Region:Europe

Author(s):Shubham

Product Code:KRAB5622

Pages:96

Published On:October 2025

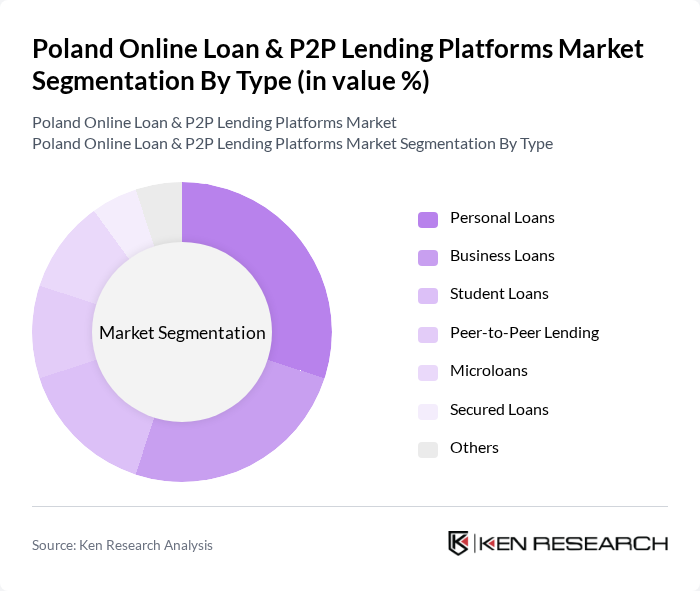

By Type:The market is segmented into various types of loans, each catering to different consumer needs. Personal loans are popular among individuals for various purposes, while business loans are essential for SMEs looking to expand. Student loans cater to the educational sector, and peer-to-peer lending has gained traction due to its innovative approach. Microloans and secured loans also play significant roles, addressing specific financial requirements.

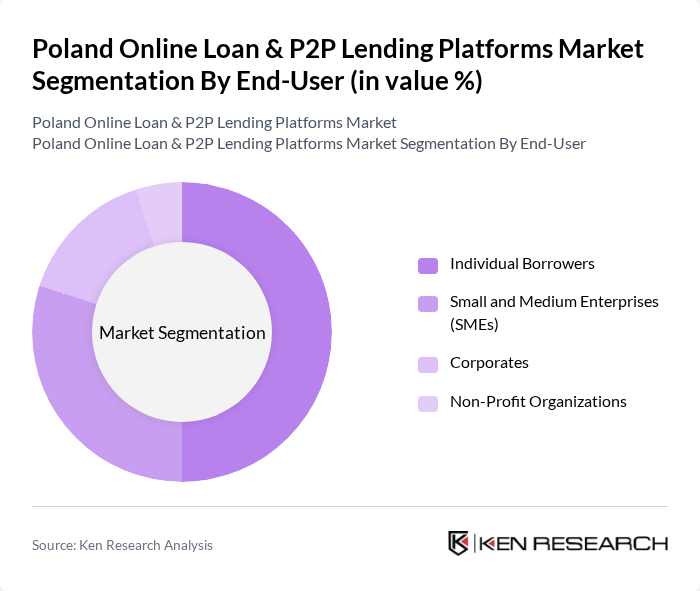

By End-User:The end-user segmentation includes individual borrowers, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individual borrowers represent a significant portion of the market, driven by personal financial needs. SMEs are increasingly turning to online loans for operational funding, while corporates and non-profits utilize these platforms for specific projects or initiatives.

The Poland Online Loan & P2P Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mintos, PeerBerry, Lendico, Kreditech, Wonga, Zaimo, Finanso, Cashper, Vivus, Monedo, Aasa, Tani Kredyt, Smartney, Szybka Gotówka, Kredyt Market contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and P2P lending market in Poland appears promising, driven by technological advancements and changing consumer behaviors. As mobile lending applications become more prevalent, user engagement is expected to rise, enhancing customer experience. Additionally, the integration of artificial intelligence in credit scoring will likely streamline the lending process, making it more efficient. These trends, coupled with a growing focus on sustainable lending practices, will shape the market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Peer-to-Peer Lending Microloans Secured Loans Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Amount | Small Loans (up to 5,000 PLN) Medium Loans (5,001 - 20,000 PLN) Large Loans (above 20,000 PLN) |

| By Loan Duration | Short-Term Loans (up to 1 year) Medium-Term Loans (1-3 years) Long-Term Loans (above 3 years) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Application Method | Online Applications Mobile Applications In-Person Applications |

| By Customer Segment | First-Time Borrowers Repeat Borrowers High-Risk Borrowers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 150 | Individuals aged 25-45, employed, with varying credit scores |

| Small Business Loan Seekers | 100 | Small business owners, entrepreneurs, and startup founders |

| P2P Lending Users | 80 | Active users of P2P platforms, both borrowers and lenders |

| Financial Advisors | 60 | Certified financial planners and investment advisors |

| Regulatory Experts | 40 | Legal professionals specializing in financial regulations |

The Poland Online Loan & P2P Lending Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for alternative financing solutions among individuals and small businesses seeking quick access to funds.