Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0641

Pages:94

Published On:December 2025

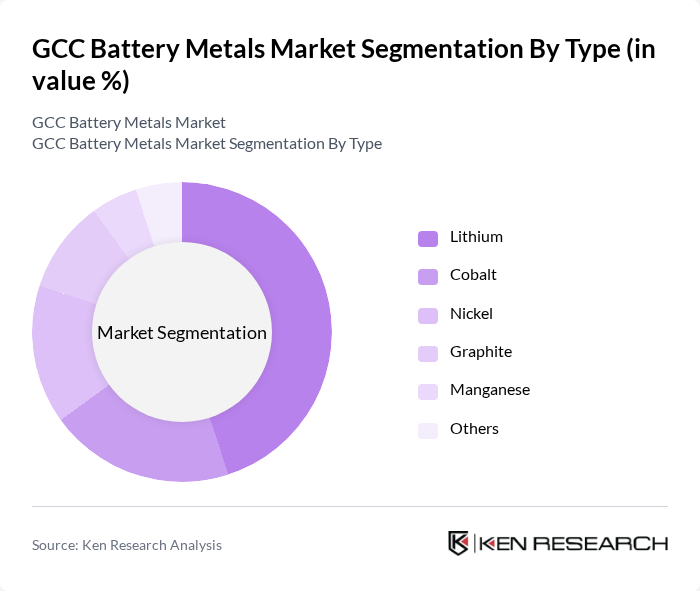

By Type:The battery metals market is segmented into various types, including lithium, cobalt, nickel, graphite, manganese, and others. Among these, lithium is the most dominant due to its critical role in the production of lithium-ion batteries, which are extensively used in electric vehicles and portable electronics. The increasing demand for electric vehicles and renewable energy storage solutions has significantly boosted the consumption of lithium, making it a key focus for manufacturers and investors alike.

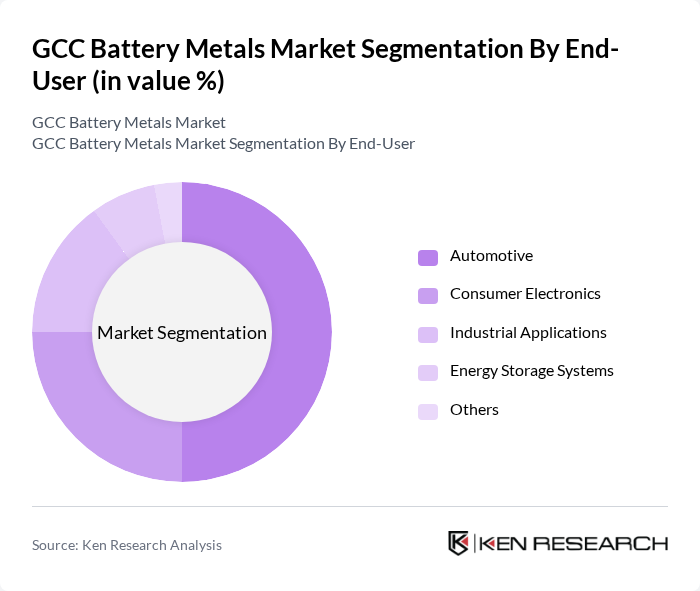

By End-User:The end-user segmentation of the battery metals market includes automotive, consumer electronics, industrial applications, energy storage systems, and others. The automotive sector is the leading end-user, driven by the rapid adoption of electric vehicles. As governments worldwide push for greener transportation solutions, the demand for battery metals in the automotive industry is expected to continue its upward trajectory, making it a focal point for market growth.

The GCC Battery Metals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), Livent Corporation, BASF SE, LG Chem, Panasonic Corporation, Samsung SDI, Contemporary Amperex Technology Co., Limited (CATL), A123 Systems LLC, BYD Company Limited, Tesla, Inc., Northvolt AB, Umicore, Novonix Limited, Orocobre Limited contribute to innovation, geographic expansion, and service delivery in this space.

The GCC battery metals market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As governments enforce stricter emission regulations, the demand for electric vehicles and renewable energy storage will continue to rise. Additionally, the integration of artificial intelligence in battery management systems is expected to enhance efficiency and performance. These trends will likely create a more resilient and innovative market landscape, fostering growth and attracting investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium Cobalt Nickel Graphite Manganese Others |

| By End-User | Automotive Consumer Electronics Industrial Applications Energy Storage Systems Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Application | Electric Vehicles Portable Electronics Grid Storage Power Tools Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies Tax Exemptions Research Grants Regulatory Support Others |

| By Technology | Lithium-ion Lead-acid Nickel-metal Hydride Solid-state Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturing Sector | 100 | Production Managers, R&D Directors |

| Electric Vehicle Manufacturers | 80 | Supply Chain Managers, Product Development Leads |

| Metal Suppliers and Distributors | 70 | Sales Directors, Procurement Managers |

| Energy Storage Solutions Providers | 60 | Technical Managers, Business Development Executives |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

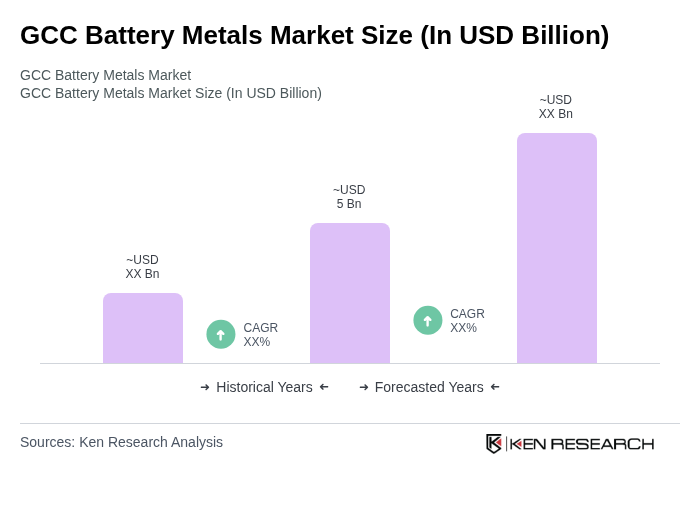

The GCC Battery Metals Market is valued at approximately USD 5 billion, driven by the increasing demand for battery metals such as lithium, cobalt, nickel, and graphite, particularly for electric vehicles and renewable energy applications.