Poland Insurance Technology (InsurTech) and Online Brokers Market Overview

- The Poland Insurance Technology (InsurTech) and Online Brokers Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of digital technologies, a surge in demand for personalized and flexible insurance products, and the proliferation of online platforms that streamline access to insurance services. The Polish market is further propelled by mobile-first solutions, AI-powered risk assessment, and the expansion of embedded and microinsurance offerings, which address underserved segments and enhance customer engagement .

- Key cities such as Warsaw, Kraków, and Wroc?aw dominate the market due to their advanced technological infrastructure, high concentration of startups, and a growing base of tech-savvy consumers. These urban centers are recognized as leading tech ecosystems in Poland, attracting both domestic and international investment and fostering a competitive environment for insurance innovation .

- In 2023, the Polish government enacted the Act of 11 September 2015 on Insurance and Reinsurance Activity (as amended), administered by the Polish Financial Supervision Authority (KNF). This regulation mandates comprehensive disclosure of policy terms and conditions, strengthens consumer rights, and imposes strict transparency requirements on insurers and brokers, thereby enhancing consumer trust and market transparency .

and Online Brokers Market.png)

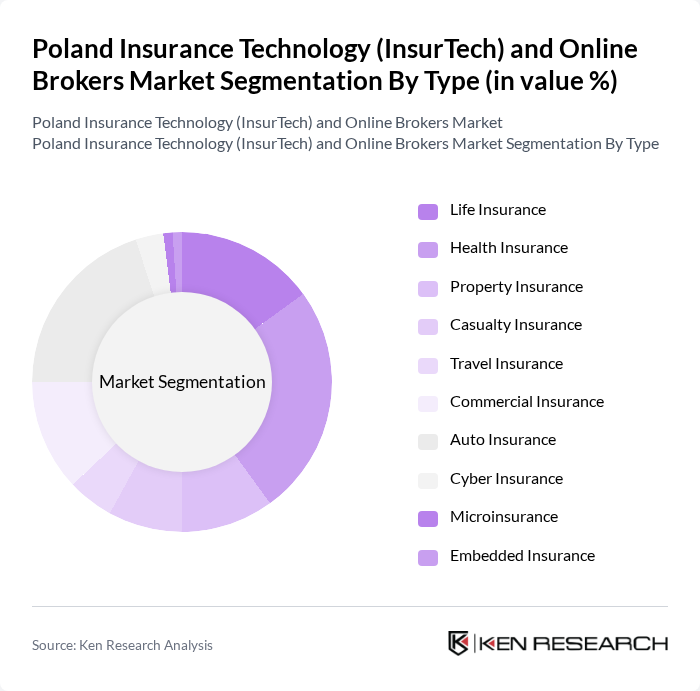

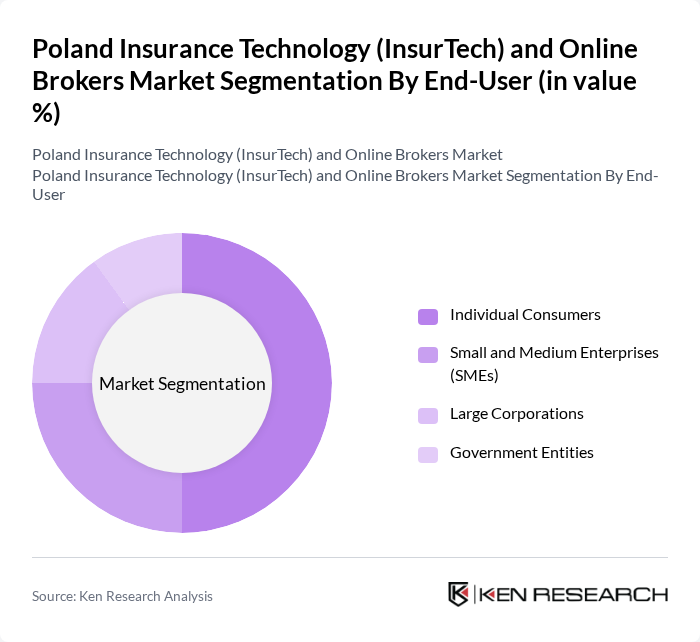

Poland Insurance Technology (InsurTech) and Online Brokers Market Segmentation

By Type:The market is segmented into various types of insurance products, each catering to different consumer needs and preferences. The subsegments include Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Travel Insurance, Commercial Insurance, Auto Insurance, Cyber Insurance, Microinsurance, and Embedded Insurance. Among these, Health Insurance and Auto Insurance remain particularly prominent, driven by rising healthcare expenditures, increased vehicle ownership, and the growing popularity of digital policy management and claims processing .

