Region:Europe

Author(s):Rebecca

Product Code:KRAB4139

Pages:93

Published On:October 2025

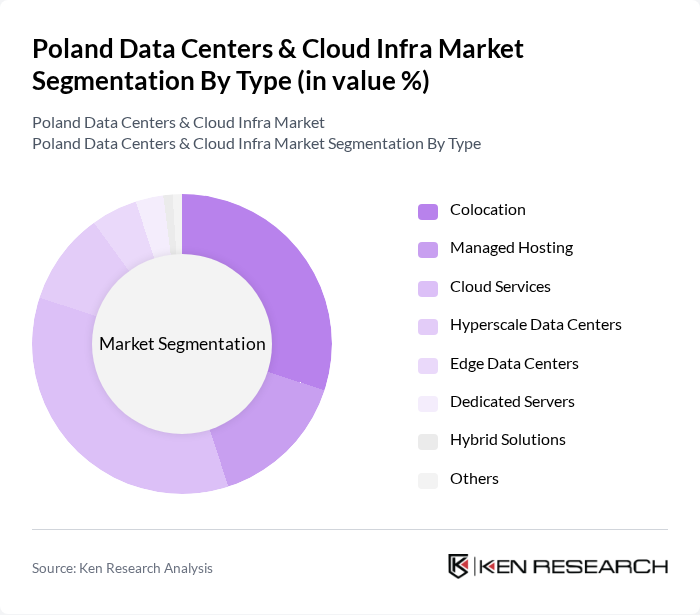

By Type:The market is segmented into Colocation, Managed Hosting, Cloud Services, Hyperscale Data Centers, Edge Data Centers, Dedicated Servers, Hybrid Solutions, and Others. Colocation and cloud services are particularly prominent, driven by the need for scalable, flexible, and cost-effective solutions. Hyperscale data centers are rapidly expanding as global cloud providers invest in Poland, while edge data centers are gaining traction to support low-latency applications and IoT deployments. Managed hosting and dedicated servers continue to serve enterprises seeking customized infrastructure, and hybrid solutions are increasingly adopted for balancing on-premises and cloud workloads .

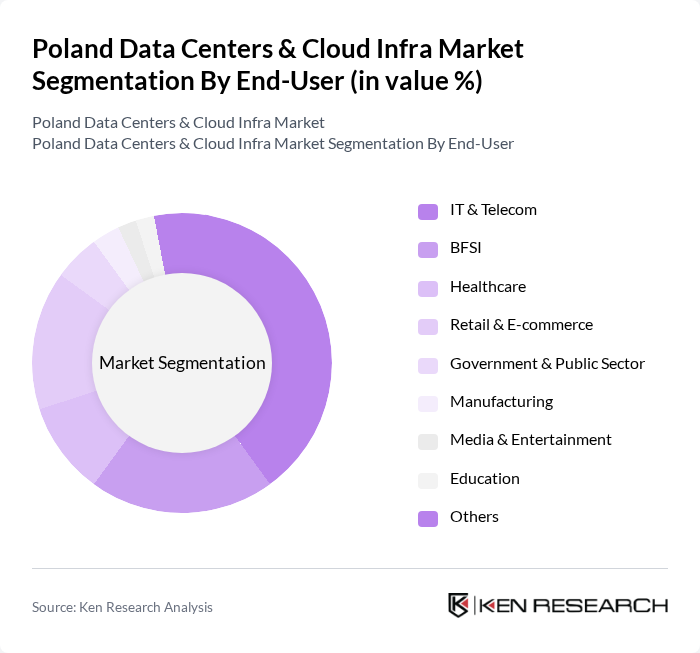

By End-User:The end-user segmentation includes IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Government & Public Sector, Manufacturing, Media & Entertainment, Education, and Others. The IT & Telecom sector is the largest consumer of data center services, driven by the need for reliable and scalable infrastructure to support digital services. BFSI and retail & e-commerce sectors are also significant, leveraging cloud and colocation solutions for secure transactions and rapid digital expansion. Healthcare and government sectors are increasingly adopting cloud and edge data centers to enhance data security, regulatory compliance, and service delivery .

The Poland Data Centers & Cloud Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atman S.A., Beyond.pl, T-Mobile Polska S.A., Orange Polska S.A., Data Center Poland Sp. z o.o., Netia S.A., Exea Data Center, K2 Data Centers (K2 Internet S.A.), Cyfrowy Polsat S.A., Equinix, Inc., Interxion (Digital Realty), Global Cloud Xchange, Microsoft Azure, Amazon Web Services (AWS), Google Cloud Platform, Data4 Group, NTT Ltd., Comarch S.A., T-Systems Polska contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland Data Centers and Cloud Infra market appears promising, driven by technological advancements and increasing digitalization across industries. As businesses continue to embrace hybrid cloud solutions, the demand for flexible and scalable infrastructure will rise. Additionally, the focus on sustainability will lead to investments in energy-efficient technologies, positioning Poland as a leader in green data center practices. Strategic collaborations between local firms and global tech giants will further enhance innovation and service offerings in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Managed Hosting Cloud Services Hyperscale Data Centers Edge Data Centers Dedicated Servers Hybrid Solutions Others |

| By End-User | IT & Telecom BFSI Healthcare Retail & E-commerce Government & Public Sector Manufacturing Media & Entertainment Education Others |

| By Application | Data Storage Disaster Recovery Backup Solutions Application Hosting Big Data Analytics AI/ML Workloads Others |

| By Service Model | IaaS PaaS SaaS Others |

| By Deployment Type | On-Premises Off-Premises (Colocation/Cloud) Hybrid Others |

| By Pricing Model | Pay-as-you-go Subscription-based One-time payment Others |

| By Region | Warsaw (Central Poland) Kraków (Southern Poland) Pozna? (Western Poland) Gda?sk (Northern Poland) Wroc?aw (Southwestern Poland) ?ód? (Central Poland) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, Cloud Architects |

| Data Center Operations | 60 | Data Center Managers, Operations Directors |

| SME Cloud Services Utilization | 50 | Business Owners, IT Consultants |

| Regulatory Compliance in Cloud | 40 | Compliance Officers, Legal Advisors |

| Cloud Security Practices | 50 | Security Analysts, Risk Management Professionals |

The Poland Data Centers & Cloud Infra Market is valued at approximately USD 6.7 billion, driven by the increasing demand for cloud services, digital transformation initiatives, and the expansion of data centers to support data-driven decision-making.