Region:Europe

Author(s):Geetanshi

Product Code:KRAA4800

Pages:98

Published On:September 2025

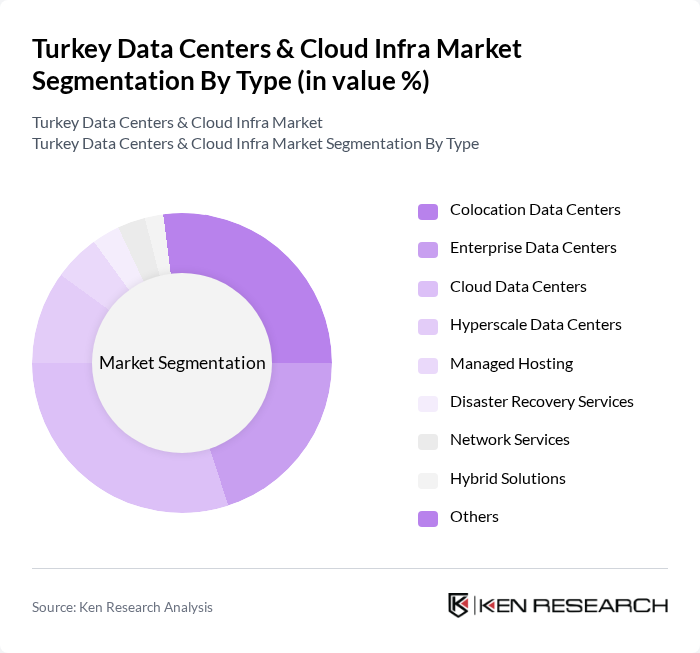

By Type:The market can be segmented into Colocation Data Centers, Enterprise Data Centers, Cloud Data Centers, Hyperscale Data Centers, Managed Hosting, Disaster Recovery Services, Network Services, Hybrid Solutions, and Others. Each of these sub-segments addresses specific requirements such as scalability, security, regulatory compliance, and business continuity. Colocation and cloud data centers are particularly prominent due to rising demand for flexible, cost-effective infrastructure and the migration of enterprise workloads to the cloud .

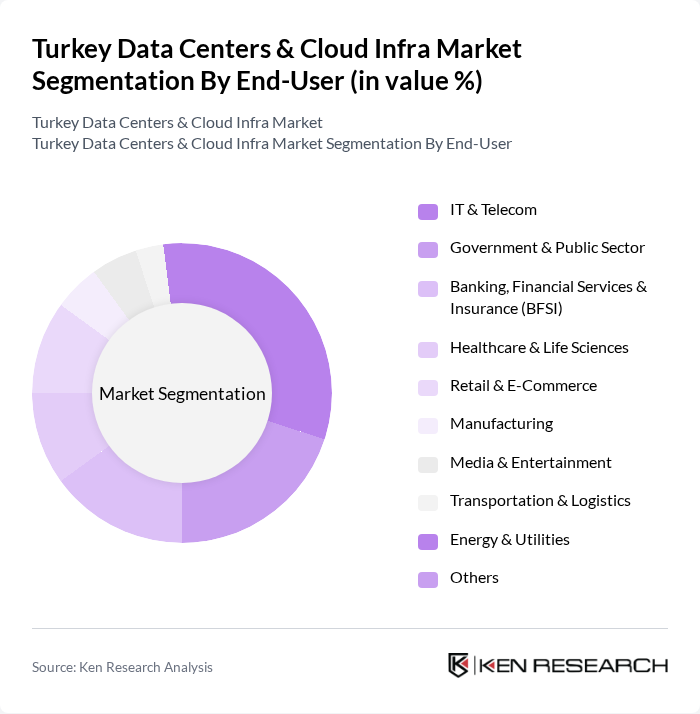

By End-User:The end-user segmentation includes IT & Telecom, Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Media & Entertainment, Transportation & Logistics, Energy & Utilities, and Others. IT & Telecom and Government & Public Sector are the largest consumers, driven by digitalization initiatives, regulatory compliance, and the need for high-availability infrastructure. BFSI and Healthcare are rapidly increasing their share due to stringent data protection requirements and the adoption of cloud-based solutions .

The Turkey Data Centers & Cloud Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turkcell, Vodafone Türkiye, Türk Telekom, NTT Global Data Centers Turkey, Data Center Turkey, KoçSistem, ?nnova Bili?im Çözümleri, Netinternet, Radore Veri Merkezi, Equinix Turkey, SadeceHosting, Veriteknik, Microsoft Türkiye, Amazon Web Services (AWS) Turkey, IBM Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's data centers and cloud infrastructure market appears promising, driven by technological advancements and increasing digitalization. The anticipated growth in hybrid cloud adoption and the expansion of 5G networks will further enhance connectivity and data processing capabilities. Additionally, the focus on sustainability and energy efficiency will likely lead to innovations in green data center technologies, positioning Turkey as a competitive player in the regional market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Enterprise Data Centers Cloud Data Centers Hyperscale Data Centers Managed Hosting Disaster Recovery Services Network Services Hybrid Solutions Others |

| By End-User | IT & Telecom Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-Commerce Manufacturing Media & Entertainment Transportation & Logistics Energy & Utilities Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Industry Vertical | Education Media & Entertainment Transportation & Logistics Energy & Utilities Others |

| By Geographic Presence | Istanbul Ankara Izmir Bursa Denizli Tekirda? Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Wholesale Colocation (per kW) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Directors, Chief Technology Officers |

| Data Center Operations | 60 | Data Center Managers, Operations Supervisors |

| Cloud Service Providers | 40 | Business Development Managers, Sales Executives |

| Regulatory Compliance in Cloud | 40 | Compliance Officers, Legal Advisors |

| SME Cloud Utilization | 50 | Small Business Owners, IT Consultants |

The Turkey Data Centers & Cloud Infra Market is valued at approximately USD 500 million, driven by digital transformation, cloud computing adoption, and increased data consumption. This growth is supported by government incentives and the expansion of high-speed internet connectivity across the country.