Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3779

Pages:96

Published On:October 2025

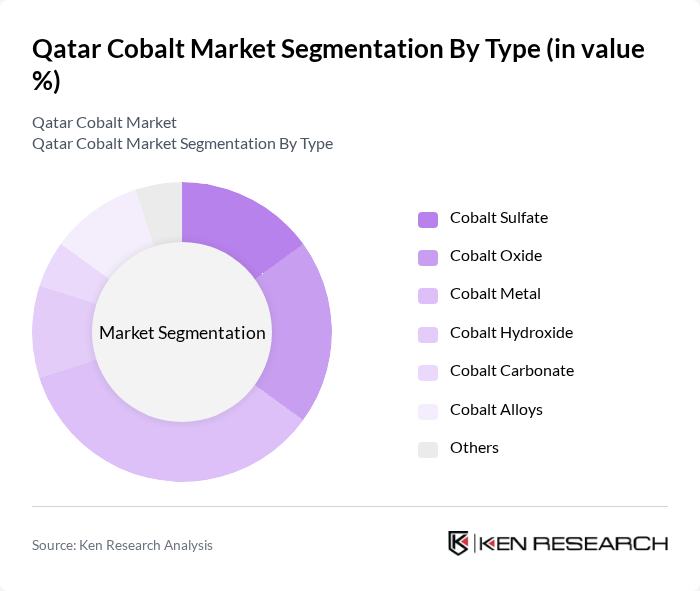

By Type:The cobalt market can be segmented into various types, including Cobalt Sulfate, Cobalt Oxide, Cobalt Metal, Cobalt Hydroxide, Cobalt Carbonate, Cobalt Alloys, and Others. Among these, Cobalt Sulfate is the leading subsegment in the Middle East region, driven by its critical role in lithium-ion battery production for electric vehicles and energy storage systems. Cobalt Metal remains important for superalloys used in aerospace and automotive applications, but the sulfate form dominates due to the battery industry’s rapid growth.

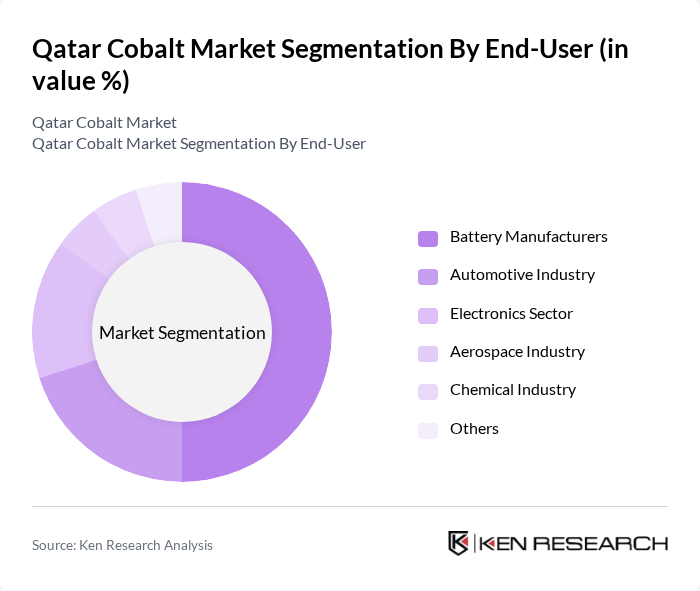

By End-User:The cobalt market is segmented by end-user industries, including Battery Manufacturers, Automotive Industry, Electronics Sector, Aerospace Industry, Chemical Industry, and Others. The Battery Manufacturers segment is the most significant, driven by the rapid growth of electric vehicles and energy storage systems. The increasing focus on renewable energy solutions and the transition to electric mobility are propelling the demand for cobalt in battery production, making it a critical component in the market. In the Middle East, the electric vehicles segment held over 35 percent revenue share in 2024, reflecting the region’s accelerating shift toward clean energy technologies.

The Qatar Cobalt Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Mining Company (QM), Ma’aden (Saudi Arabian Mining Company), Glencore International AG, China Molybdenum Co., Ltd., Emirates Global Aluminium (EGA), Advanced Battery Metals Middle East, Gulf Mining Group, Aluminium Bahrain (Alba), Dubai Multi Commodities Centre (DMCC), Rusal Middle East, FAMCO (Fajr Capital), Umicore S.A., Jinchuan Group International Resources Co. Ltd., Sherritt International Corporation, ERG (Eurasian Resources Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cobalt market in Qatar appears promising, driven by the increasing integration of cobalt in advanced technologies and sustainable practices. As the demand for electric vehicles and renewable energy storage solutions rises, the local cobalt industry is expected to adapt by enhancing extraction methods and forming strategic partnerships. Additionally, the focus on recycling initiatives and sustainable sourcing will likely shape the market landscape, ensuring that Qatar remains competitive in the global cobalt supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Cobalt Sulfate Cobalt Oxide Cobalt Metal Cobalt Hydroxide Cobalt Carbonate Cobalt Alloys Others |

| By End-User | Battery Manufacturers Automotive Industry Electronics Sector Aerospace Industry Chemical Industry Others |

| By Application | Lithium-Ion Batteries Superalloys Catalysts Hard Metals Pigments Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing Others |

| By Source of Supply | Domestic Mining Imported Cobalt Recycled Cobalt Others |

| By Quality Grade | Industrial Grade Battery Grade High Purity Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cobalt Mining Operations | 60 | Mining Engineers, Operations Managers |

| Cobalt Processing Facilities | 50 | Plant Managers, Quality Control Supervisors |

| Battery Manufacturers | 40 | Product Development Engineers, Procurement Managers |

| Alloy Producers | 40 | Production Managers, Sales Directors |

| Research Institutions | 40 | Research Scientists, Industry Analysts |

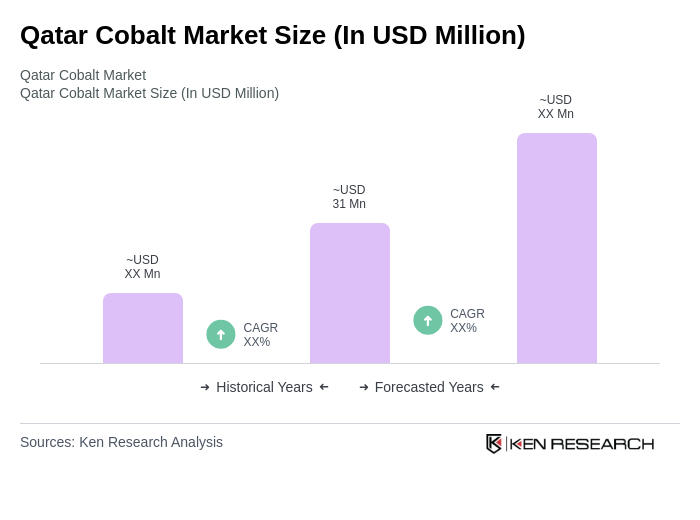

The Qatar Cobalt Market is valued at approximately USD 31 million, driven by increasing demand for cobalt in battery production, particularly for electric vehicles and renewable energy storage systems.