Region:Asia

Author(s):Shubham

Product Code:KRAB5089

Pages:98

Published On:October 2025

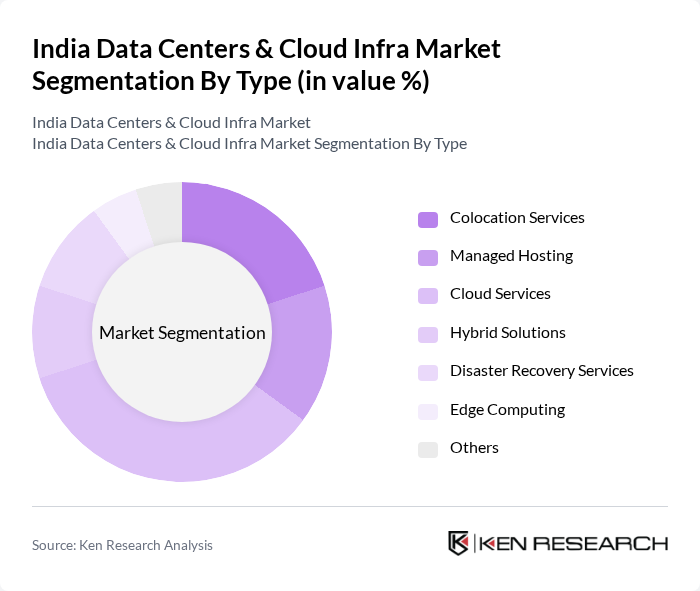

By Type:The market is segmented into various types, including Colocation Services, Managed Hosting, Cloud Services, Hybrid Solutions, Disaster Recovery Services, Edge Computing, and Others. Each of these segments caters to different customer needs, with cloud services currently leading due to the increasing shift towards digital solutions.

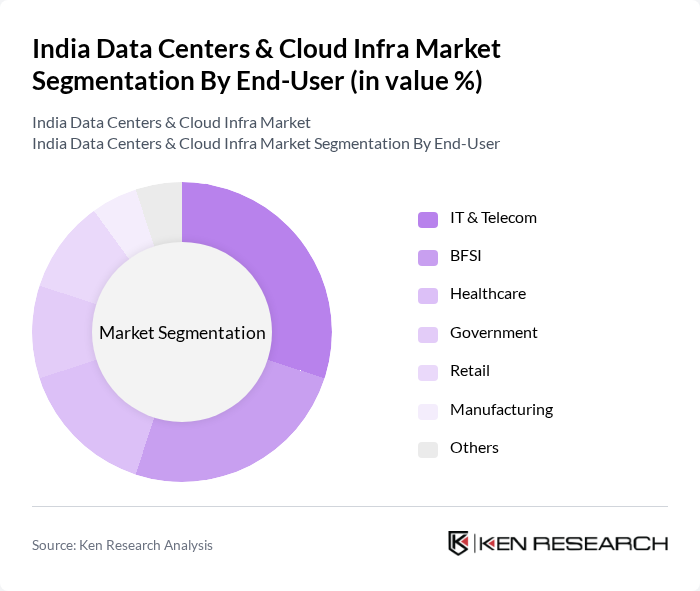

By End-User:The end-user segmentation includes IT & Telecom, BFSI, Healthcare, Government, Retail, Manufacturing, and Others. The IT & Telecom sector is the largest consumer of data center services, driven by the need for high-speed connectivity and data management solutions.

The India Data Centers & Cloud Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT Communications, Tata Communications, CtrlS Datacenters, Sify Technologies, Adani Group, Bharti Airtel, AWS (Amazon Web Services), Microsoft Azure, Google Cloud, Rackspace Technology, Web Werks, ESDS Software Solution, Netmagic Solutions, KIO Networks, DigitalOcean contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Data Centers and Cloud Infra market appears promising, driven by technological advancements and increasing digitalization. The adoption of hybrid cloud solutions is expected to gain momentum, allowing businesses to optimize their IT infrastructure. Furthermore, the focus on sustainability will likely lead to investments in energy-efficient data centers, aligning with global environmental goals. As the market matures, collaboration between cloud providers and telecom companies will enhance service delivery and expand reach, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Services Managed Hosting Cloud Services Hybrid Solutions Disaster Recovery Services Edge Computing Others |

| By End-User | IT & Telecom BFSI Healthcare Government Retail Manufacturing Others |

| By Region | North India South India East India West India |

| By Technology | Virtualization Cloud Computing AI Integration IoT Solutions Big Data Analytics Others |

| By Application | Data Storage Data Backup Disaster Recovery Application Hosting Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, CTOs, Digital Transformation Leads |

| Data Center Operations | 100 | Data Center Managers, Operations Directors |

| SME Cloud Utilization | 80 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 70 | Government IT Officials, Policy Makers |

| Cloud Security and Compliance | 90 | Security Officers, Compliance Managers |

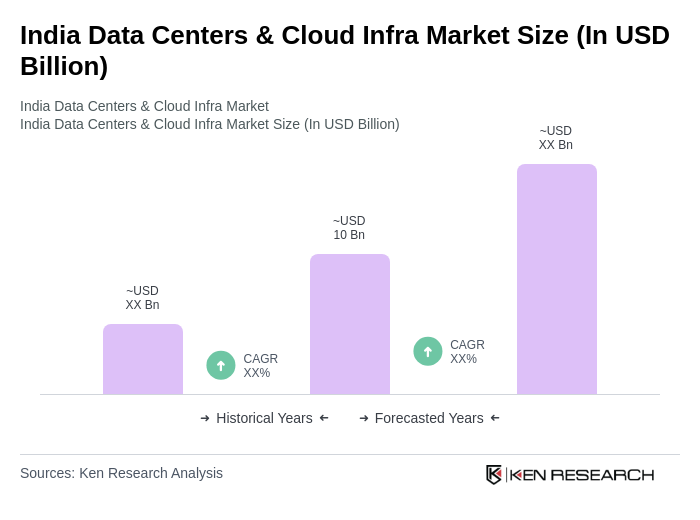

The India Data Centers & Cloud Infra Market is valued at approximately USD 10 billion, driven by the increasing demand for cloud services, digital transformation initiatives, and the rise in data consumption across various sectors.