Region:Europe

Author(s):Shubham

Product Code:KRAB5671

Pages:97

Published On:October 2025

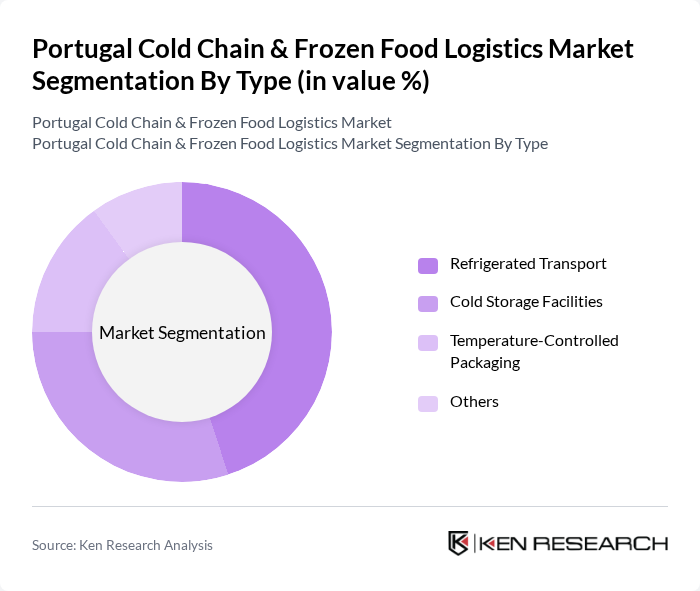

By Type:The cold chain logistics market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Others. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for fresh and frozen food products. The growth of e-commerce has also significantly contributed to the rise in refrigerated transport services, as consumers increasingly prefer home delivery of perishable goods.

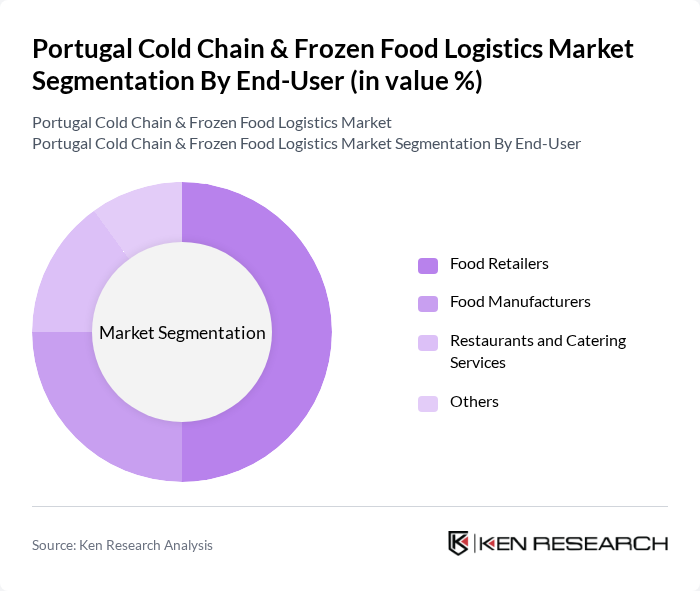

By End-User:The end-user segmentation includes Food Retailers, Food Manufacturers, Restaurants and Catering Services, and Others. Food Retailers dominate this segment, as they require efficient cold chain logistics to maintain the quality and safety of perishable goods. The increasing trend of online grocery shopping has further amplified the need for reliable cold chain solutions among food retailers.

The Portugal Cold Chain & Frozen Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo E. Leclerc, Logista, Transports F. M. S. A., Frio A. S., Unilabs, DSV Panalpina, Kuehne + Nagel, XPO Logistics, DB Schenker, Norbert Dentressangle, CTT - Correios de Portugal, Grupo Sonae, Pingo Doce, Continente, Lidl Portugal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and frozen food logistics market in Portugal appears promising, driven by increasing consumer demand for fresh and frozen products and the expansion of e-commerce. As companies invest in advanced technologies and sustainable practices, the market is likely to see enhanced efficiency and reduced environmental impact. Additionally, the focus on health-conscious food options will further stimulate growth, encouraging innovation and collaboration within the industry to meet evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Food Retailers Food Manufacturers Restaurants and Catering Services Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Product Type | Frozen Foods Fresh Produce Dairy Products Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services Others |

| By Packaging Type | Bulk Packaging Retail Packaging Customized Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frozen Food Retail Logistics | 150 | Logistics Coordinators, Supply Chain Managers |

| Cold Chain Technology Providers | 100 | Product Managers, Technical Directors |

| Food Service Distribution | 80 | Operations Managers, Procurement Specialists |

| Pharmaceutical Cold Chain | 70 | Quality Assurance Managers, Compliance Officers |

| Transport and Storage Operators | 90 | Warehouse Managers, Fleet Supervisors |

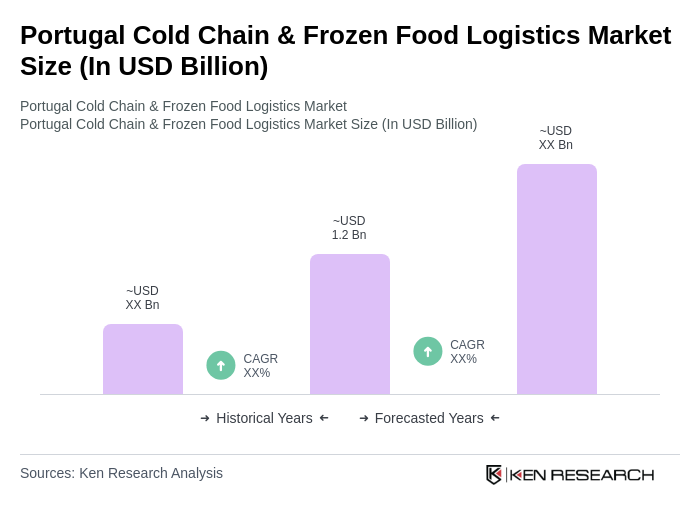

The Portugal Cold Chain & Frozen Food Logistics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for perishable goods, e-commerce expansion, and advancements in cold chain technology.