Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7332

Pages:85

Published On:December 2025

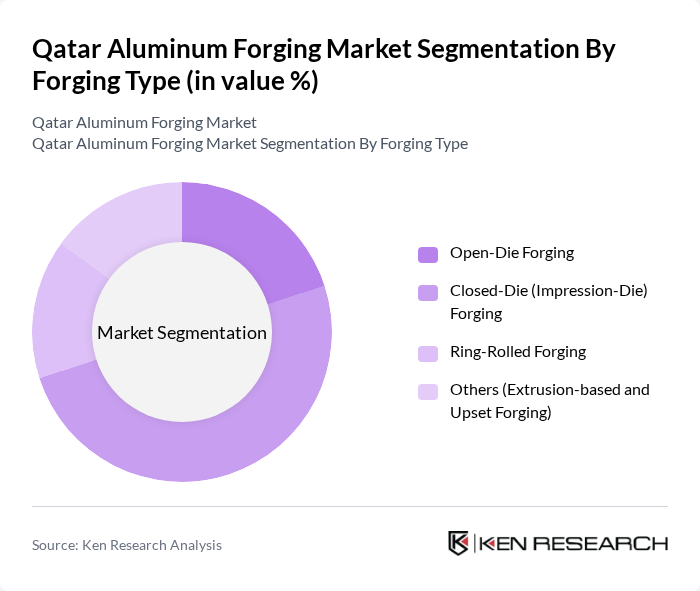

By Forging Type:

The forging type segment includes Open-Die Forging, Closed-Die (Impression-Die) Forging, Ring-Rolled Forging, and Others (Extrusion-based and Upset Forging). At a global and regional level, Closed-Die Forging is widely used for near-net-shape, high-precision aluminum components in automotive, aerospace, and industrial machinery due to its ability to deliver tight tolerances and repeatable quality at medium to high volumes, and it can be considered the leading subsegment in technologically advanced applications. The demand for lightweight and high-strength components, particularly forged suspension parts, wheel hubs, structural brackets, and aircraft fittings, has further propelled the growth of this subsegment as manufacturers seek to optimize performance, reduce vehicle and equipment weight, and improve fuel efficiency and payload capacity.

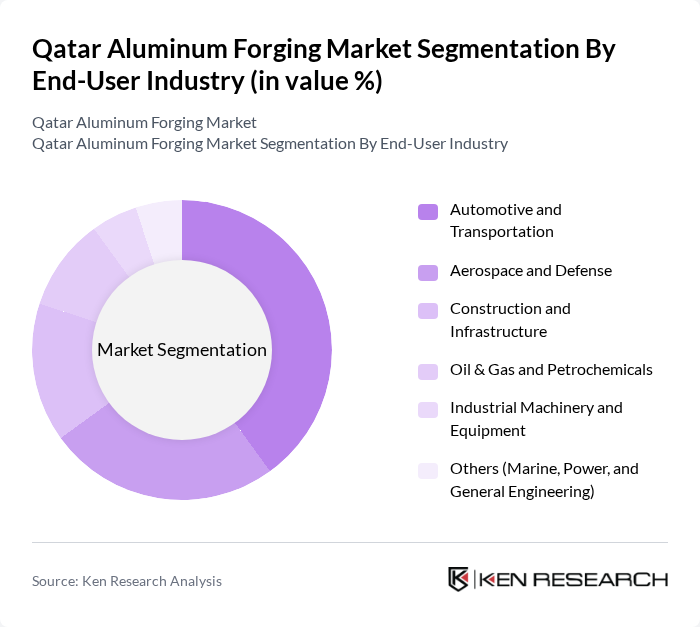

By End-User Industry:

This segment encompasses Automotive and Transportation, Aerospace and Defense, Construction and Infrastructure, Oil & Gas and Petrochemicals, Industrial Machinery and Equipment, and Others (Marine, Power, and General Engineering). Across the GCC and Middle East, automotive and broader transportation applications—covering commercial vehicles, rail, and off-highway equipment—represent a major demand area for forged metal components, though oil and gas, power, and construction remain very significant end-users of forgings in Qatar. The growing adoption of lightweight and corrosion-resistant aluminum forgings in transport equipment, alongside requirements for high-integrity parts such as flanges, valves, fittings, and connectors in oil and gas and petrochemicals, supports a diversified end-use profile that increasingly reflects global trends toward efficiency, reliability, and reduced lifecycle emissions.

