Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4456

Pages:99

Published On:October 2025

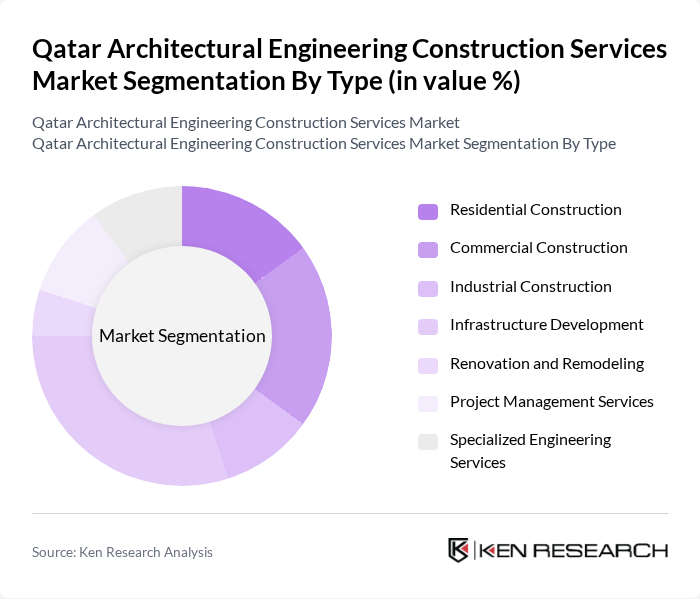

By Type:The market is segmented into various types, including Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development (Transportation), Energy and Utilities Construction, Renovation and Remodeling, Project Management Services, and Specialized Engineering Services. Among these, Infrastructure Development is the leading segment, driven by significant government investments in transportation, utilities, and public facilities. The focus on enhancing connectivity and urban infrastructure, including the expansion of the Doha Metro network through The Blue Line project and the multibillion-dollar Sharq Bridge connecting Katara Cultural Village to Hamad International Airport, has led to a surge in demand for specialized engineering services. Digital services and city planning services represent rapidly growing subsegments within the architectural and engineering services category, with sustainability services and technical engineering also gaining prominence as Qatar emphasizes green construction methods and smart city development.

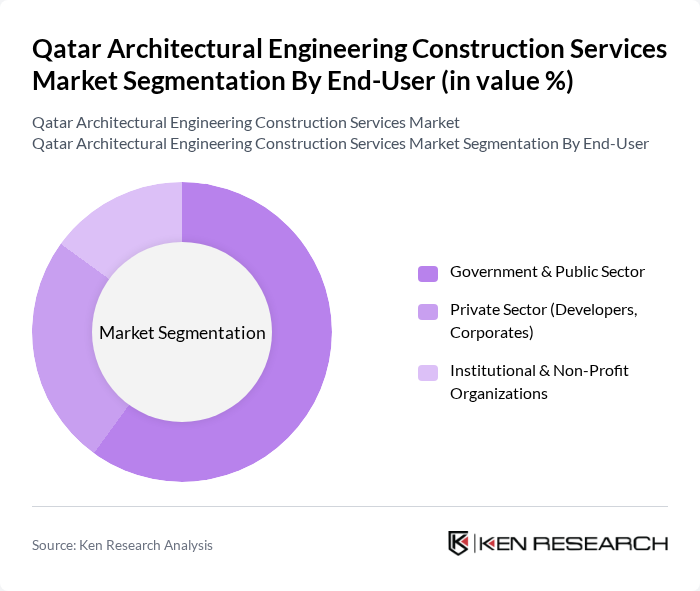

By End-User:The market is categorized into Government & Public Sector, Private Sector (Developers, Corporates), and Institutional & Non-Profit Organizations. The Government & Public Sector segment is the most dominant, as it accounts for a significant portion of construction projects funded by national budgets. This segment's growth is fueled by large-scale infrastructure initiatives and public works, which are essential for supporting Qatar's economic development and urbanization efforts. The government's commitment to hosting the 2030 Asian Games and implementing the Second National Development Strategy under the current Emir has further strengthened public sector investment. Additionally, public-private partnerships are increasingly being utilized, with Qatar set to award projects valued at USD 85 billion by 2030 through PPP mechanisms, facilitating greater private sector participation in infrastructure development.

The Qatar Architectural Engineering Construction Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as HBK Contracting Company W.L.L., Galfar Al Misnad Engineering and Contracting W.L.L., Midmac Contracting Co. W.L.L., Qatari Diar Real Estate Investment Company, Arab Engineering Bureau, Al Jaber Engineering, Dar Al-Handasah Consultants (Shair and Partners), KEO International Consultants, AECOM, WSP Global Inc., Turner Construction Company, CEG International, Al Habtoor Group, Consolidated Contractors Company (CCC), Qatar Engineering & Construction Company (QCon), United Development Company (UDC), Bojamhoor Trading & Contracting, Contraco W.L.L., Madina Group W.L.L., Palmera Landscape contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's architectural engineering construction services market appears promising, driven by ongoing government initiatives and a focus on sustainable development. As the country continues to invest in infrastructure and mega projects, the demand for innovative construction solutions will rise. Additionally, the integration of advanced technologies such as Building Information Modeling (BIM) and smart city concepts will reshape the industry landscape, enhancing efficiency and sustainability. The emphasis on green building practices will further align with global trends, positioning Qatar as a leader in sustainable construction.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial Construction Industrial Construction Infrastructure Development Renovation and Remodeling Project Management Services Specialized Engineering Services |

| By End-User | Government & Public Sector Private Sector (Developers, Corporates) Institutional & Non-Profit Organizations |

| By Project Size | Small Scale Projects (< QAR 50 million) Medium Scale Projects (QAR 50–500 million) Large Scale Projects (> QAR 500 million) |

| By Service Type | Architectural Design Services Structural & Civil Engineering Services MEP (Mechanical, Electrical, Plumbing) Engineering Construction & Project Management Consulting & Advisory Services |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Design-Build Contracts EPC (Engineering, Procurement, Construction) Contracts Time and Materials Contracts |

| By Geographic Focus | Doha Metropolitan Area Lusail & Northern Municipalities Southern & Western Qatar Industrial Zones (e.g., Ras Laffan, Mesaieed) |

| By Investment Source | Domestic Investment Foreign Direct Investment Public-Private Partnerships Government Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 50 | Project Managers, Architects |

| Commercial Building Developments | 40 | Construction Managers, Real Estate Developers |

| Infrastructure Projects (Roads, Bridges) | 45 | Civil Engineers, Urban Planners |

| Green Building Initiatives | 30 | Sustainability Consultants, Environmental Engineers |

| Public Sector Construction Contracts | 50 | Government Officials, Procurement Officers |

The Qatar Architectural Engineering Construction Services Market is valued at approximately USD 385 million, driven by significant investments in infrastructure projects and urban development initiatives, particularly following the FIFA World Cup 2022 and ongoing projects like Lusail City.