Region:Europe

Author(s):Geetanshi

Product Code:KRAB5101

Pages:80

Published On:October 2025

By Type:The market can be segmented into various types, including Mobile Banking Platforms, Online Banking Platforms, Digital Wallets, Payment Processing Solutions, Personal Finance Management Tools, Investment Platforms, BNPL (Buy Now Pay Later) Solutions, Open Banking APIs, and Others. Each of these subsegments plays a crucial role in shaping the digital banking landscape. Mobile and online banking platforms are the most widely adopted, while digital wallets and BNPL solutions are experiencing rapid growth due to e-commerce expansion and consumer demand for flexible payment options .

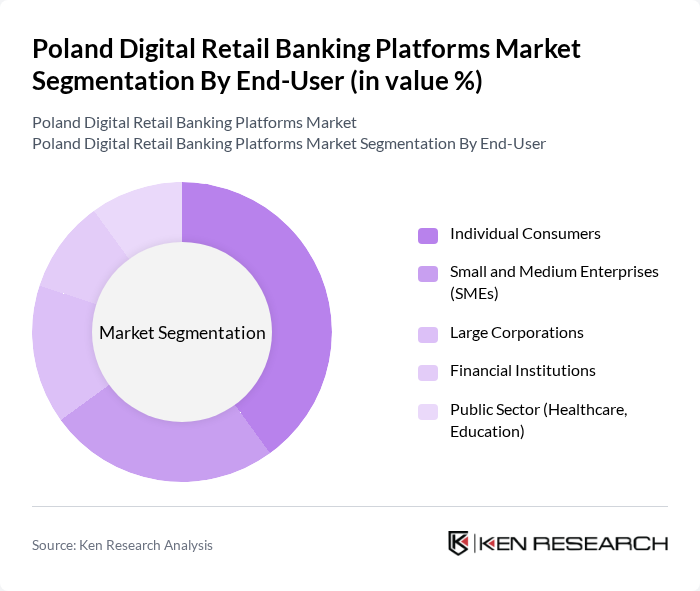

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, and the Public Sector (Healthcare, Education). Each segment has unique needs and preferences that influence the adoption of digital banking solutions. Individual consumers drive the largest share, with SMEs and large corporations increasingly adopting digital platforms for efficiency and integration with payment ecosystems. The public sector is also accelerating digital transformation, particularly in healthcare and education .

The Poland Digital Retail Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PKO Bank Polski, mBank S.A., ING Bank ?l?ski, Santander Bank Polska, Bank Millennium, Alior Bank, Getin Noble Bank, BNP Paribas Bank Polska, Credit Agricole Bank Polska, T-Mobile Us?ugi Bankowe, EnveloBank (division of Bank Pocztowy), Nest Bank, VeloBank, Revolut Ltd., PayU, DotPay, Bank Pekao S.A., Millennium Goodie (digital wallet), Apple Pay (Poland operations), Google Pay (Poland operations), BLIK (Polski Standard P?atno?ci) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Poland's digital retail banking market appears promising, driven by technological advancements and evolving consumer preferences. As digital banking becomes increasingly integrated into daily life, banks are expected to enhance their offerings through innovative solutions. The focus on customer-centric services, coupled with regulatory support for fintech innovations, will likely foster a more competitive landscape. Additionally, the integration of emerging technologies such as AI and blockchain will further transform the banking experience, making it more efficient and secure.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Platforms Online Banking Platforms Digital Wallets Payment Processing Solutions Personal Finance Management Tools Investment Platforms BNPL (Buy Now Pay Later) Solutions Open Banking APIs Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Public Sector (Healthcare, Education) |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) C2B (Consumer to Business) B2B2C (Business to Business to Consumer) |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Retailers Fintech Partnerships |

| By Customer Segment | Millennials Gen Z Gen X Baby Boomers Micro-entrepreneurs |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments BLIK Payments Contactless Payments |

| By Regulatory Compliance | PSD2 Compliant Solutions GDPR Compliant Solutions AML Compliant Solutions KYC (Know Your Customer) Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Individual Account Holders, Digital Banking Users |

| Fintech Service Providers | 60 | Product Managers, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Banking Technology Vendors | 50 | Sales Directors, Technical Consultants |

| Industry Analysts | 40 | Market Researchers, Financial Analysts |

The Poland Digital Retail Banking Platforms Market is valued at approximately USD 5.7 billion, reflecting a significant growth driven by the increasing adoption of digital banking solutions and fintech innovations.