Region:Asia

Author(s):Shubham

Product Code:KRAA5991

Pages:91

Published On:September 2025

By Type:The market is segmented into various types, including Online Marketplaces, Mobile Applications, Classified Ads Websites, Social Media Platforms, Auction Sites, and Others. Among these, Online Marketplaces are the most dominant due to their user-friendly interfaces and extensive product listings, catering to a wide range of consumer needs. Mobile Applications are also gaining traction as they offer convenience and accessibility, particularly among younger demographics. The increasing use of smartphones has further propelled the growth of mobile applications in this sector.

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Non-Profit Organizations. Individual Consumers dominate the market as they are the primary users of classifieds and digital platforms for buying and selling goods. Small Businesses also play a significant role, utilizing these platforms for marketing and sales. The trend of digitalization among small enterprises has led to increased engagement in online classifieds.

The Japan Classifieds and Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Recruit Holdings Co., Ltd., ZOZO, Inc., Mercari, Inc., Indeed, Inc., DMM.com LLC, Yahoo Japan Corporation, Rakuten, Inc., Kakaku.com, Inc., Jiji.co.jp, Suumo (Recruit), At Home Co., Ltd., LIFULL Co., Ltd., Gree, Inc., C2C Marketplaces, Others contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan classifieds and digital platforms market appears promising, driven by technological advancements and evolving consumer behaviors. As mobile usage continues to rise, platforms that prioritize user experience and integrate innovative features will likely thrive. Additionally, the increasing demand for localized services will push companies to tailor their offerings, enhancing customer satisfaction. Strategic partnerships with local businesses will also play a crucial role in expanding market reach and fostering community engagement, ensuring long-term sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Marketplaces Mobile Applications Classified Ads Websites Social Media Platforms Auction Sites Others |

| By End-User | Individual Consumers Small Businesses Corporations Non-Profit Organizations |

| By Product Category | Electronics Real Estate Automotive Services Fashion Others |

| By Sales Channel | Direct Sales Affiliate Marketing Social Media Advertising Email Marketing |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Engagement | Active Users Inactive Users New Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Classifieds | 150 | General Consumers, Online Shoppers |

| Small Business Advertising Strategies | 100 | Small Business Owners, Marketing Managers |

| Digital Platform User Experience | 120 | Frequent Users, New Users |

| Market Trends in E-commerce | 80 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Social Media on Classifieds | 90 | Social Media Managers, Content Creators |

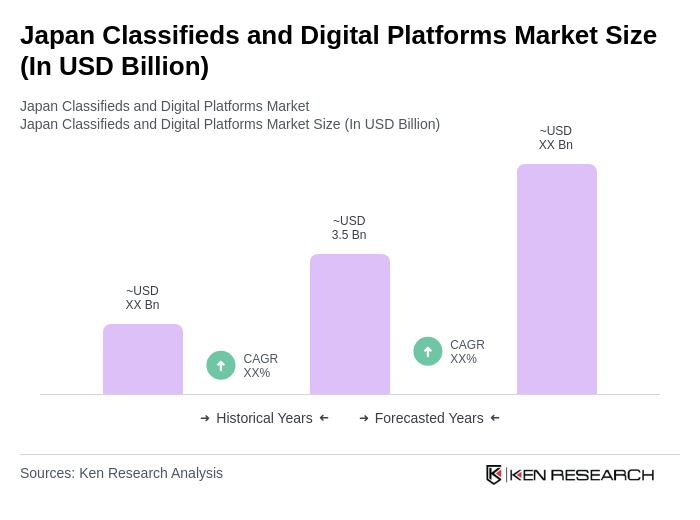

The Japan Classifieds and Digital Platforms Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and services.