The Qatar Aluminum Forging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Aluminium Manufacturing Company Q.P.S.C. (QAMCO), Qatar Aluminium Limited (Qatalum), Gulf International Services Q.P.S.C. – GIS (Industrial & Energy Services Group), Qatar Industrial Manufacturing Company Q.P.S.C. (QIMC), Mannai Trading Company W.L.L. – Engineering & Industrial Division, Saudi Aluminium Industries Company (SALUMCO), Gulf Extrusions Co. LLC, Al Ghurair Group – Aluminium & Metal Fabrication Division, Alcoa Corporation, Howmet Aerospace Inc., Kobe Steel, Ltd. (KOBELCO), Bharat Forge Ltd., Otto Fuchs KG, Constellium SE, Local Fabricators & Forging Job Shops (Selected SMEs in Qatar and GCC) contribute to innovation, geographic expansion, and service delivery in this space, leveraging their capabilities in primary aluminum production, extrusion, machining, and forging to serve regional demand across automotive, aerospace, oil and gas, power, and infrastructure value chains.

The future of the aluminum forging market in Qatar appears promising, driven by increasing demand from various sectors, particularly automotive and construction. As the country continues to invest in infrastructure and technological advancements, the market is expected to adapt to evolving consumer preferences, emphasizing lightweight and sustainable materials. Furthermore, the integration of automation and Industry 4.0 practices will likely enhance production efficiency, positioning the industry for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Forging Type | Open-Die Forging Closed-Die (Impression-Die) Forging Ring-Rolled Forging Others (Extrusion-based and Upset Forging) |

| By End-User Industry | Automotive and Transportation Aerospace and Defense Construction and Infrastructure Oil & Gas and Petrochemicals Industrial Machinery and Equipment Others (Marine, Power, and General Engineering) |

| By Application | Structural & Chassis Components (Beams, Frames, Brackets) Powertrain, Engine & Drivetrain Components Flanges, Fittings, and Pressure-containing Parts Aerospace-grade Components (Landing Gear, Fittings, Hubs) Others (Custom Forged Parts and Fasteners) |

| By Manufacturing Process | Conventional Hydraulic/Mechanical Forging CNC & Closed-Die Automated Forging Isothermal / Precision Forging Others (Hybrid and Integrated Machining–Forging Lines) |

| By Alloy / Material Grade | Series Aluminum Alloys (Aerospace-grade) Series Aluminum Alloys (Marine & Structural) Series Aluminum Alloys (General Engineering & Construction) Series Aluminum Alloys (High-strength Applications) Others (1000, 3000, and Specialty Alloys) |

| By Sales / Distribution Channel | Direct Sales to OEMs Sales via Local Distributors / Stockists Project-based EPC & Fabricator Contracts Others (Export Traders and Online B2B Platforms) |

| By Region | Doha Al Rayyan Al Wakrah Al Khor & Al Thakhira Umm Salal, Al Daayen & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Aluminum Forging | 100 | Production Managers, Quality Engineers |

| Aerospace Component Manufacturing | 80 | Design Engineers, Operations Managers |

| Construction Industry Applications | 70 | Project Managers, Procurement Specialists |

| General Manufacturing Insights | 90 | Manufacturing Executives, Supply Chain Analysts |

| Market Trends and Innovations | 60 | Industry Analysts, R&D Managers |

The Qatar Aluminum Forging Market is valued at approximately USD 130 million, reflecting its significance within the broader Middle East and Africa aluminum forging market, driven by demand across various industries such as automotive, aerospace, and construction.