Region:Middle East

Author(s):Dev

Product Code:KRAA4886

Pages:81

Published On:September 2025

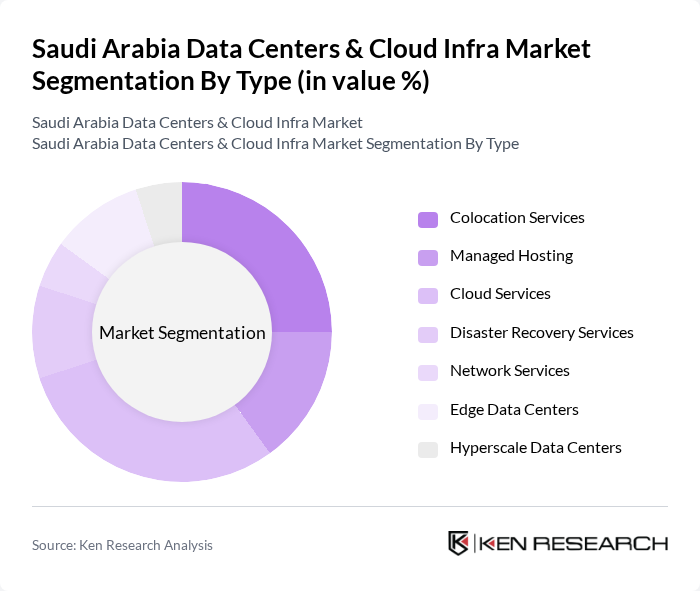

By Type:The market is segmented into various types, including Colocation Services, Managed Hosting, Cloud Services, Disaster Recovery Services, Network Services, Edge Data Centers, and Hyperscale Data Centers. Each of these segments plays a crucial role in meeting the diverse needs of businesses and organizations in Saudi Arabia. Colocation and cloud services are particularly prominent, driven by enterprise demand for scalable, secure, and cost-effective infrastructure solutions. Hyperscale and edge data centers are gaining traction due to increased adoption of AI, IoT, and latency-sensitive applications.

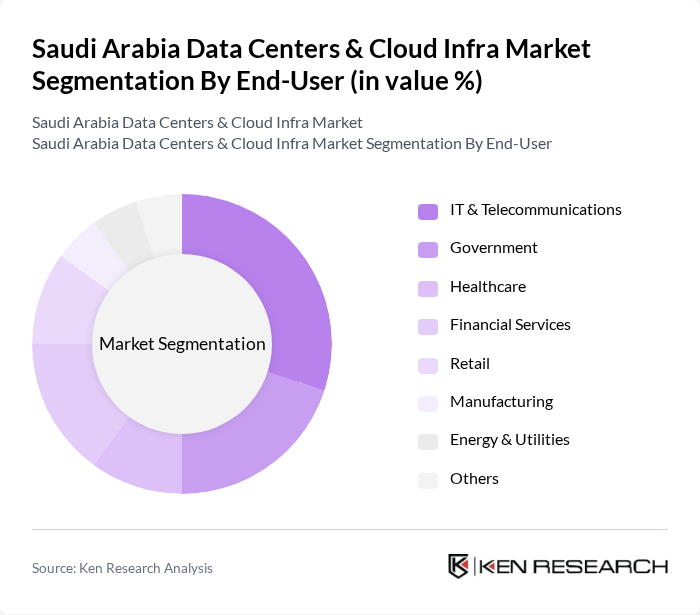

By End-User:The end-user segmentation includes IT & Telecommunications, Government, Healthcare, Financial Services, Retail, Manufacturing, Energy & Utilities, and Others. Each sector has unique requirements for data management and cloud services, driving the demand for tailored solutions. The IT & Telecommunications and Government sectors are leading adopters, propelled by digital transformation, e-government initiatives, and the expansion of 5G and AI-driven services.

The Saudi Arabia Data Centers & Cloud Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, NTT Communications, Equinix, Gulf Data Hub, Khazna Data Centers, Saudi Aramco, Microsoft Azure, Amazon Web Services (AWS), Google Cloud, Oracle Cloud, IBM Cloud, Digital Realty, and Alibaba Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia data centers and cloud infrastructure market appears promising, driven by ongoing government support and technological advancements. As the country continues to embrace digital transformation, investments in renewable energy and AI technologies are expected to enhance operational efficiencies. Furthermore, the shift towards hybrid cloud solutions will likely gain momentum, enabling businesses to leverage both on-premises and cloud resources effectively, thus fostering innovation and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Services Managed Hosting Cloud Services Disaster Recovery Services Network Services Edge Data Centers Hyperscale Data Centers |

| By End-User | IT & Telecommunications Government Healthcare Financial Services Retail Manufacturing Energy & Utilities Others |

| By Application | Data Storage Backup & Recovery Big Data Analytics Application Hosting AI/ML Workloads IoT Processing Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Disaster Recovery as a Service (DRaaS) Others |

| By Deployment Type | On-Premises Off-Premises Hybrid Multi-Cloud Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Usage-Based Pricing Others |

| By Geographic Presence | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha) NEOM & Special Economic Zones Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, CTOs, Cloud Architects |

| Data Center Operations | 90 | Data Center Managers, Operations Directors |

| Telecommunications Cloud Services | 70 | Network Engineers, Service Delivery Managers |

| Healthcare Data Management | 50 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cloud Solutions | 60 | Risk Management Officers, IT Security Managers |

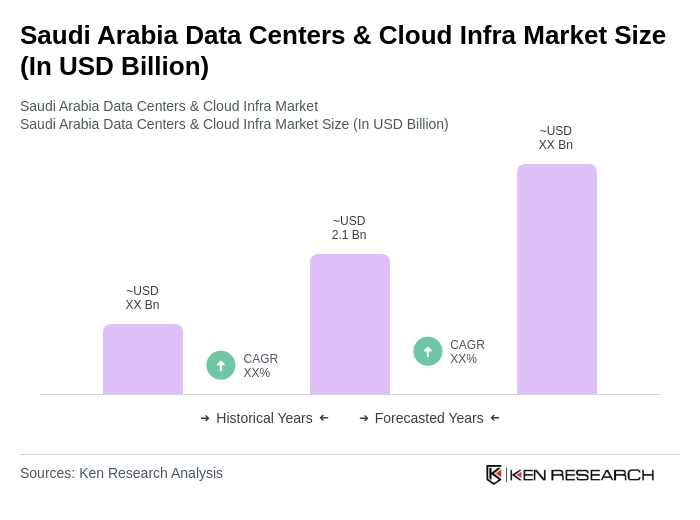

The Saudi Arabia Data Centers & Cloud Infra Market is valued at approximately USD 2.1 billion, driven by increasing demand for cloud services, government-led digital transformation initiatives, and the rise of e-commerce and AI adoption in the region.