Region:Middle East

Author(s):Dev

Product Code:KRAB8403

Pages:83

Published On:October 2025

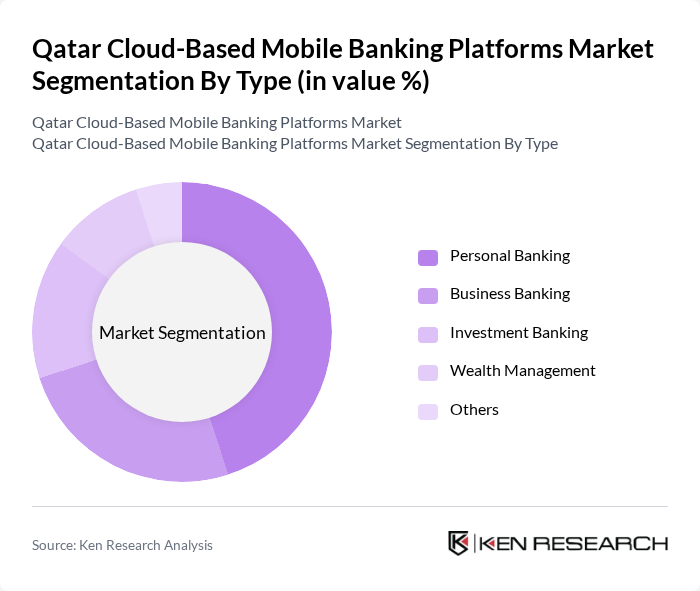

By Type:The market is segmented into various types, including Personal Banking, Business Banking, Investment Banking, Wealth Management, and Others. Among these, Personal Banking is the leading segment, driven by the increasing number of individual consumers seeking convenient banking solutions. The trend towards digitalization and the growing preference for mobile applications have significantly influenced consumer behavior, making Personal Banking the most popular choice.

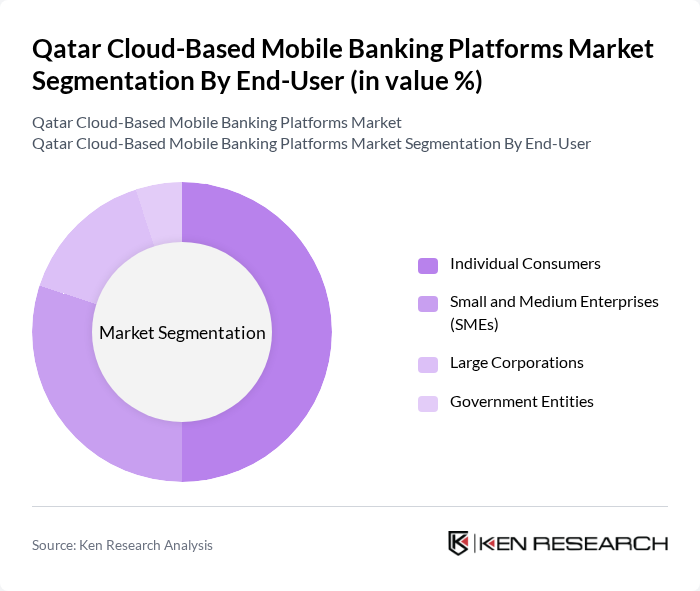

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate this segment, as the increasing smartphone penetration and the demand for user-friendly banking solutions drive the adoption of mobile banking services. The convenience and accessibility offered by these platforms cater to the needs of individual users, making them the primary end-users.

The Qatar Cloud-Based Mobile Banking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Commercial Bank of Qatar, Doha Bank, Masraf Al Rayan, Qatar Islamic Bank, Ahli Bank, Al Khalij Commercial Bank, Qatar Development Bank, Vodafone Qatar, Ooredoo Qatar, DNB ASA, Emirates NBD, Abu Dhabi Commercial Bank, National Bank of Kuwait, Bank of Beirut and the Arab Countries contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud-based mobile banking platforms in Qatar appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning is expected to enhance customer service and operational efficiency. Additionally, the shift towards open banking frameworks will facilitate collaboration between banks and fintechs, fostering innovation. As digital literacy improves, more consumers will embrace mobile banking, further propelling market growth and diversification of services offered.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Banking Business Banking Investment Banking Wealth Management Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Others |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Geographic Coverage | Urban Areas Rural Areas International Markets |

| By Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Users | 150 | Individual Account Holders, Retail Banking Managers |

| Corporate Banking Clients | 100 | Corporate Account Managers, CFOs of SMEs |

| Fintech Innovators | 80 | Product Development Leads, Technology Officers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Mobile Banking Users | 120 | Tech-Savvy Consumers, Digital Banking Advocates |

The Qatar Cloud-Based Mobile Banking Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and mobile banking services among consumers.