVA Logistics, XPO Logistics, UPS Healthcare, FedEx HealthCare, Maersk Logistics, Panalpina, Yusen Logistics, AmerisourceBergen, Cardinal Health, McKesson Corporation, Owens & Minor contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC healthcare logistics market appears promising, driven by ongoing technological innovations and increasing healthcare demands. As telemedicine continues to expand, logistics providers will need to adapt to new delivery models, ensuring timely access to medical supplies. Furthermore, the focus on sustainable logistics practices is expected to grow, with companies investing in eco-friendly transportation solutions. These trends will shape the logistics landscape, enhancing efficiency and responsiveness in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Inventory Management Solutions Cold Chain Logistics Last-Mile Delivery Services Packaging Solutions Others |

| By End-User | Hospitals Pharmacies Medical Device Manufacturers Research Institutions Home Healthcare Providers Others |

| By Service Type | Freight Forwarding Customs Clearance Distribution Management Supply Chain Consulting Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Distribution Channel | Direct Sales Online Sales Third-Party Logistics Providers Others |

| By Packaging Type | Standard Packaging Temperature-Controlled Packaging Custom Packaging Solutions Others |

| By Compliance Type | Regulatory Compliance Quality Assurance Compliance Environmental Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Supply Chain Management | 100 | Supply Chain Managers, Procurement Officers |

| Pharmaceutical Distribution Logistics | 80 | Logistics Coordinators, Operations Managers |

| Medical Equipment Supply Chains | 70 | Warehouse Managers, Compliance Officers |

| Cold Chain Logistics for Pharmaceuticals | 60 | Quality Assurance Managers, Logistics Directors |

| Home Healthcare Delivery Systems | 90 | Healthcare Administrators, Delivery Managers |

The GCC Healthcare Logistics Market is valued at approximately USD 15 billion, driven by increasing healthcare service demand, advancements in medical technology, and the rising prevalence of chronic diseases. This growth reflects a robust healthcare infrastructure and efficient supply chain management needs in the region.