Region:Europe

Author(s):Rebecca

Product Code:KRAB5328

Pages:82

Published On:October 2025

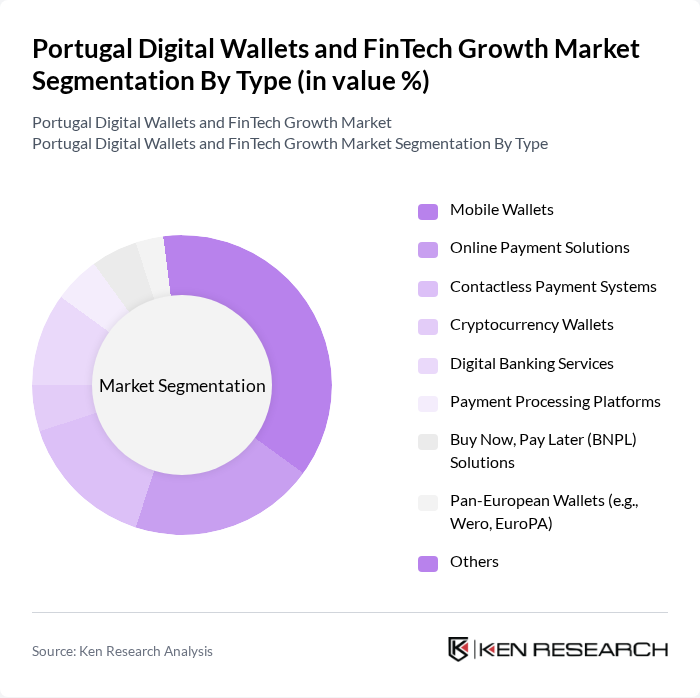

By Type:The segmentation by type includes various subsegments such as Mobile Wallets, Online Payment Solutions, Contactless Payment Systems, Cryptocurrency Wallets, Digital Banking Services, Payment Processing Platforms, Buy Now, Pay Later (BNPL) Solutions, Pan-European Wallets (e.g., Wero, EuroPA), and Others. Among these, Mobile Wallets are leading the market due to their convenience and widespread acceptance among consumers. MB WAY dominates the Portuguese digital wallet landscape, accounting for up to 45% of e-commerce transactions with over 5 million active users and 9 million monthly purchases. The increasing trend of cashless transactions has further propelled the growth of this subsegment, with mobile commerce accounting for over 40% of online purchases.

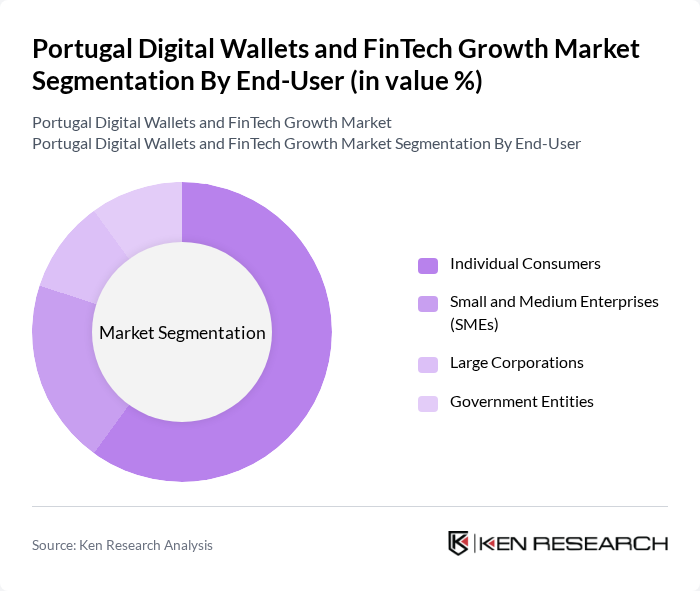

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate this segment, driven by the increasing adoption of digital wallets for everyday transactions. The convenience and security offered by digital wallets have made them a preferred choice for personal finance management. Portugal has experienced rapid digital adoption with daily smartphone use for banking and a notable increase in peer-to-peer payment activity among consumers.

The Portugal Digital Wallets and FinTech Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as SIBS S.A., MB WAY, Multibanco, Easypay S.A., Unicre S.A., YAP, Banco BPI S.A., Caixa Geral de Depósitos, Millennium BCP, Novo Banco S.A., Revolut Ltd., N26 GmbH, PayPal Holdings, Inc., Stripe, Inc., Wise PLC, Adyen N.V., Apple Pay, Google Pay, Wero (European Payments Initiative), EuroPA (SIBS, Bancomat Pay, Bizum), Fiserv, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital wallets in Portugal appears promising, driven by technological advancements and evolving consumer behaviors. As smartphone usage continues to rise, coupled with an increasing preference for cashless transactions, digital wallets are likely to become integral to everyday financial activities. Additionally, the integration of AI and biometric authentication will enhance security and user experience, further encouraging adoption. The collaboration between FinTech companies and traditional banks will also play a crucial role in expanding service offerings and improving accessibility for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Payment Solutions Contactless Payment Systems Cryptocurrency Wallets Digital Banking Services Payment Processing Platforms Buy Now, Pay Later (BNPL) Solutions Pan-European Wallets (e.g., Wero, EuroPA) Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Retail Payments Bill Payments Money Transfers E-commerce Transactions Peer-to-Peer (P2P) Payments |

| By Distribution Channel | Direct Sales Online Platforms Mobile Applications Bank Branches |

| By Consumer Demographics | Age Groups Income Levels Geographic Locations Digital Literacy |

| By Payment Method | Credit/Debit Cards Bank Transfers Digital Currencies QR Code Payments |

| By Policy Support | Government Incentives Tax Benefits Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users, Non-Users |

| Small Business Adoption of FinTech Solutions | 80 | Business Owners, Financial Managers |

| Impact of Digital Wallets on E-commerce | 100 | E-commerce Managers, Marketing Directors |

| Regulatory Perspectives on Digital Payments | 60 | Regulatory Officials, Compliance Officers |

| FinTech Innovation Insights | 70 | Product Development Leads, Technology Officers |

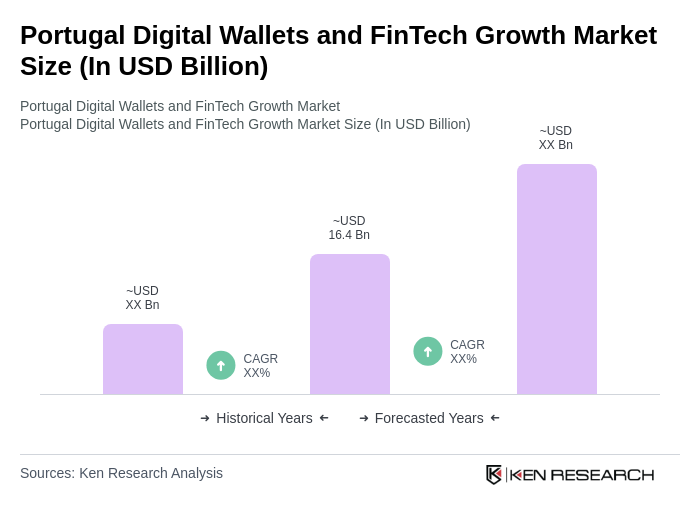

The Portugal Digital Wallets and FinTech Growth Market is valued at approximately USD 16.4 billion, driven by the increasing adoption of digital payment solutions and a surge in e-commerce activities among consumers.