By End-User:The market is segmented by end-users, which include Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent a significant portion of the market, driven by heightened awareness of personal insurance needs, the convenience of digital platforms, and the proliferation of user-friendly online broker services .

Poland Insurance Technology (InsurTech) and Online Brokers Market Competitive Landscape

The Poland Insurance Technology (InsurTech) and Online Brokers Market is characterized by a dynamic mix of regional and international players. Leading participants such as PZU SA, Allianz Polska S.A., Warta S.A., Generali Polska S.A., AXA Ubezpieczenia, Link4, Ergo Hestia, Aviva Polska, Compensa Vienna Insurance Group, InterRisk Vienna Insurance Group, UNIQA Polska, MetLife Poland, Cigna Poland, Insly, Rankomat.pl, Mubi.pl, Beesafe, Unilink, Punkta, Comparer.pl contribute to innovation, geographic expansion, and service delivery in this space.

Poland Insurance Technology (InsurTech) and Online Brokers Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital adoption rate in Poland has surged, with over90%of the population using the internet. This trend is bolstered by asteady increase in smartphone penetration, with estimates above 80%, facilitating access to InsurTech services. Additionally, the Polish government’s digitalization initiatives aim to enhance online service delivery, which is expected to further drive the adoption of digital insurance solutions. This environment fosters innovation and encourages consumers to engage with InsurTech platforms.

- Regulatory Support for InsurTech:The Polish Financial Supervision Authority (KNF) has introduced supportive regulations that promote InsurTech innovation. The KNF reported a25%increase in the number of licensed InsurTech firms, reflecting a favorable regulatory landscape. These regulations aim to streamline compliance processes and encourage startups to enter the market, thus enhancing competition and consumer choice. This supportive framework is crucial for fostering a robust InsurTech ecosystem in Poland.

- Demand for Personalized Insurance Products:A significant shift towards personalized insurance products is evident, with60%of consumers expressing a preference for tailored coverage options. This demand is driven by changing consumer expectations and the availability of data analytics tools that enable insurers to offer customized solutions. As a result, InsurTech companies are increasingly leveraging technology to create innovative products that meet individual needs, thereby enhancing customer satisfaction and loyalty.

Market Challenges

- Data Privacy Concerns:Data privacy remains a critical challenge for the InsurTech sector in Poland, particularly with the implementation of the General Data Protection Regulation (GDPR). A significant percentage of consumers expressed concerns about how their personal data is handled by InsurTech firms. This apprehension can hinder the adoption of digital insurance solutions, as consumers may be reluctant to share sensitive information. InsurTech companies must prioritize data security to build trust and encourage user engagement.

- High Competition Among InsurTech Firms:The Polish InsurTech market is characterized by intense competition, with over100active InsurTech startups. This saturation leads to price wars and challenges in differentiating services. Established insurance companies are also entering the digital space, further intensifying competition. As a result, InsurTech firms must innovate continuously and enhance their value propositions to maintain market share and attract customers in this crowded landscape.

Poland Insurance Technology (InsurTech) and Online Brokers Market Future Outlook

The future of the InsurTech market in Poland appears promising, driven by technological advancements and evolving consumer preferences. As digital solutions become more integrated into everyday life, InsurTech firms are expected to leverage artificial intelligence and machine learning to enhance customer experiences. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly insurance products, aligning with global trends. These factors will shape a dynamic market landscape, fostering innovation and growth in the coming years.

Market Opportunities

- Expansion of Microinsurance Products:The microinsurance segment presents a significant opportunity, with an estimated3 millionPoles lacking adequate insurance coverage. By offering affordable, tailored microinsurance products, InsurTech firms can tap into this underserved market, providing essential protection to low-income consumers. This approach not only enhances financial inclusion but also drives growth for InsurTech companies in Poland.

- Growth in Usage-Based Insurance Models:The rise of telematics and IoT technology is paving the way for usage-based insurance models, which are projected to grow by20%. These models allow consumers to pay premiums based on actual usage, appealing to cost-conscious customers. InsurTech firms that adopt this innovative approach can attract a broader customer base while promoting responsible behavior, thus enhancing profitability and customer loyalty.

and Online Brokers Market.png)