Region:Europe

Author(s):Rebecca

Product Code:KRAB4063

Pages:98

Published On:October 2025

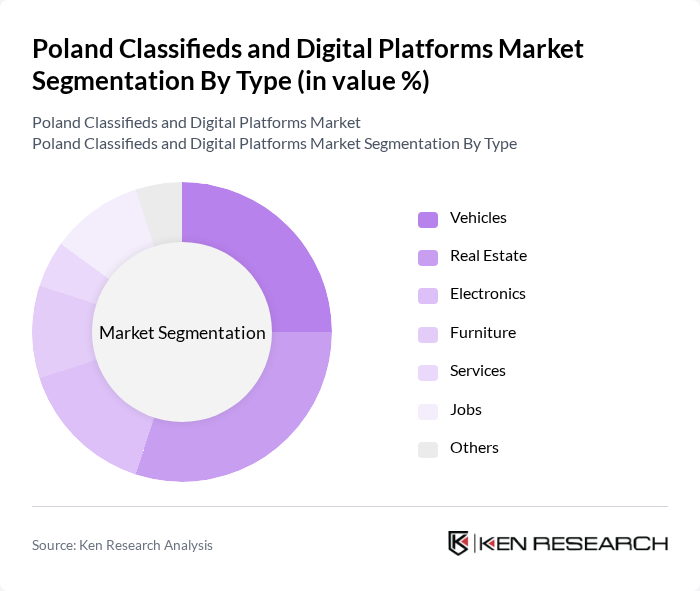

By Type:The market is segmented into various types, including Vehicles, Real Estate, Electronics, Furniture, Services, Jobs, and Others. Each of these segments caters to different consumer needs and preferences, with some experiencing higher demand than others. The Vehicles segment is particularly dominant, driven by the increasing demand for used cars and the convenience of online transactions. Real Estate also shows significant activity, fueled by urbanization and the growing trend of online property listings .

The Vehicles segment is a significant contributor to the market, driven by the increasing demand for personal and commercial transportation options. Consumers are increasingly turning to online platforms for buying and selling vehicles due to the convenience and broader reach these platforms offer. The Real Estate segment follows closely, fueled by the growing urban population and the need for housing solutions. The trend of digitalization in real estate transactions, including virtual tours and online listings, has further enhanced its appeal. Overall, the Vehicles and Real Estate segments lead the market due to their high transaction volumes and consumer interest .

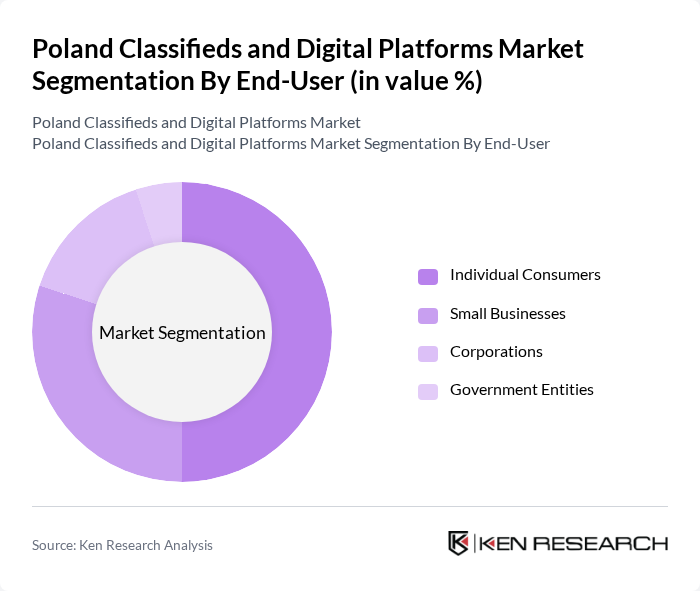

By End-User:The market is segmented by end-user into Individual Consumers, Small Businesses, Corporations, and Government Entities. Each segment has distinct needs and usage patterns, influencing the overall market dynamics. Individual Consumers dominate the market, driven by the increasing trend of online shopping and the convenience of accessing various products and services from home. Small businesses also play a crucial role, leveraging online platforms to reach a broader audience without the need for physical storefronts .

The Individual Consumers segment dominates the market, accounting for half of the total share. This is largely due to the increasing number of individuals engaging in online buying and selling activities, driven by convenience and accessibility. Small Businesses also represent a significant portion of the market, utilizing digital platforms to reach a wider audience and streamline their operations. Corporations and Government Entities, while smaller in comparison, are increasingly adopting digital platforms for various transactions, contributing to the overall growth of the market .

The Poland Classifieds and Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Poland, Allegro.pl, Gumtree Poland, Gratka.pl, Oferteo.pl, Lento.pl, Sprzedajemy.pl, eBay Poland, Facebook Marketplace, Ceneo.pl, Trovit.pl, Noclegi.pl, Zumi.pl, AutoScout24.pl, Pracuj.pl, OtoMoto.pl, Morizon.pl, Nieruchomosci-online.pl, Szybko.pl contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Poland classifieds and digital platforms market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms are likely to enhance user experiences through personalized services and improved security measures. Additionally, the integration of AI and machine learning will facilitate better matchmaking between buyers and sellers, while the growing trend of sustainability will encourage platforms to adopt eco-friendly practices, further attracting environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicles Real Estate Electronics Furniture Services Jobs Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Category | Real Estate Automotive Job Listings Services Electronics Furniture Others |

| By Sales Channel | Direct Listings Auction Platforms Classified Ads Social Media |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Price Range | Low-End Mid-Range High-End |

| By Listing Duration | Short-Term Listings Long-Term Listings |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash on Delivery Digital Wallets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales Platforms | 60 | Car Dealership Owners, Automotive Sales Managers |

| Job Posting Services | 50 | HR Managers, Recruitment Specialists |

| Consumer Goods Classifieds | 70 | Small Business Owners, E-commerce Entrepreneurs |

| Local Services Advertising | 40 | Service Providers, Marketing Managers |

The Poland Classifieds and Digital Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile commerce, and a shift towards online shopping among consumers.