Region:Asia

Author(s):Rebecca

Product Code:KRAB5365

Pages:82

Published On:October 2025

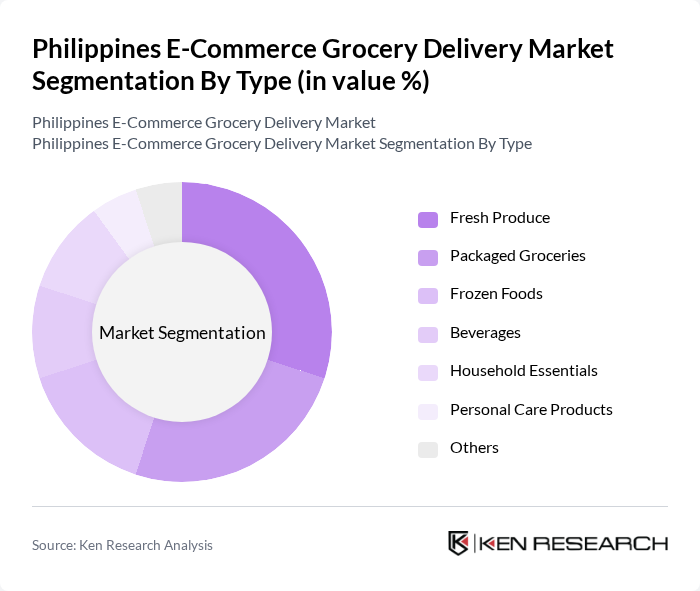

By Type:The market is segmented into various types of grocery products, including fresh produce, packaged groceries, frozen foods, beverages, household essentials, personal care products, and others. Each sub-segment caters to different consumer needs and preferences, with fresh produce and packaged groceries being particularly popular due to their convenience and availability.

The fresh produce segment is currently dominating the market due to the increasing consumer demand for healthy and organic food options. As more consumers become health-conscious, the preference for fresh fruits and vegetables has surged, leading to a significant rise in online orders. Additionally, the convenience of having fresh groceries delivered directly to homes has further fueled this trend, making it a key driver in the e-commerce grocery delivery landscape.

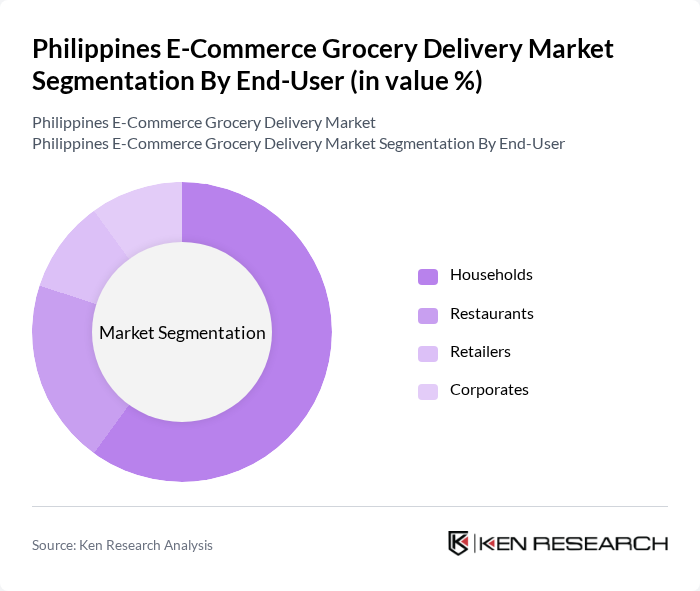

By End-User:The market is segmented by end-users, including households, restaurants, retailers, and corporates. Each segment has unique requirements and purchasing behaviors, with households being the largest consumer group due to the increasing trend of online grocery shopping for convenience.

Households dominate the market as they increasingly turn to online grocery delivery services for convenience and time-saving benefits. The busy lifestyles of urban consumers, coupled with the desire for safe shopping options, have led to a significant rise in household orders. This trend is expected to continue as more families embrace the convenience of having groceries delivered to their doorsteps.

The Philippines E-Commerce Grocery Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada, Shopee, MetroMart, GrabMart, Puregold, Robinsons Supermarket, S&R Membership Shopping, Foodpanda, Zalora, AllDay Supermarket, GCash, PayMaya, 7-Eleven, Landers Superstore, The Marketplace contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines e-commerce grocery delivery market appears promising, driven by technological advancements and changing consumer preferences. As mobile commerce continues to grow, with mobile transactions projected to reach PHP 30 billion in future, businesses will need to adapt to this trend. Additionally, the integration of AI and data analytics will enhance customer experiences, allowing for personalized shopping. Companies that embrace these innovations are likely to thrive in this evolving landscape, capturing a larger share of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Frozen Foods Beverages Household Essentials Personal Care Products Others |

| By End-User | Households Restaurants Retailers Corporates |

| By Sales Channel | Mobile Apps Websites Social Media Platforms Others |

| By Distribution Mode | Direct Delivery Click and Collect Third-Party Delivery Services |

| By Price Range | Budget Mid-Range Premium |

| By Customer Demographics | Age Group Income Level Urban vs Rural |

| By Payment Method | Credit/Debit Cards E-Wallets Cash on Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Grocery Delivery Users | 150 | Frequent online shoppers, age 18-45 |

| Rural Grocery Delivery Users | 100 | Households utilizing delivery services, age 30-60 |

| Logistics Providers in E-commerce | 80 | Operations Managers, Delivery Coordinators |

| Retail Grocery Store Owners | 70 | Small to medium-sized business owners |

| Industry Experts and Analysts | 50 | Market analysts, e-commerce consultants |

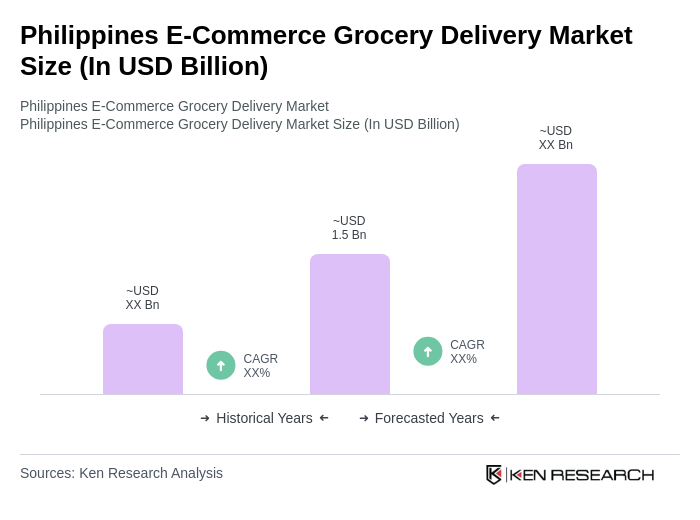

The Philippines E-Commerce Grocery Delivery Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased online shopping, changing consumer preferences, and advancements in mobile technology.