Region:Middle East

Author(s):Rebecca

Product Code:KRAC8446

Pages:86

Published On:November 2025

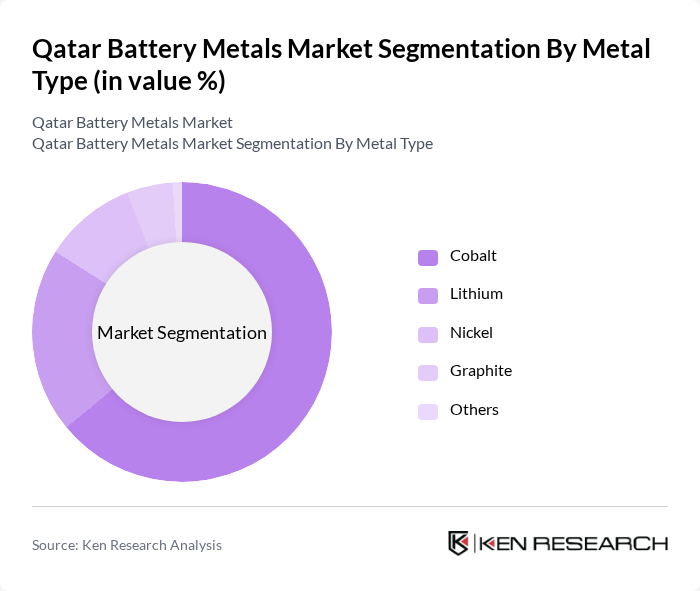

By Metal Type:The battery metals market is segmented into various metal types, including Cobalt, Lithium, Nickel, Graphite, and Others. Among these, Cobalt is the most dominant due to its essential role in high-performance lithium-ion batteries, which are widely used in electric vehicles and portable electronics. The increasing adoption of electric vehicles has significantly boosted the demand for battery metals, making Cobalt a critical component in the battery supply chain.

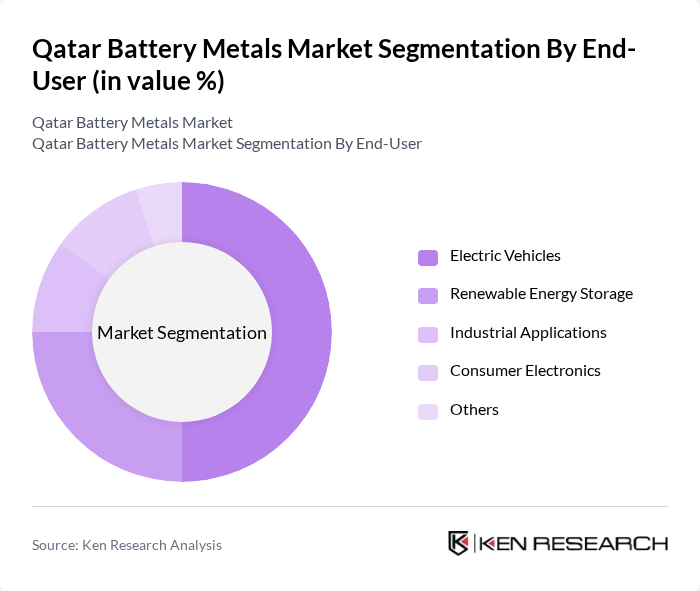

By End-User:The end-user segmentation includes Electric Vehicles, Renewable Energy Storage, Industrial Applications, Consumer Electronics, and Others. The Electric Vehicles segment is leading the market, driven by the global shift towards sustainable transportation and the increasing number of electric vehicle models available. This trend is further supported by government incentives and consumer awareness regarding environmental issues.

The Qatar Battery Metals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Mining Company (QM), Middle East Battery Company (MEBCO), Panasonic Corporation, BASF SE, LG Chem, Nafees Batteries, JMJ Group, Elemental Group, Gulf Mining Group, Emirates Global Aluminium (EGA), Saudi Aramco, Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd., Mitsubishi Chemical Group, Duracell Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Battery Metals Market is poised for significant transformation as the country enhances its focus on sustainable energy solutions. With government backing and increasing investments in renewable energy, the demand for battery storage systems is expected to rise. Additionally, the establishment of recycling facilities will promote a circular economy, reducing raw material dependency. As technological advancements continue, the market will likely see innovations in battery efficiency and safety, positioning Qatar as a key player in the regional battery landscape.

| Segment | Sub-Segments |

|---|---|

| By Metal Type | Cobalt Lithium Nickel Graphite Others |

| By End-User | Electric Vehicles Renewable Energy Storage Industrial Applications Consumer Electronics Others |

| By Application | Battery Production Energy Storage Systems Grid Stabilization Aerospace and Defense Others |

| By Distribution Channel | Direct Sales to Manufacturers Distributors and Traders Online Platforms Recycling Facilities Others |

| By Geography | Doha Al Rayyan Al Wakrah Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Battery Production Tax Incentives for R&D Grants for Renewable Energy Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 45 | Production Managers, R&D Directors |

| Raw Material Suppliers | 38 | Supply Chain Managers, Procurement Officers |

| Regulatory Bodies | 25 | Policy Makers, Compliance Officers |

| Electric Vehicle Manufacturers | 32 | Product Development Managers, Engineering Leads |

| Research Institutions | 28 | Research Analysts, Industry Experts |

The Qatar Battery Metals Market is valued at approximately USD 70 million, driven by the increasing demand for electric vehicles and renewable energy storage solutions, along with government initiatives promoting sustainable energy practices.