Region:Middle East

Author(s):Dev

Product Code:KRAD5290

Pages:98

Published On:December 2025

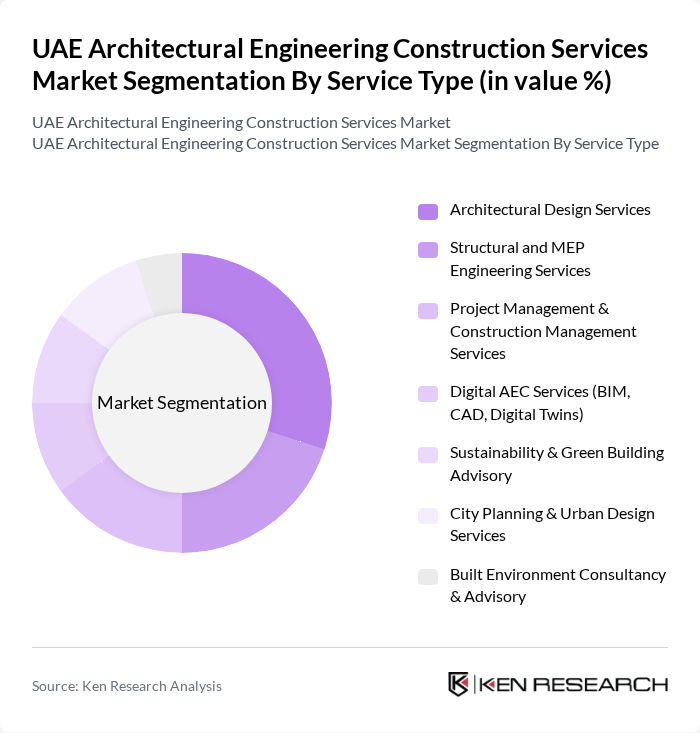

By Service Type:The service type segmentation includes various specialized services that cater to the diverse needs of the construction industry. The subsegments are Architectural Design Services, Structural and MEP Engineering Services, Project Management & Construction Management Services, Digital AEC Services (BIM, CAD, Digital Twins), Sustainability & Green Building Advisory, City Planning & Urban Design Services, and Built Environment Consultancy & Advisory. Among these, Digital AEC Services is the leading subsegment, driven by the increasing demand for innovative and aesthetically pleasing structures integrated with advanced technologies. The focus on sustainability and energy efficiency has also led to a rise in the adoption of green building practices, further enhancing the relevance of these services in the market.

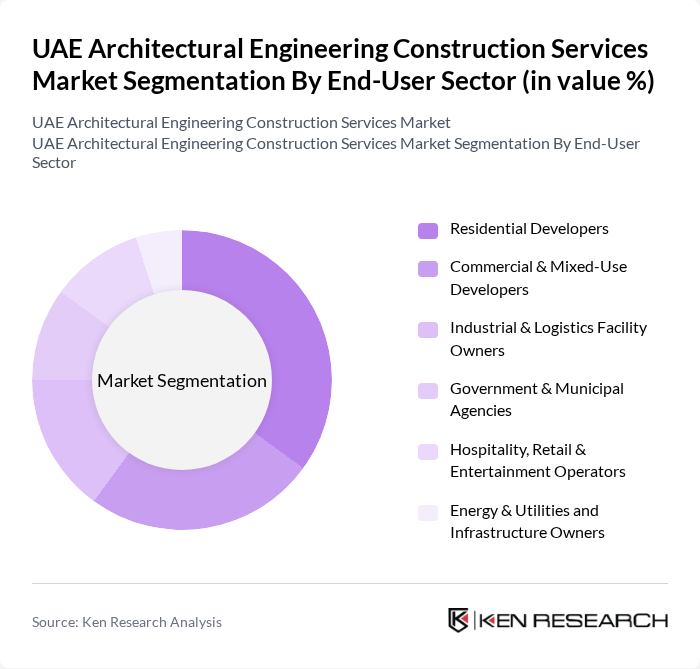

By End-User Sector:The end-user sector segmentation encompasses various industries that utilize architectural engineering construction services. The subsegments include Residential Developers, Commercial & Mixed-Use Developers, Industrial & Logistics Facility Owners, Government & Municipal Agencies, Hospitality, Retail & Entertainment Operators, and Energy & Utilities and Infrastructure Owners. The Residential Developers segment is currently the most significant, driven by the growing population and the demand for housing. The trend towards mixed-use developments is also gaining traction, reflecting changing consumer preferences for integrated living and working spaces.

The UAE Architectural Engineering Construction Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as AECOM Middle East Limited, WSP Middle East (WSP Global Inc.), AtkinsRéalis (Atkins Middle East), Dar Al-Handasah (Shair and Partners), KEO International Consultants, Arab Engineering Bureau, Arabtec Construction LLC, Al Habtoor Engineering Enterprises, Khansaheb Civil Engineering LLC, Al Shafar General Contracting Co. LLC, Dutco Balfour Beatty LLC, ALEC Engineering and Contracting LLC, Emaar Engineering & Construction (Emaar Properties PJSC), Parsons Corporation (Parsons Overseas Limited – UAE), SSH Design contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE architectural engineering construction services market appears promising, driven by ongoing urbanization and government initiatives. With a projected increase in infrastructure spending, particularly in smart city developments, the market is set to evolve in future. Companies that embrace technological advancements and sustainable practices will likely gain a competitive edge. Additionally, the integration of IoT and AI in construction processes is expected to enhance efficiency and project outcomes, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Architectural Design Services Structural and MEP Engineering Services Project Management & Construction Management Services Digital AEC Services (BIM, CAD, Digital Twins) Sustainability & Green Building Advisory City Planning & Urban Design Services Built Environment Consultancy & Advisory |

| By End-User Sector | Residential Developers Commercial & Mixed-Use Developers Industrial & Logistics Facility Owners Government & Municipal Agencies Hospitality, Retail & Entertainment Operators Energy & Utilities and Infrastructure Owners |

| By Project Lifecycle Stage | Concept & Feasibility Studies Detailed Design & Engineering Construction & Site Supervision Operation, Maintenance & Retrofit Services |

| By Delivery Model | Design-Bid-Build (DBB) Design-Build (DB) Engineering, Procurement & Construction (EPC/EPCM) Public-Private Partnership (PPP) Integrated Project Delivery (IPD) |

| By Technology Adoption | Traditional / 2D CAD-Based Services BIM-Enabled Services Advanced Digital & Automation Services (IoT, AI, Digital Twin) |

| By Sustainability & Certification Level | LEED-Certified and Estidama/Pearl-Rated Projects Other Green Building Certified Projects Non-Certified / Conventional Projects |

| By Client Type | Domestic Clients International Clients (FDI, Multinational Corporates) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Architects |

| Commercial Building Developments | 100 | Construction Supervisors, Engineers |

| Infrastructure Projects (Roads, Bridges) | 80 | Site Managers, Civil Engineers |

| Green Building Initiatives | 70 | Sustainability Consultants, Architects |

| Public Sector Construction Contracts | 90 | Government Officials, Procurement Managers |

The UAE Architectural Engineering Construction Services Market is valued at approximately USD 800 million, reflecting significant growth driven by urbanization, government infrastructure investments, and a booming real estate sector.