Region:Asia

Author(s):Rebecca

Product Code:KRAD7505

Pages:98

Published On:December 2025

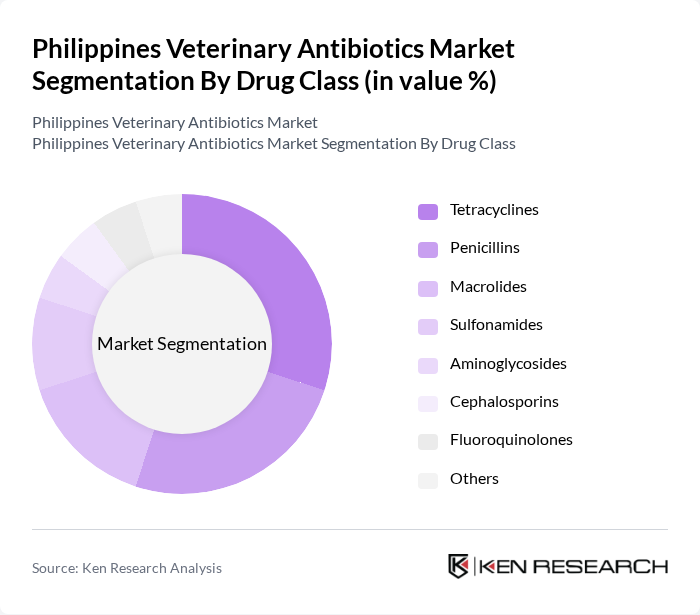

By Drug Class:The market is segmented into various drug classes, including Tetracyclines, Penicillins, Macrolides, Sulfonamides, Aminoglycosides, Cephalosporins, Fluoroquinolones, and Others. Among these, Tetracyclines and Penicillins are the most widely used due to their broad-spectrum efficacy and cost-effectiveness. The increasing prevalence of bacterial infections in livestock and companion animals drives the demand for these antibiotics.

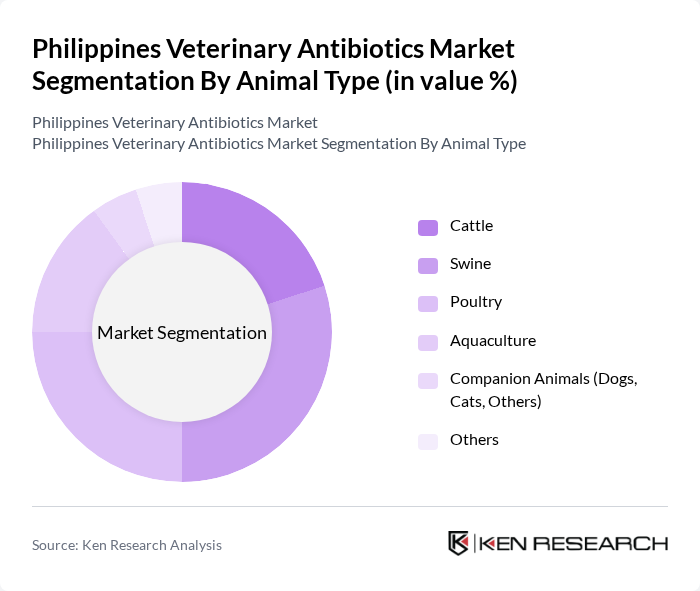

By Animal Type:The market is categorized based on animal types, including Cattle, Swine, Poultry, Aquaculture, Companion Animals (Dogs, Cats, Others), and Others. Poultry and Swine are the leading segments due to the high demand for meat and eggs in the Philippines. The growing aquaculture sector also contributes significantly to the market, driven by the increasing consumption of fish and seafood.

The Philippines Veterinary Antibiotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health Incorporated, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac S.A., Vetoquinol S.A., Phibro Animal Health Corporation, Dechra Pharmaceuticals PLC, Huvepharma EOOD, Bimeda, Inc., Norbrook Laboratories Ltd, Univet Nutrition and Animal Healthcare Co. (Philippines), Unahco, Inc. (United Laboratories Animal Health Company), PacificVet Group Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary antibiotics market in the Philippines appears promising, driven by increasing livestock production and heightened awareness of animal health. As the government continues to invest in disease control initiatives, the demand for effective antibiotics is expected to rise. Additionally, the market is likely to see innovations in antibiotic formulations and a shift towards preventive healthcare practices, which will enhance overall animal health and productivity in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Tetracyclines Penicillins Macrolides Sulfonamides Aminoglycosides Cephalosporins Fluoroquinolones Others |

| By Animal Type | Cattle Swine Poultry Aquaculture Companion Animals (Dogs, Cats, Others) Others |

| By End-User | Commercial Livestock & Poultry Farms Aquaculture Farms Veterinary Hospitals & Clinics Household Pet Owners Others |

| By Distribution Channel | Veterinary Drug Stores & Agro?vet Retailers Hospital & Clinic Pharmacies Cooperatives and Feed Mill Outlets Online Retail & E?pharmacies Direct Sales Others |

| By Route of Administration | Oral Injectable (Parenteral) Topical In?feed & In?water Medication Others |

| By Therapeutic Area | Respiratory Infections Gastrointestinal Infections Systemic & Septicemic Infections Dermatological & Soft Tissue Infections Reproductive & Urogenital Infections Mastitis and Udder Health Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Antibiotic Usage | 120 | Poultry Farmers, Veterinarians |

| Swine Health Management | 100 | Swine Producers, Animal Health Technicians |

| Cattle Antibiotic Practices | 80 | Dairy Farmers, Livestock Veterinarians |

| Veterinary Pharmaceutical Insights | 90 | Pharmaceutical Sales Representatives, Product Managers |

| Regulatory Compliance in Veterinary Medicine | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Philippines Veterinary Antibiotics Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for livestock and poultry products, as well as heightened awareness of animal health and welfare.